Main finance indicators proceed to reach file highs, suggesting a heated financial system regardless of the macroeconomic challenges.

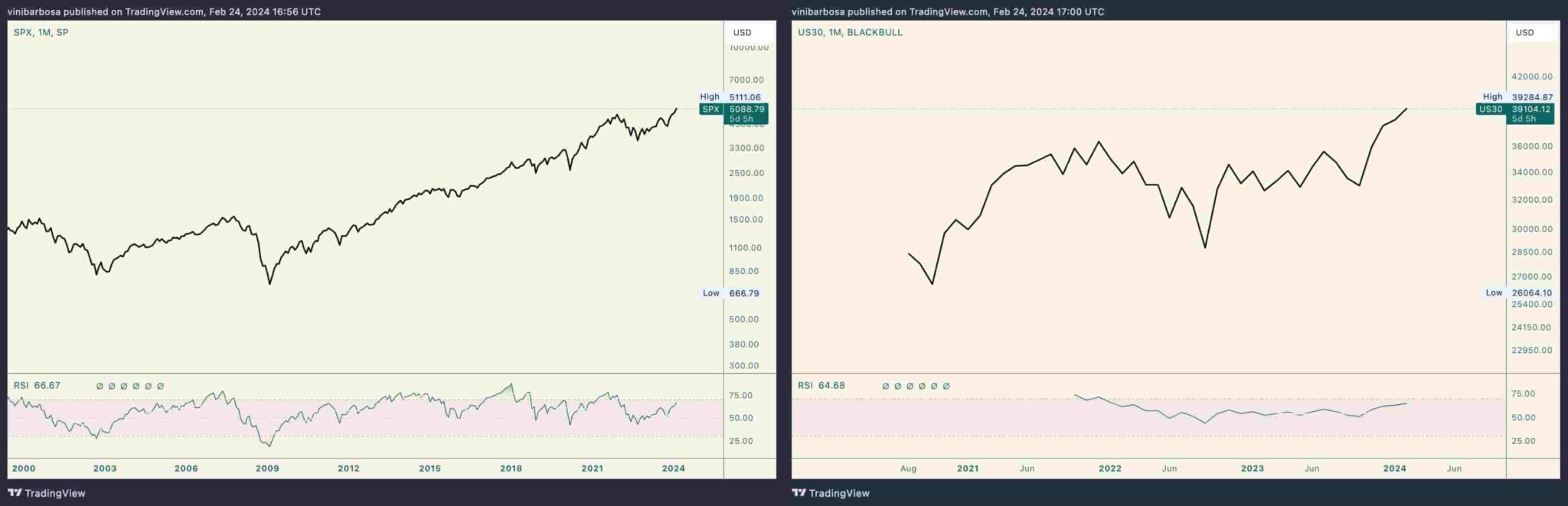

Critically, the S&P 500 and the Dow Jones Industrial Life like reached original all-time highs on February 23. The outdated reached a file $5,111.06 on the SP index and closed the week at $5,088.seventy 9. Meanwhile, Dow Jones made a brand original excessive at $39,284.87 and closed the week at $39,104.12.

Interestingly, both indexes are buying and selling with a solid momentum within the month-to-month Relative Strength Index (RSI). Continually, this potential a continuation of the uptrend.

The macroeconomics of main indexes at file highs

On the opposite hand, macroeconomics is at a lot times from diversified perspectives, constructing a conventional divergence among monetary indicators. On that novel, Jamie Dimon, CEO of JPMorgan Lag & Co (NYSE: JPM), warned we are living within the “most unsafe times.”

As an instance, dozens of countries worldwide fetch viewed file inflation within the past few years, using passion rates to native highs. Furthermore, war escalation and political disputes worsen the pronounce and redirect the capital drift to the conflicts.

On the opposite hand, the man made intelligence (AI) surge earned the eye of investors, fueling abilities stocks look after NVIDIA Corp (NASDAQ: NVDA). On this context, the Nasdaq Composite reached file highs earlier this month.

Some consultants judge this is no longer a sustainable spin, pondering the macroeconomics. Here is linked to MFHoz, who suggested a synthetic pump to entice retail capital.

Nothing is long-established about this stock market rally since december.

A community of of us favor retail fully invested.

— HZ (@MFHoz) February 22, 2024

At the 2nd, the finance market awaits additional developments on the Federal Reserve’s goal passion rate resolution on March 20. The market consensus is betting that the Federal Reserve will support the goal passion rate as is, with a likely slit within the next assembly.

Excessive rates fetch historically ignited financial recessions. Continually, it is a long way first noticed within the labor market and danger sources reminiscent of stocks and cryptocurrencies. Attributable to this truth, this might occasionally impact these main indicators at most fashionable file highs, causing a retracement.

Disclaimer: The convey on this assign have to collected no longer be regarded as investment recommendation. Investing is speculative. When investing, your capital is at danger.