The worldwide crypto market cap is at the moment hovering $3.4 trillion Sunday, contracting after it added an additional $170 billion in valuation from the earlier week.

The earlier all-time high of $3.8 trillion — an 18.7% spike — turned into as soon as spurred by a ambitious mark circulation from Bitcoin (BTC), which soared to $99,655 because it eyed the elusive $100,000 designate. Within the rupture overview Sunday morning, it’s hovering precise beneath $97,000.

Listed below are just a few of closing week’s excellent performers, all from the gaming market segment:

SAND retests six-month resistance

No topic starting the week on a bearish existing amid increased volatility, gaming token The Sandbox (SAND) managed to shut closing week with an 11% develop.

From Nov. 17 to 21, SAND collapsed 17%. On the other hand, a recovery ensued after the bears hit the stable pork up at Fib. 0.236 ($0.3245). On Nov. 23, SAND rallied past the Fib. 38.2% resistance at $0.3871, knocking on the June highs around $0.4591.

After closing closing week with an 11% amplify, SAND has rallied extra within the recent week, retesting the six-month resistance at $0.6525, up 31% nowadays. The asset’s hopes of a sustained uptrend count on clearing this resistance, which might most seemingly allow it to switch toward Fib. 1.618 ($0.9178).

The Sandbox is phase of the broader metaverse pattern, providing virtual areas the set up customers can socialize, trade, and manufacture. Excessive-profile collaborations with manufacturers and personalities cherish Adidas and Snoop Dogg maintain boosted its visibility.

MANA beneficial properties 51%

Decentraland (MANA) followed a identical trajectory to SAND. On the other hand, MANA showed increased resilience, at closing ending the week with a 51% amplify.

MANA dropped only 6% from Nov. 17 to twenty, after which staged an amazing comeback that has seen it attain a 9-month height above $0.72 this recent week.

On the other hand, MANA appears to be to be forming an ascending broadening wedge sample, which suggests sellers are struggling to take aid an eye fixed on of the market. Besides, RSI has surged to 84.21, which, in spite of indicating power, presentations MANA has entered an overbought living.

From this stage, if MANA remains at some level of the wedge, a descend might most seemingly ensue this recent week. Nonetheless, if the bulls can yarn a push above the upper trendline for MANA to shut above $0.7280, the uptrend might most seemingly be sustained.

Decentraland launched its preliminary coin providing in 2017, raising approximately $24 million. The platform permits customers to aquire, promote, and construct on virtual land parcels the spend of MANA.

It has since grown right into a excellent metaverse mission, emphasizing consumer ownership, creativity, and decentralization.

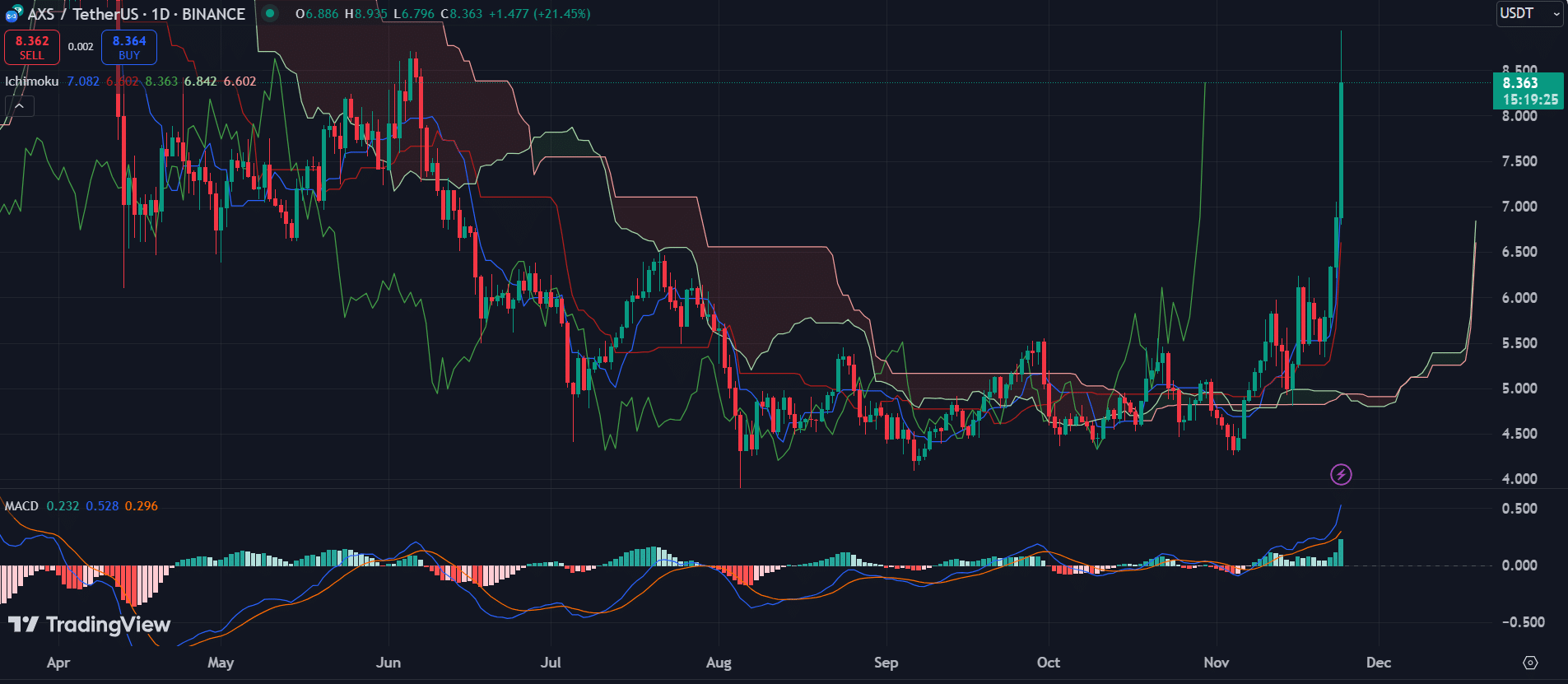

AXS eyes $9

Axie Infinity (AXS) engineered an equally bullish momentum. It soared 31% from a low of $5.34 on Nov. 21 to a six-month height of $7.050 on Nov. 23.

Following a pullback, it obtained 12% closing week.

On the other hand, the recent week has begun with intense bullishness, as AXS rose 21.78% this morning. AXS rallied to a local high of $8.935, eyeing the $9 mark designate, a stage it has traded beneath since April.

Axie Infinity has staged a breakout above the Ichimoku Cloud, now trading smartly above the cloud, which serves as a pork up zone. The Tenkan-sen and Kijun-sen maintain also aligned bullishly.

The MACD indicator confirms this bullish pattern, because the MACD line has crossed above the signal line, with a increasing certain histogram.

Given the breakout above the Ichimoku Cloud and the MACD’s bullish alignment, AXS appears to be to be in a stable upward pattern. If sustained, the price might most seemingly purpose for higher resistance ranges. The coin wants to breach $9 this week to stand in a extra favorable set up of abode.

Axie Infinity, created by Vietnam-essentially based Sky Mavis, is a blockchain-essentially based game the spend of a “play-to-form” mannequin. It permits gamers to form cryptocurrency via gameplay. It changed into a predominant driver of interest in non-fungible tokens, or NFTs, and the gaming and decentralized finance condominium.