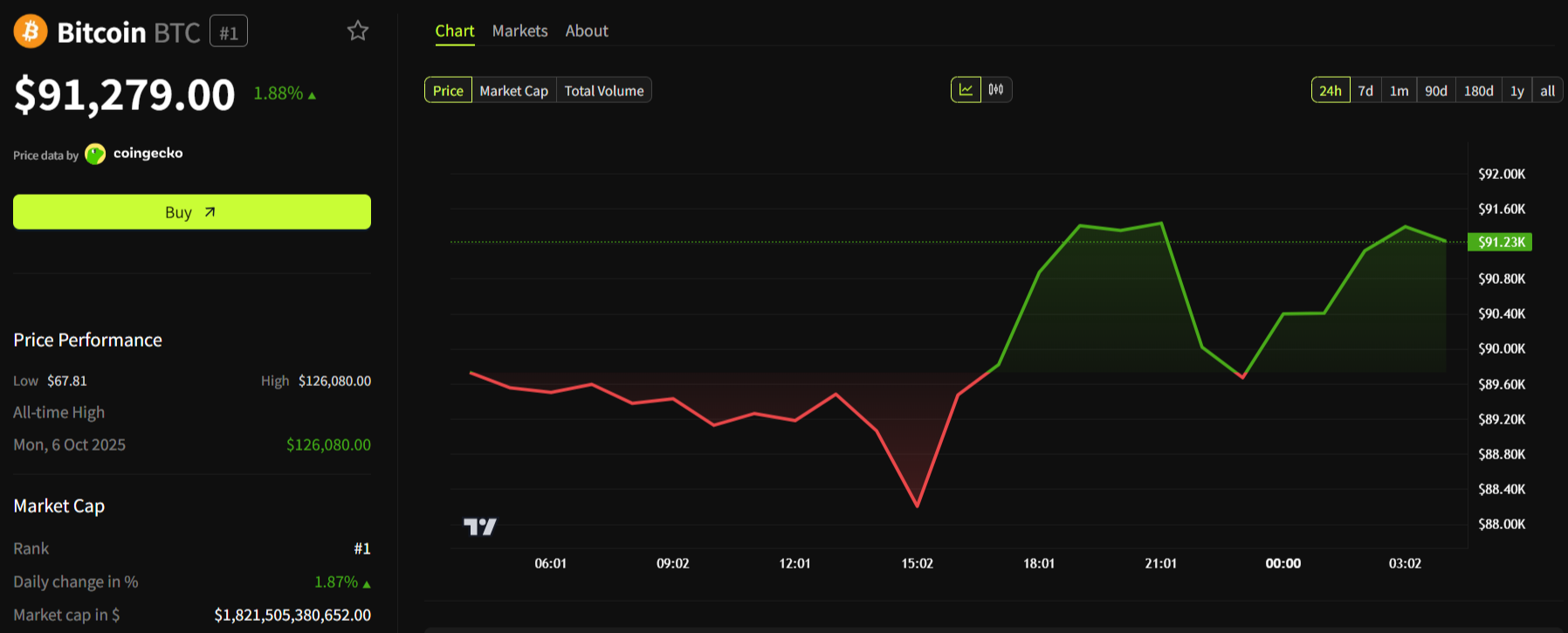

One enigmatic put up from Michael Saylor propelled Bitcoin over $4,000 in lower than three hours early in Asian morning on Monday. His “₿ack to Orange Dots?” message sparked hypothesis about MicroStrategy’s accumulation approach, pushing the digital asset from correct below $88,000 to above $91,000.

This response highlights how the manager chairman’s communications can strongly impact market sentiment, even while the total market sentiment remains gripped by grievous anxiety.

Decoding the Orange and Green Dot Map

Michael Saylor’s colour-coded blueprint wields necessary market impact. The “orange dots” denote every Bitcoin purchase tournament by MicroStrategy, visible on the firm’s StrategyTracker.com portfolio chart. Every marker represents every other step within the firm’s sturdy Bitcoin accumulation thought.

The chart’s inexperienced line displays the realistic purchase mark of all acquisitions, serving as a performance benchmark. As of Dec 8, MicroStrategy held 650,000 BTC valued at $57.80 billion, with a median cost of $74,436 per coin. This set mirrored a make of 19.47%, translating to about $9.42 billion in unrealized earnings.

₿ack to Orange Dots? pic.twitter.com/npB0NWSZ52

— Michael Saylor (@saylor) December 7, 2025

No longer too long ago, Saylor added a new twist to this visual vocabulary. His cryptic “inexperienced dots” find spurred hypothesis about attainable approach changes. The inexperienced dashed line—tracking the realistic cost—has taken heart stage. Some analysts factor in greater buying explain might well well per chance doubtless pass this metric upward.

Within hours of Saylor’s update, the fee soared above $91,000. The day’s fluctuate stretched from $87,887 to $91,673, highlighting marked volatility across the signal.

Market Dynamics and Trader Positioning

Despite the rally, market sentiment remained fragile. The Concern and Greed Index signaled endured anxiety, but long-rapid ratios showed bullish vendor positioning. As anxiety and profit transitioned, market psychology remained advanced.

Knowledge from CoinGlass revealed Binance and OKX reported 52.22% long positions versus 47.78% rapid, while Bybit’s bullish skew used to be even stronger at 54.22% long and 45.78% rapid. The most contemporary four-hour futures volume showed $106.77 million (56.23%) long in opposition to $83.11 million (43.77%) rapid. Merchants looked optimistic no subject terrified sentiment metrics.

The ruin up between sentiment indicators and vendor positioning highlights this day’s market complexity. Many are interesting to wager on sustained momentum, especially after influential indicators from necessary holders, though anxiety persists within the background.

MicroStrategy’s impact extends additional. The firm lately constructed a $1.44 billion cash reserve to conceal dividends and present 21 months of liquidity. On December 1, 2024, it obtained 130 BTC for roughly $11.7 million at $89,960 per coin, bringing total holdings to 650,000 BTC.

Strategic Evolution and Market Implications

The corporate draw has shifted in most contemporary weeks. CEO Phong Le lately admitted MicroStrategy might well well per chance doubtless sell Bitcoin if the stock drops below 1x modified Gain Asset Tag—must always still fairness or debt no longer be raised. In November 2024, the mNAV touched 0.95, bringing this scenario nearer to actuality.

This marks a pass away from the extinct “beneath no conditions sell” stance. Annual dividend requirements of $750 million to $800 million find forced the firm to rob into account new liquidity, making its market characteristic resemble a leveraged Bitcoin ETF. Shares find misplaced over 60% from highs, elevating questions on endured accumulation in unstable instances.

The put up Saylor’s ‘Orange Dot’ Drives Bitcoin From $87K to $91K looked first on BeInCrypto.