After weeks of immense volatility, some crypto assets are left with important imbalances that may per chance presumably cause drastic changes. In particular, Finbold seen two presumably overbought cryptocurrencies in what is probably going to be a sell signal for April.

The overbought signal is in total identified through a technical indicator called the Relative Strength Index (RSI). In fact, it measures the momentum of an underlying asset primarily primarily based on previous mark motion, enraged about extra than one components.

A mighty momentum, above 60 index parts is in total sure and indicates an uptrend or a bull market. Nonetheless, going for coarse strength can gradually signal the cryptocurrency is as a result of a correction or kind reversal.

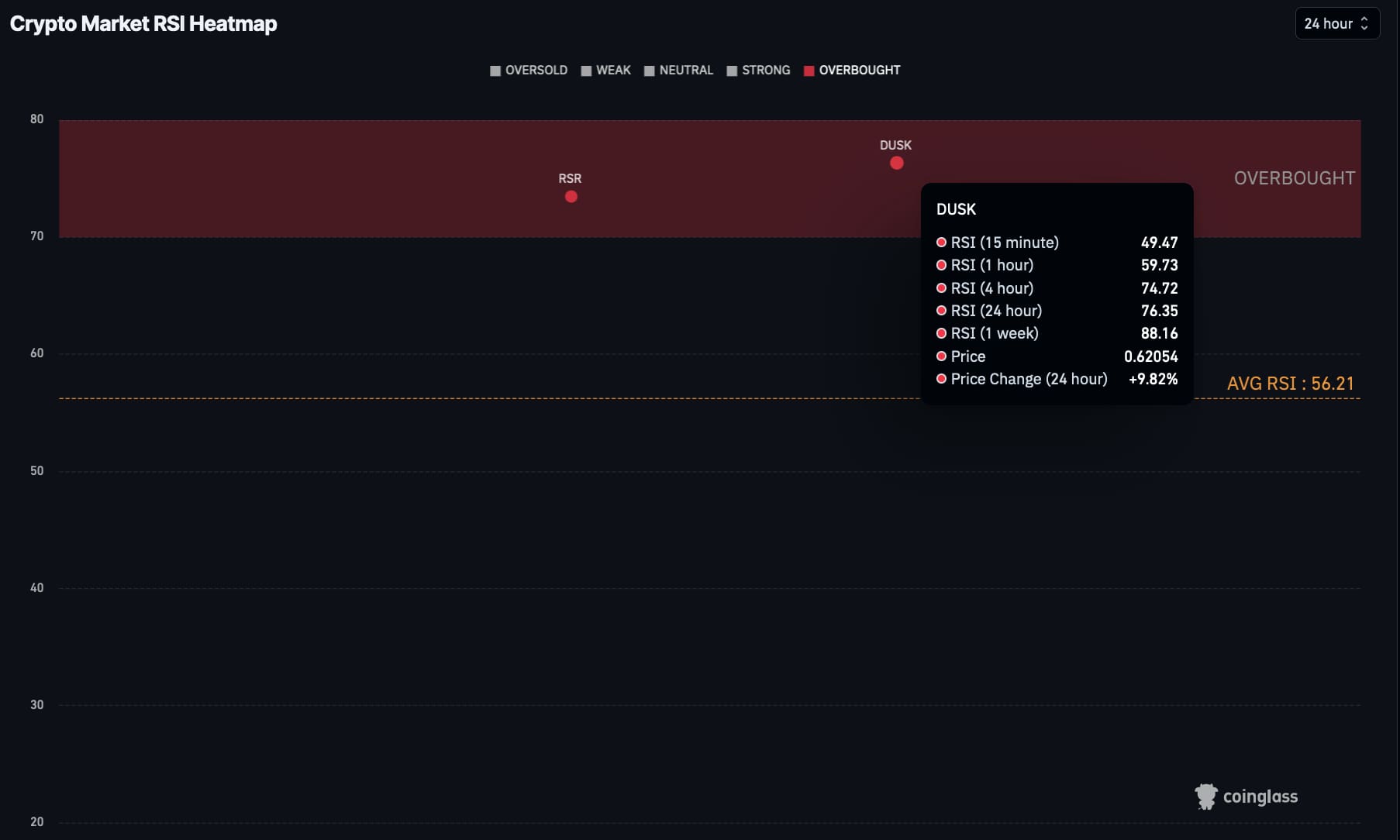

As an instance, as Finbold seen using the CoinGlass RSI heatmap on March 26, taking a behold at the every single day and weekly time frames.

Overbought Reserve Rights (RSR) may per chance presumably smash quickly

First, Reserve Rights (RSR) is an ERC-20 token for the Reserve Protocol, for the time being with over $500 million in capitalization.

The token has seen a 12.88% form larger in the last 24 hours, procuring and selling at $0.01 by press time. Particularly, RSR is overbought in the every single day and weekly time frames, with 73.48 and 88.78 RSI parts, respectively.

This internet site threatens a huge correction for the supposedly overbought ERC-20 token, which has one of many perfect weekly Relative Strength Indexes as of at the present time.

Promote signal for Nightfall (DUSK)

2nd, Nightfall (DUSK) has a identical weekly and every single day RSI to the Reserve Rights token. With a 76.35 and 88.16 overbought internet site, respectively, merchants ought to have in mind a pair of sell signal for DUSK.

The token belongs to a layer-1 blockchain founded in 2018, focusing on true-world assets (RWA) compliance for institutional investors.

Interestingly, DUSK rose over 9.82% in the last 24 hours, coming from about a weeks of sure mark motion. BlackRock’s most modern switch in opposition to a tokenization fund and RWA enterprises non-public fueled the take a look at for this challenge, which may per chance presumably now face a non everlasting retracement.

Nonetheless, sure trends in the institutional landscape would prefer extra hiss for Nightfall, invalidating this technical prognosis.

All in all, RSR’s and DUSK’s RSI data indicate a sell signal for these two overbought cryptocurrencies in April. Yet, traditional parts may per chance presumably have an effect on an uptrend continuation and investors must alternate cautiously in each scenarios.

Disclaimer: The vow material on this internet site ought to no longer be opinion-about funding advice. Investing is speculative. When investing, your capital is at anxiety.