Basically based totally on Bitwise’s Chief Investment Officer, Matt Hougan, the Securities and Alternate Price (SEC) is pondering a lengthen in approving extremely anticipated Ethereum replace-traded funds (ETFs).

This construction comes on the heels of Bitwise Asset Administration’s procedure to listing a situation Ethereum ETF.

Doable Ethereum ETF Approval Lengthen

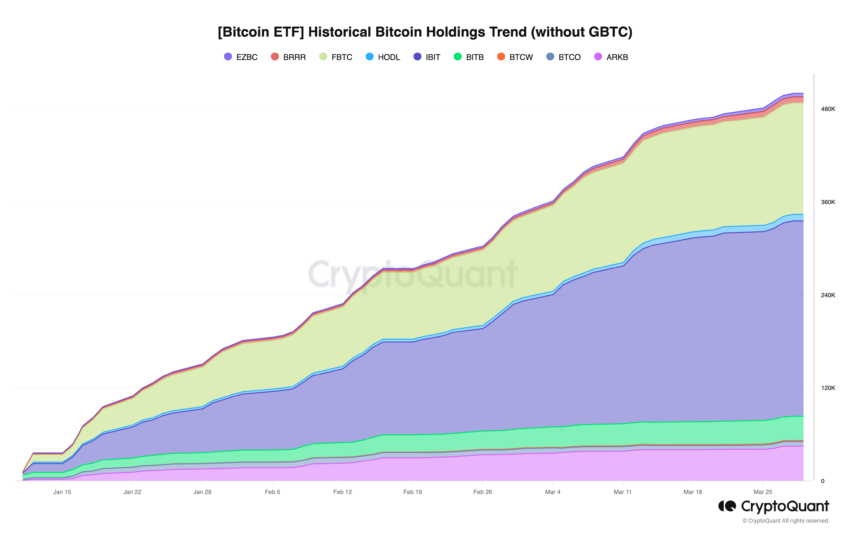

Bitwise launched its situation Bitcoin ETF, the Bitwise Bitcoin ETF (BITB), on January 11. Since then, the ETF has seen a meteoric rise, amassing over $2 billion in property and rating fifth in the so-known as “Cointucky Derby.”

Hougan shared insights into the explosive progress of BITB and diversified situation ETFs, underscoring their remarkable acceleration when in contrast with ancient ETF launches.

“These [spot Bitcoin ETFs] are the quickest rising ETFs of all time by a stout fraction. I remember the quickest rising ETF earlier than these became once the Nasdaq 100 ETF (QQQM), which went from zero to $5 billion in one year. These ETFs like pulled in to find $10-plus billion in below two months,” Hougan emphasised.

Despite the sucess situation Bitcoin ETFs like seen, Hougan warned about the aptitude lengthen in the Ethereum ETF’s approval. This can also just stem from regulatory caution, given the rising hobby in cryptocurrency investments and the advanced dynamics of the market.

Hougan expressed self assurance in the eventual originate of an Ethereum ETF. Silent, he anticipated that a lengthen until later in the year could well per chance per chance in truth attend the market by allowing frail finance (TradFi) more time to adore and embrace crypto.

“We predict that’s a pure pathway that crypto merchants like followed for 15 years. They birth with Bitcoin and then they need publicity to diversified issues. I feel Ethereum will more than likely be very supreme-trying. I feel the [Ethereum] ETFs will more than likely be more worthwhile if they originate in 365 days than if they originate in Might per chance per chance presumably also just. I do know that sounds goofy, but I feel TradFi is aloof digesting Bitcoin and whenever you give TradFi time to to find elated with Bitcoin and crypto, they are going to be ready for the following element,” Hougan defined.

This strategic endurance could well per chance per chance pave the draw for a more sturdy and advised entry of institutional and retail merchants into Ethereum, following the overwhelming success of Bitcoin ETFs.

Hougan’s insights hide a well-known shift in the perception of cryptocurrencies, from skepticism to a identified doable for gigantic returns on investment. Because the SEC weighs its resolution, the cryptocurrency neighborhood stays on edge, eager for a green gentle that will per chance per chance per chance additional legitimize and catalyze investments in Ethereum and past.