CryptoQuant, a leading cryptocurrency analysis company, has launched its most modern market analysis, revealing a essential shift amongst skilled Bitcoin traders.

Per the company, these skilled traders are getting in an accumulation phase, a style that has historically preceded essential designate increases.

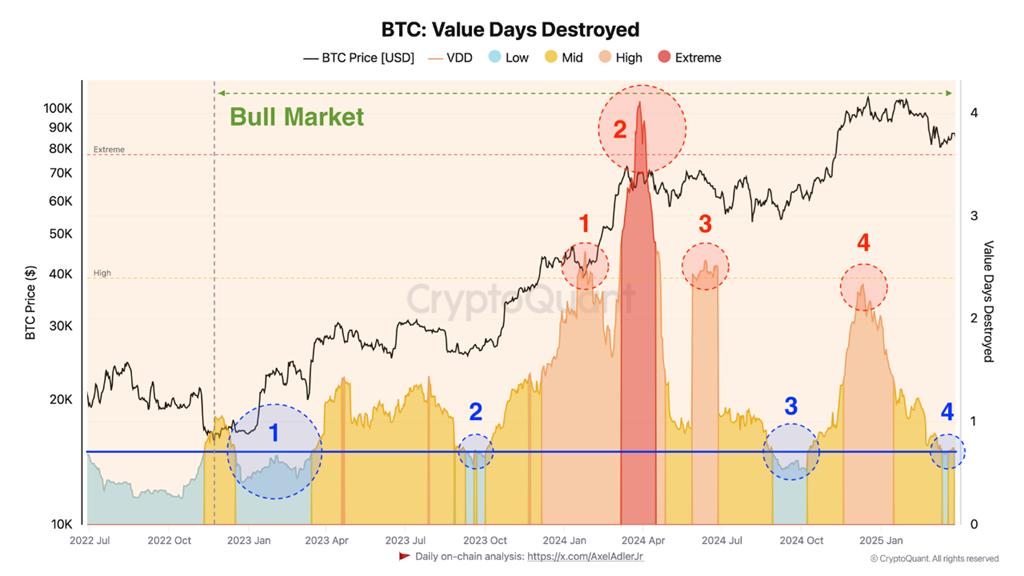

CryptoQuant identifies four major intervals of coin accumulation by skilled market contributors: January 2023, October 2023, October 2024, and the most modern phase in March 2025. These phases are marked with blue circles on the company’s analysis table. In difference, four essential selling peaks befell in January, April, and July of 2024, with the closing peak going on in March 2025, marked with crimson circles.

Per the analyst company, the most modern accumulation phase is characterized by several serious components:

- Transferring from Promote to Defend – Investors who beforehand offered at market peaks enjoy now adopted a conserving technique. Here’s evident from the Model Days Destroyed (VDD) indicator, which is at its minimal in March 2025.

- Lack of Significant Promoting – The dearth of essential selling suggests that skilled contributors receive the most modern Bitcoin designate stage unattractive for income-taking.

- Historical Precedence for Model Will enhance – Historical market cycles squawk that intervals of low VDD marked by accumulation phases precede upward designate movements.

CryptoQuant’s findings counsel that the most modern accumulation phase would possibly per chance additionally signal extra appreciation of Bitcoin’s designate within the medium duration of time.

*Here’s now now not investment advice.