The cryptocurrency Saros (SAROS) experienced a dramatic 70% price drop on August 24, plummeting to its lowest level since April 2025.

The steep decline, which briefly erased months of positive aspects, has sparked frequent self-discipline amongst patrons. Some market watchers dangle even drawn parallels to the stricken trajectory of MANTRA (OM).

Why Did SAROS Token’s Rate Wreck?

For context, Saros is a decentralized finance (DeFi) platform built on the Solana (SOL) blockchain. It combines a colossal preference of services precise into a single ecosystem, including procuring and selling, staking, yield farming, launchpad participation, and more.

Its native utility token, SAROS, powers governance, staking, liquidity incentives, and more. The token is deployed on each and each Solana and Viction.

The altcoin, which has a market cap of $922 million, has been on a predominantly upward pattern for months and reached an all-time high (ATH) on August 04.

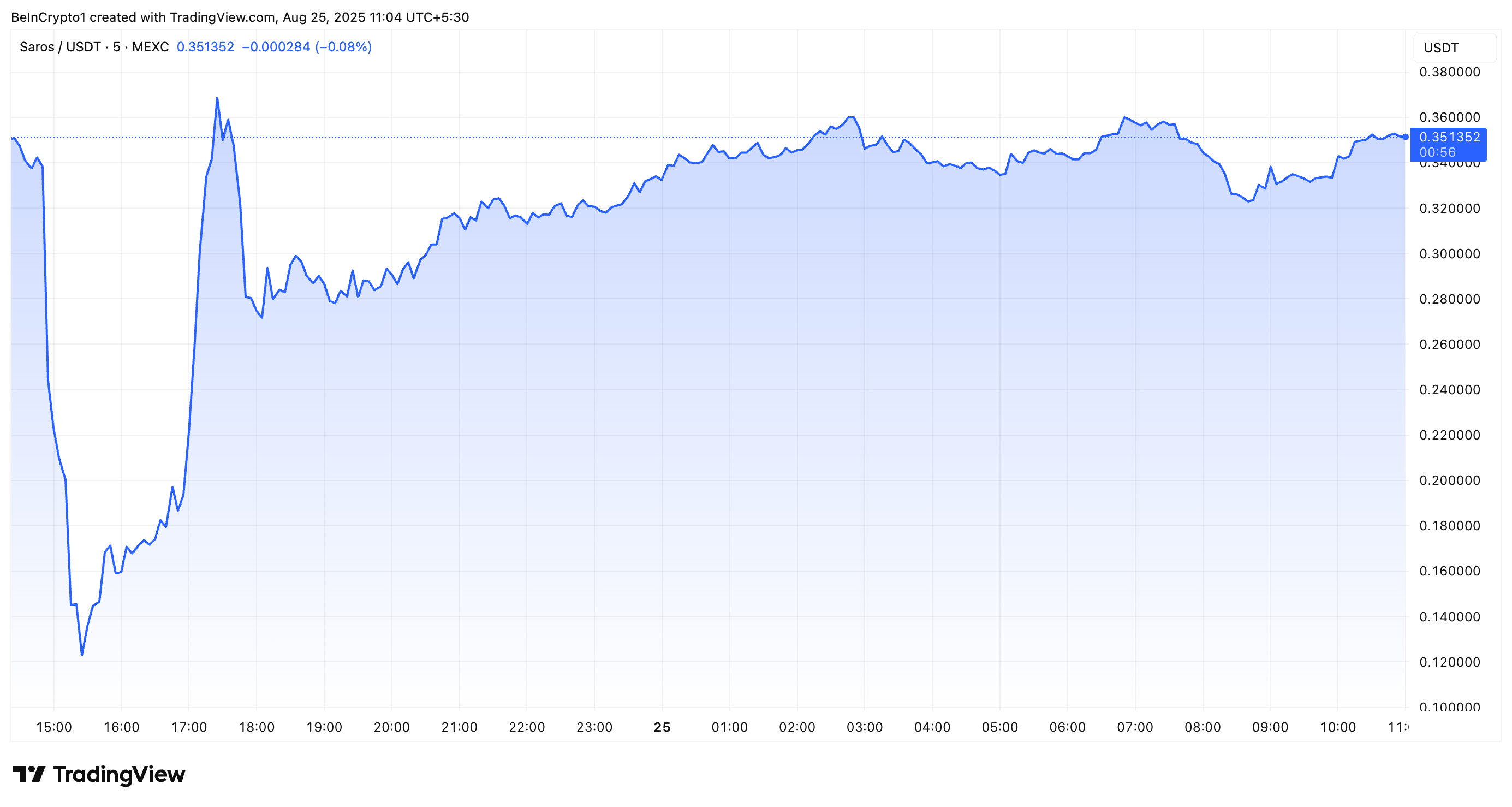

Then all all over again, the day gone by’s 70% crash hindered this upward trajectory, pulling the price rapidly reduction to four-month lows. Market knowledge showed that SAROS’ price dipped to $0.109, a level closing considered in April.

Then all all over again, the dip became as soon as brief. SAROS bounced reduction and reversed its losses. At the time of writing, it became as soon as procuring and selling at $0.35, down 5.3% all the device throughout the final day.

Thanh Le, founding father of Saros, addressed present price volatility. He explained that the engaging strikes in SAROS resulted from leveraged merchants reducing their positions on centralized exchanges, which caused open curiosity to tumble sharply.

“Per our ongoing investigations and readily available knowledge, we predict right here’s a market-pushed adjustment, doubtlessly titillating a huge, extremely-leveraged dilemma reducing its exposure on centralized exchanges (CEX). Ahead of the movement, open curiosity became as soon as roughly 90M SAROS, in accordance to swap knowledge, and it has since decreased to around 20M SAROS,” he talked about.

He wired that neither the crew nor long-term patrons supplied their holdings.

“Market cycles come and run, but our focus stays the the same: constructing Saros into the liquidity backbone of Solana. Your belief and crimson meat up are what force us, and we’ll continue to abet you suggested every step of the components,” Le added.

No topic this, the important thing crash caused many merchants to lose money and shook the market sentiment. CoinGecko knowledge showed that over 50% of the community is bearish on SAROS.

Welcome to crypto

By no components alternate with out a Terminate-Loss! No topic how noteworthy revenue you’re sitting on, one surprising pass can wipe all of it out.

Correct sort behold at #SAROS — 142 days of positive aspects erased in a single day dump.

Chance management > Hype. pic.twitter.com/mlnhh4WY9v— Crypto Tigers (@Crypto_Tigers1) August 24, 2025

The volatility has reignited comparisons to OM, which experienced a 90% crash in April and has but to get greater fully.

“It’s going to abet falling for in spite of everything 1-2 years now…Whatever I talked about about OM before got right here staunch, and now whatever we talked about about Saros got right here staunch too,” an analyst remarked.

Shock surprise$SAROS https://t.co/3ZzVDv4k3a pic.twitter.com/f5VU52pyEY

— VIKTOR (@thedefivillain) August 24, 2025

Thus, this incident highlights the broader risks internal the altcoin market. While SAROS has confirmed some restoration, the price drop has left many questioning the market’s steadiness. Now, the community will undercover agent carefully to explore how Saros navigates this setback.

The put up Saros (SAROS) Faces 70% Wreck: What Introduced on the Surprising Rate Drop? appeared first on BeInCrypto.