Joe Lubin, one amongst the orchestrators of SharpLink Gaming’s Ethereum treasury plot, wishes his firm to stack Ether as quick as doable for shareholders — a war shout as companies clamber to manual the ETH accumulation flee.

“We specialize in that we’ll have the opportunity to possess more Ether — per fully diluted half — worthy sooner than any other Ethereum-primarily primarily based project, or with out a doubt sooner than the Bitcoin-primarily primarily based initiatives,” the firm’s chairman told Bloomberg Television on Monday.

SharpLink is amassing capital “on each day basis” thru at-the-market services to expand its Ether (ETH) reserves, whereas simultaneously staking its existing holdings to invent yield and compound its relate, acknowledged Lubin, who is one amongst eight founders of Ethereum and currently the CEO at Ethereum infrastructure firm Consensys.

BitMine Immersion Tech is currently main the ETH treasury flee

Lubin’s SharpLink is tussling with Tom Lee’s BitMine Immersion Tech to changed into the main Ethereum treasury firm.

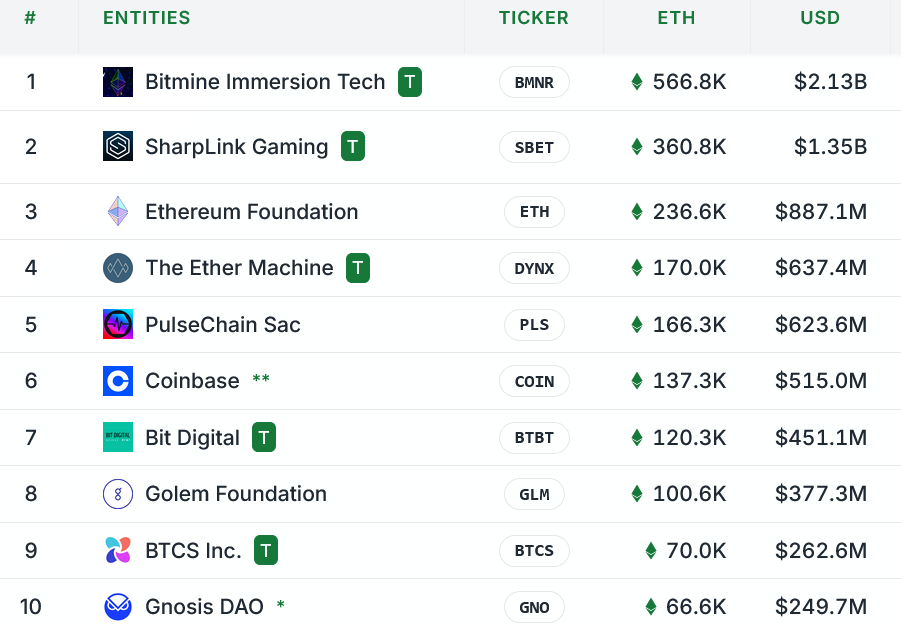

Lee’s firm currently leads the vogue with 566,800 ETH valued at $2.13 billion, whereas SharpLink comes in 2nd at 360,800 ETH price $1.35 billion, StrategicETHReserve data exhibits.

The Ethereum Basis, The Ether Machine and PulseChain round out the terminate five, whereas Coinbase, Bit Digital and Golem Basis also preserve bigger than 100,000 ETH every.

Flee to stack ETH is riding attach a question to stress

The ETH treasury adoption vogue has been seen as actively riding attach a question to for Ether, serving to it fetch up after trailing the likes of Bitcoin (BTC) and Solana (SOL) earlier on this bull cycle.

Consequently, ETH is now up 110% to $3,800 over the final three months, whereas quite a lot of its competitors have made modest double-digit beneficial properties, CoinGecko data exhibits.

“What we’re seeing is institutional FOMO at scale — well-known gamers racing to connect dominant positions before capacity ETF approvals fabricate even more attach a question to stress,” crypto cybersecurity analyst Wilson Ye posted to X on Monday.

“This competition with out a doubt validates the thesis that ETH is popping into institutionalized infrastructure,” Ye added.

🟢 BREAKING SΞR NEWS: Bitmine Immersion Expertise $BMNR purchases 137,515 ETH and overtakes SharpLink Gaming to changed into the #1 holder within the SΞR with a gigantic 300,657 ETH.

Tom Lee vs Joe Lubin – the $ETH accumulation flee is on. pic.twitter.com/9SpONxIPm6

— fabda.eth (@fabdarice) July 17, 2025

SharpLink to adopt low-risk manner

SharpLink plans to rob a conservative manner when it comes to leverage, in response to Lubin.

Lubin acknowledged SharpLink currently carries no leverage however is exploring a convertible display offering — a financing manner that Michael Saylor’s MicroStrategy repeatedly primitive to develop its Bitcoin holdings.

Linked: Evolving ETH futures data hints a doable rally to $5K

“It’s no longer with out a doubt well-known what we provide out, we’re going to preserve leverage very worthy in test,” Lubin acknowledged.

“[We will] remain prudent regarding risk ranges,” Lubin acknowledged, adding that over time its shareholders would revenue.

Journal: Robinhood’s tokenized shares have stirred up an correct hornet’s nest