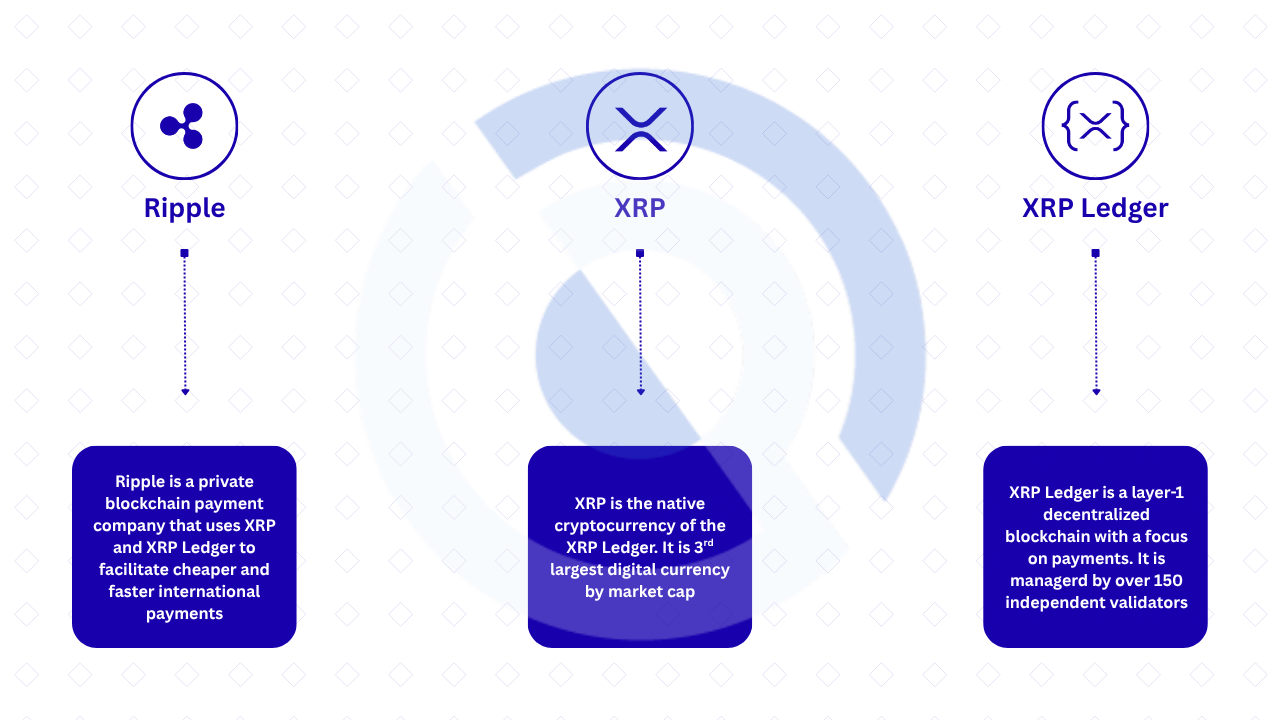

Infrequently, many americans are inclined to narrate Ripple after they indicate to narrate XRP, i.e., the third-very top cryptocurrency. Whereas they are sure beneath the ecosystem, Ripple vs XRP vs XRP Ledger are entirely diversified things supposed to play diversified roles.

“Let’s make certain, Ripple is diversified than XRP.” Brad Garlinghouse, the now-CEO of Ripple, precisely made this assertion in 2022, organising the distinction.

In a nutshell, the most straight forward manner to evaluate it’s to survey Ripple as a company, XRP as a coin, and XRP Ledger as a blockchain. However it absolutely sounds as if, no longer many people know this, as they’ve persisted to interchange one for one more for more than a decade.

The root of this confusion boils correct down to the early days of the initiatives, when branding changed into as soon as deliberately huge. Let’s focus on it more.

Why the Confusion Exists

The preliminary branding and the ancient mislabeling of Ripple, XRP, and XRP Ledger are two factors that chiefly contributed to this confusion that exists even now.

Ripple, XRP, and XRP Ledger On the full Inclined Interchangeably

The XRP Ledger changed into as soon as first launched because the Ripple Consensus Ledger in 2012. Encourage then, the network, the protocols, and even the native cryptocurrency XRP, had been all branded as “Ripple.” Many of us carried on with this unified branding, referring to the ledger and XRP as Ripple.

It grew worse after the interior most company changed into as soon as created. The company changed into as soon as at the origin known as NewCoin and later rebranded to Ripple.

Though Ripple claims to be shatter free the ledger, the perceived hyperlink between the corporate and the coin led to other folks using terms delight in “Ripple’s blockchain” and “Ripple’s coin” when referring to XRP.

Historical past of Mislabeling in Media and Exchanges

Crypto exchanges and media shops contributed to the scandalous-footing of patrons who mislabel Ripple, XRP, and XRP Ledger.

The media over-linked XRP with Ripple, with some automatically writing headlines delight in “Ripple’s mark crossed $3 this day,” as an illustration, when it must had been written as “XRP’s mark crossed $3 this day.” In Might perhaps even 2021, Brad Garlinghouse corrected CNBC on this after they listed “Ripple” in top crypto rankings and referred to XRP mark surges as “Ripple’s rally.”

“Thanks [Joe Kernen] and [Andrew Ross Sorkin] for having me on to communicate about Ripple’s traction, the adaptations between Ripple and XRP, and the need for regulatory clarity. On the 2nd point…fastened your graphic for you,” Garlinghouse wrote.

Kraken, Binance, and lots other crypto exchanges had been additionally guilty of mislabeling XRP and Ripple. In 2022, a veteran Fox Substitute journalist, Eleanor Terrett, known as out Kraken for labeling XRPL because the “Ripple network” and additionally checklist XRP beneath a “Ripple” header.

Having known what stirred the confusion, here’s how XRP, Ripple, and XRP Ledger differ from one one more.

What Is Ripple?

Ripple is a interior most blockchain company that oversees the pattern of exhaust cases and the adoption of the XRP Ledger. Ripple holds the majority of the XRP present in escrow, but the firm stays structurally shatter free either XRP or XRP Ledger.

Ripple Labs Overview

Ripple Labs began as NewCoin in September 2012 by Chris Larsen, Jed McCaleb, David Schwartz, and Arthur Britto.

Right now after the inception, the corporate changed into as soon as rebranded to OpenCoin and later Ripple Labs, after which shortened to Ripple, all within 2012 and 2015.

The founders shaped Ripple to present a higher replace to the primitive banking systems, where harmful-border funds would possibly perhaps perhaps resolve in 3-5 seconds and at a merely about zero-mark rate, using XRP and the XRPL network. So, Ripple is genuinely a vital particular person on the network supposed to showcase the exhaust case of XRP Ledger.

As an incentive for doing this, Ripple changed into as soon as given 80% (or 80 billion) of XRP’s total present to fund its fee choices, present liquidity, and seed markets by map of partnerships, all for the motive of promoting the XRPL network.

RippleNet and Price Ideas

RippleNet is Ripple’s replace to primitive fee networks delight in SWIFT. RippleNet is not very any longer a blockchain itself. Reasonably, it leverages the XRP Ledger and XRP coin to present faster and more affordable transactions across borders.

As of October 2025, over 300 financial institutions are reported to absorb joined RippleNet, along with SBI Holdings, Bank of Japan, American Mumble, Fashioned Chartered, Santander UK and Spain, and Commonwealth Bank of Australia, amongst others.

The network processed a whopping $1.3 trillion in quarterly volume in Q2 2025 by myself.

Except for RippleNet, the corporate additionally presents other products delight in On-Query Liquidity (ODL), Ripple CBDC Platform, RLUSD stablecoin, and so forth.

Ripple’s Institutional Partnerships

Ripple has scored lots of partnerships with one of the most realm’s very top financial institutions, banks, custodians, and fintech suppliers to exhaust its services.

As mentioned earlier, SBI Holdings, Fashioned Chartered, and 300 other institutions at demonstrate exhaust RippleNet to resolve harmful-border funds.

In September 2025, Ripple partnered with Securitize to integrate its no longer too long ago debuted greenback-stablecoin RLUSD into the latter’s tokenization platform, allowing patrons of tokenized money-market funds from BlackRock and VanEck to redeem their holdings for RLUSD on rely upon.

The central banks of Georgia, Colombia, etc., had additionally chosen Ripple as a know-how partner to oversee their CBDC pilot in 2023.

Ripple’s Role in Riding XRP Adoption

Ripple has been instrumental in the institutional adoption of XRP and XRP Ledger. Most of its services are underpinned by the coin and network.

The ODL, as an illustration, uses XRP as a exact-time bridge asset for global funds, which is conception to be one of the most important essential XRP token exhaust cases.

Below the ODL provider, the full partners that can need to critically change their local currency into XRP, ship the XRP across the network, after which absorb it suddenly converted into the shuffle back and forth plight fiat currency, e.g., USD to XRP to GBP.

The company is additionally dabbling in other areas delight in tokenization, institutional DeFi, all of which raise more traction to the XRPL network.

What Is XRP?

XRP refers to the exact cryptocurrency that powers the XRP Ledger. It’s a ways the harmful currency for the XRPL network, upright delight in ETH is the currency for Ethereum.

XRP as a Digital Asset

XRP changed into as soon as particularly created for rapid, low-mark global financial transactions. It has a maximum of 100 billion money, which had been all created (pre-mined) when the XRP Ledger changed into as soon as launched. So, how is present being managed, you would possibly perchance quiz.

Recall that about 80 billion XRP changed into as soon as allocated to Ripple to fund the expansion of XRPL. Ripple locked the majority of those money in a time-locked escrow to set aside present predictability available in the market.

Every month, 1 billion XRP is launched from escrow, but most cases, no longer the full money hit the market. Any unused tokens are locked aid into escrow for a later date.

Handiest about 59.8 billion XRP are at demonstrate in circulation, in response to CoinMarketCap recordsdata.

Use Instances

XRP without lengthen addresses the very top factors with global fee systems. This present day, it’s historical by many institutions to direction of snappily, low-mark harmful-border funds, which historical to be a vital distress point with legacy systems delight in SWIFT.

The 3rd-very top crypto has additionally made it more straightforward for institutions to rating admission to liquidity in seconds by Ripple’s ODL. Beforehand, when banks wanted to direction of a worldwide fee, they’d to first pre-fund Nostro and Vostro accounts in diversified in a foreign country change to shore up liquidity.

The ODL will get rid of this need by using XRP as a bridge currency, where the money is first converted to XRP, transferred in seconds, after which converted to the receiver’s local currency.

As with other cryptocurrencies, XRP is additionally historical for remittance ensuing from the inherent properties of the blockchain that allow for faster and more affordable funds, when in contrast to primitive suppliers delight in Western Union.

XRP’s Velocity and Label Advantages

XRP transactions are processed within 3-5 seconds and rate at least 0.00001 XRP, which is comparable to $0.0000297 at fresh prices. Meanwhile, transfers with primitive systems delight in SWIFT can absorb to 3-5 industry days. Even Bitcoin transactions absorb to 10 or more to resolve.

The velocity and rate advantages of XRP are primarily ensuing from XRP Ledger’s queer consensus mechanism, which most effective depends on a checklist of relied on validators to like a flash ascertain transactions – more on this later in the article.

XRP vs Heaps of Cryptocurrencies

XRP is comparable to BTC, ETH, stablecoins, and other digital assets in that they’re backed by blockchain. Then again, the motive is what devices it as an alternative of the relaxation.

Staunch delight in BTC changed into as soon as created to enable survey-to-survey transactions with none central authority, the principle motive of XRP is to facilitate snappily and low-mark harmful-border funds for financial institutions.

XRP differs from stablecoins delight in USDT, USDC, etc., in pricing. Whereas the cost of XRP is basically pushed by present and rely upon in the initiating market, stablecoins are pegged to an underlying asset or currency, which keeps their mark stable.

Right here’s a transient overview of how XRP compares to BTC and ETH by manner of transaction motive, bustle, and consensus mechanism.

| XRP | BTC | ETH | |

| Cause | To facilitate faster and more affordable global funds | To enable an electronic survey-to-survey money machine | To vitality a programmable platform of neat contracts and dApps |

| Transaction Velocity | 3 to 5 seconds | 10 minutes or more | 15 seconds to 5 minutes |

| Consensus Mechanism | XRP Ledger Consensus Protocol | Proof-of-Work | Proof-of-Stake |

What Is the XRP Ledger?

XRP Ledger is more delight in the engine that powers the XRP ecosystem. Both RippleNet and XRP are in step with the XRP Ledger. It changed into as soon as created by the identical founders of Ripple, but operates independently of the corporate.

XRP Ledger Basics

The XRPL network is a decentralized and public layer-1 blockchain, meaning no single entity has beefy abet watch over over the network, no longer even Ripple. Anybody can settle to change into a validator on the network from wherever on this planet.

XRPL is start-provide, meaning anyone to peek, alter, and create on it. You would possibly perhaps create neat contracts and decentralized applications (dApps) on the network.

XRP Ledger additionally now helps Ethereum Virtual Machine (EVM) by a sidechain, which changed into as soon as deployed in June 2025. That supposed any Ethereum dApps can now bustle on the XRPL by the layer-2 blockchain. In upright the first week, the sidechain noticed over 1400 neat contracts deployed.

Consensus Mechanism

As mentioned earlier, XRP Ledger uses a particular consensus mechanism known as XRP Ledger Consensus Protocol. It’s a ways the reason transactions on the network finalize within 3 to 5 seconds, and additionally why you can’t mine XRP delight in BTC, or stake XRP in the primitive sense delight in ETH or SOL.

The protocol is in step with the Byzantine fault-tolerant consensus mechanism, which ensures that XRPL continues to work most continuously even in cases where the validators fail or act maliciously.

There are roughly 150 validator nodes on the XRPL network bustle by Ripple and institutions delight in universities, exchanges, and self reliant operators. Every validator on the network owns a checklist of alternative validators it trusts no longer to behave maliciously, which is named the Bright Node Record (UNL).

When a transaction is made, a validator collects and shares it with their UNL. This can most effective be validated after 80% or more of a validator’s UNL approves of it. Curiously, this complete direction of occurs in the dwelling of 3 to 5 seconds.

Clear Contracts and Tokenization Capabilities

The no longer too long ago launched XRP EVM sidechain makes it doable for anyone to deploy Ethereum-successfully suited neat contracts and dApps on the XRP Ledger this day.

Except for that, XRPL is able to natively abet programmability of lightweight neat contracts at the protocol level by what it calls “Hooks.”

In the intervening time, XRPL does no longer natively abet Turing-total neat contracts, so the full heavyweight dApps considered on Ethereum, comparable to Uniswap and Aave, can no longer be constructed without lengthen on XRPL, but are doable by the sidechain.

Tokenization, meanwhile, is extremely grand doable with XRPL. It’s a ways supported natively on the ledger so successfully that you just wouldn’t need to deploy any custom neat contracts.

Environmental and Efficiency Advantages

Over the years, Bitcoin’s Proof-of-Work consensus mechanism has been a field of criticism ensuing from the vitality-intensive direction of of mining new money. XRP Ledger refrained from this worry by deciding on to exhaust a federated consensus, which does no longer require mining.

It’s stable to narrate that XRPL is more eco-friendly and scalable when in contrast to Bitcoin. The ledger handles up to 1,500 transactions per 2nd at merely about zero rate.

How Ripple, XRP, and XRP Ledger Work Collectively

By now, it ought to make certain to you the distinction between Ripple and XRP and how every of them works collectively in the network. Ripple fronts the adoption of XRPL by leveraging XRP and the blockchain in its products. XRP serves because the harmful currency on the XRPL network, which powers the full transactions.

Ripple The exhaust of XRP and XRPL in Its Price Ideas

RippleNet is one example of how Ripple uses XRP and XRPL networks in fee choices. RippleNet leverages the XRP Ledger for exact-time messaging, clearing, and settlement of economic transactions across borders, grand faster and more affordable than primitive selections.

Furthermore, Ripple uses XRP in its On-Query Liquidity provider as a bridge currency, weeding out the need for banks to pre-fund accounts in diversified local currencies upright to facilitate global funds.

Independent Builders Constructing on XRPL Beyond Ripple

Ripple is not very any longer the most straight forward developer transport products on XRPL. There had been other applications launched on the network by self reliant developers. Listed below are about a examples.

1. xrp.cafe

xrp.cafe is both an NFT marketplace and a launchpad for the XRPL ecosystem, where anyone need to aquire, sell, and mint NFTs on the XRP Ledger. The developers additionally created “First Ledger,” a Telegram-based entirely entirely trading bot for XRPL.

2. Xaman Pockets

Xaman is leading a self-custodial crypto pockets for the XRPL ecosystem. It changed into as soon as particularly designed to permit users to abet an eye on digital assets on the XRP Ledger.

3. Sologenic

Sologenic is an XRP Ledger-based entirely entirely platform that goals to bridge the primitive financial market to crypto. The platform enables users to change tokenized shares and ETFs using XRP.

4. Vertex Protocol

Vertex Protocol is a decentralized alternate for trading on-chain tokens. It changed into as soon as at the origin launched on Arbitrum but later deployed to XRP Ledger by map of the sidechain.

Correct and Regulatory Implications

The tie and mislabeling of XRP, Ripple, and XRP Ledger weren’t with out some implications.

Ripple’s profound contribution to the network, along with the whopping 80 billion XRP it bought from the founders, stays a level of competition for many crypto critics on the claim that XRP Ledger is “decentralized.”

Some argued that any single entity, especially a for-income company delight in Ripple, with this form of huge allocation, has too grand affect over the XRP market.

On the regulatory aspect, the interchange of XRP and Ripple led to counterfeit narratives that patrons had been taking a look for for into Ripple companies, as an alternate of the XRP coin. This shaped phase of the U.S. Securities and Switch Commission (SEC) argument against Ripple for the interval of its merely about five-year correct fight.

SEC alleged Ripple performed an unregistered securities offering by selling XRP, claiming XRP changed into as soon as a security because its mark changed into as soon as tied to the corporate’s efforts.

Popular Misconceptions About Ripple and XRP

The shared ancient past between XRP, Ripple, and the XRP Ledger has resulted in definite misconceptions. Let’s rating the info straight.

Ripple Does Now no longer Possess the XRP Ledger

Ripple and XRP Ledger would possibly perhaps perhaps had been created by the identical founders, but they feature independently from one one more. Despite the indisputable reality that Ripple ceases to exist this day, the network will proceed to feature as continually.

The explanation being that the network is managed by a network of self reliant validators. Ripple operates a validator node, too, but their rights and abet watch over are the identical as every other participant.

XRP Is Now no longer Staunch “Ripple’s Coin”

It’s scandalous to consult XRP as Ripple’s coin, and that’s because Ripple did no longer anguish XRP. The firm does no longer win the cryptocurrency itself.

XRP changed into as soon as issued natively to the XRP Ledger for paying transaction charges and as a “bridge currency” to facilitate snappily, low-mark harmful-border funds.

The XRP Ledger Is Maintained by Independent Validators

Many of us assumed Ripple completely maintains the XRPL, with its validators acting as company nodes. However as we mentioned before, Ripple is most effective a participant in the network with no particular privilege.

The network is extremely maintained by a decentralized network of over 150 validators operated by self reliant entities, along with universities (e.g., MIT), crypto exchanges, and neighborhood contributors.

Use Instances of XRP Ledger Beyond Ripple

Ripple and its services are no longer all that the XRP Ledger has to give. The blockchain has many native functionalities that enable other exhaust cases.

Micropayments and Incorrect-Border Remittances

Ripple’s capability to present faster and more affordable harmful-border funds with its services is not very any longer a prerogative of the corporate by myself.

If reality be told, that capability is an inherent technical characteristic of the XRPL network. And so, it manner that anyone wherever can additionally mediate to create a identical efficient platform for micropayment and harmful-border transactions using XRPL.

Central Bank Digital Currency (CBDC) Pilots

The XRP Ledger can additionally be historical to anguish and organize central bank digital currencies.

Ripple itself proved this by launching its win interior most network in step with XRPL, where central banks absorb total abet watch over and sovereignty to search out and pilot CBDC initiatives.

NFTs and Tokenization on XRPL

Whereas you happen to’ll be in a position to recall, we mentioned earlier that the XRP Ledger natively helps tokenization of assets. That’s a huge exhaust case. You would possibly perhaps with out problems leverage the network to mint, change, and burn diversified tokenized assets, along with non-fungible tokens and exact-world assets.

The Future of Ripple, XRP, and the XRP Ledger

The resolution of the years-long correct fight between Ripple and the SEC is a big accumulate for the manner forward for the corporate, XRP, and the network at gigantic.

When the SEC sued Ripple in 2020, we noticed how that impacted the Ripple and XRP’s mark. However when both events at very top filed to brush aside the case in August 2025, the outlook became bullish, with XRP’s mark reflecting that.

With that uncertainty now waived, we ask to survey notify across key areas.

Institutional Adoption Outlook

Following recordsdata that Ripple changed into as soon as ending its case with the SEC, the corporate has been in a position to onboard more institutional partners, along with BNY Mellon. That perchance gives a stumble on of more institutional adoption going forward.

Correct Clarity and Regulations in 2025

There would possibly perhaps be now some clarity that XRP doesn’t qualify as a security, which has paved the manner for XRP plight ETFs and institutional investments, which are wholesome for XRP’s mark. We can ask to survey more ETF launches and XRP digital asset treasury companies in the long bustle.

XRPL Enlargement and Developer Ecosystem

With all things conception of, it’s no longer worrying to foretell that the XRPL ecosystem will make bigger from here, especially with the open of the EVM sidechain, which bridges Ethereum to XRP Ledger. We can ask to survey liquidity float into the XRPL ecosystem.