On August 7, Ripple’s (XRP) mark climbed to $0.63, prompting speculation that the cryptocurrency would be on the level of a significant breakout. On the opposite hand, that did no longer happen, because the worth had fallen to $0.59 at press time.

The old mark bounce led traders to make bigger their bets on contracts tied to the token, aiming to learn from the movement. On the opposite hand, that momentum has shifted as of this writing.

Traders Step Motivate as Ripple Dominance Wanes

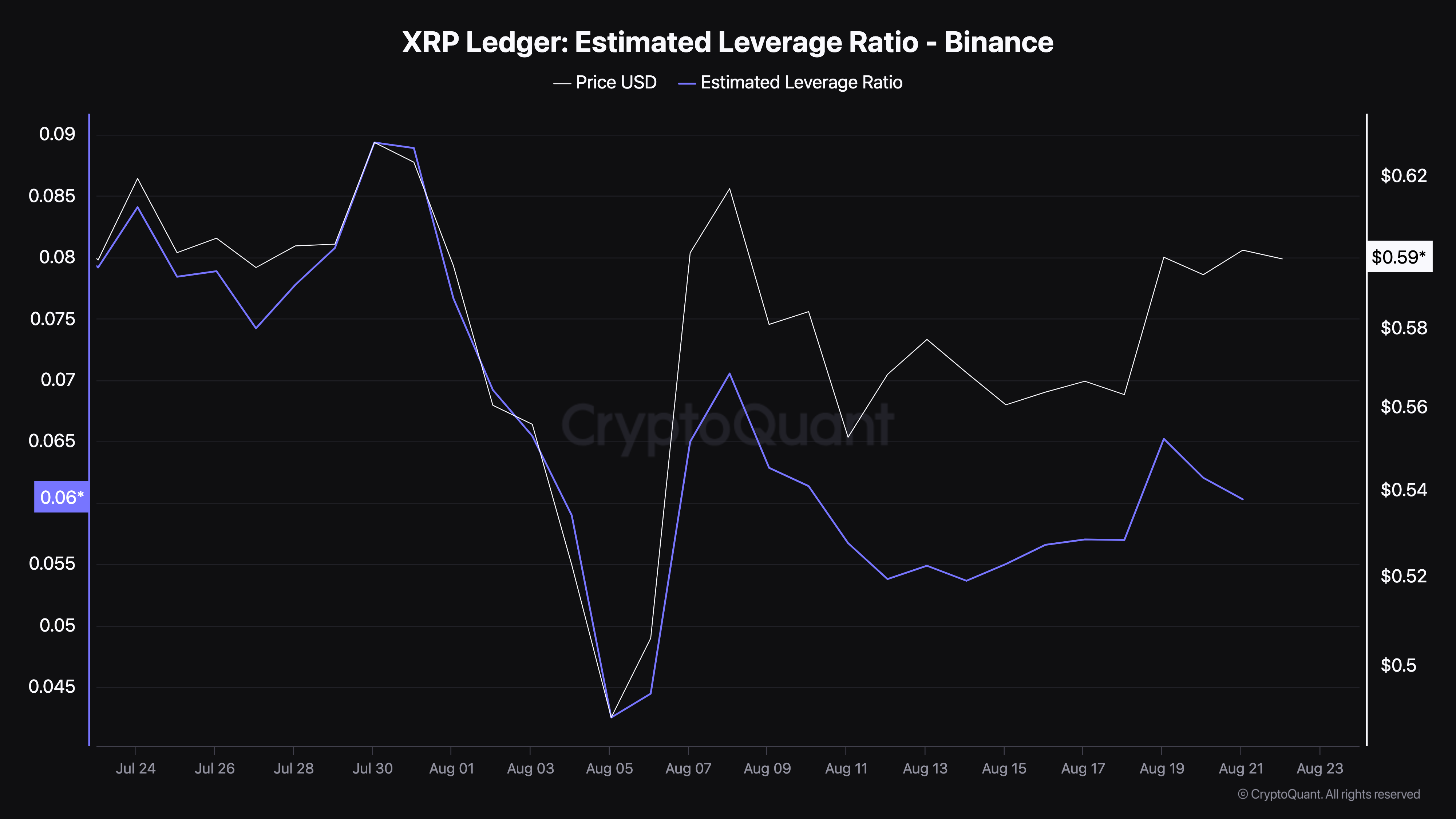

In accordance with CryptoQuant, the XRP Estimated Leverage Ratio (ELR) is the total vogue down to 0.060. As the title suggests, the ELR suggests how significant leverage traders are the utilization of to bet on their positions in the market.

Increasing leverage ratio indicates that traders are taking excessive-possibility bets in the market. This in overall map self perception that the worth will pass in a particular route.

On the opposite hand, a lower suggests that traders are skeptical about the worth movement. So, in its attach of opening contracts with 25x, 50x, and 100x leverage, fresh data reveals that they are applying warning to steer clear of being liquidated.

Read extra: How To Aquire XRP and Every thing You Need To Know

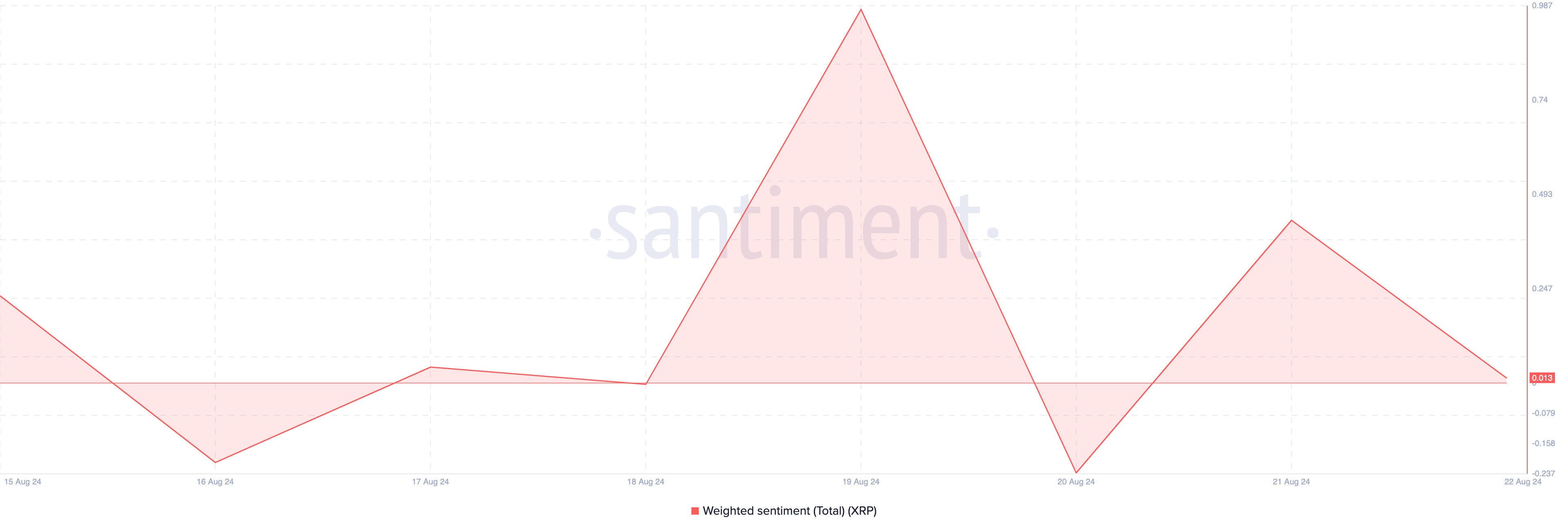

This cautious means looks connected to XRP’s fresh performance. Each traders in the derivatives market and the broader market possess began to temper their bullish outlook on XRP. This shift is reflected in the Weighted Sentiment metric, provided by the on-chain analytics platform Santiment.

Weighted Sentiment gauges how positively or negatively market participants feel about a cryptocurrency. When this metric rises and stays scoot, it suggests excessive self perception that the worth will make bigger. Conversely, a detrimental reading indicates pessimism in market sentiment.

In the intervening time, the metric is nearing detrimental territory, signaling a decline in bullish sentiment. If it dips additional, demand for XRP would perchance presumably well moreover impartial weaken, doubtlessly main to a mark fall beneath $0.59.

XRP Trace Prediction: Next Conclude Would perchance presumably Be $0.55

XRP mark rally to $0.63 coincided with the partial conclusion of the Ripple-SEC lawsuit. On the opposite hand, while market participants anticipated an extra make bigger, the crypto confronted a failed breakout.

As considered in the chart beneath, bulls managed to preserve XRP from losing beneath $0.55. On the opposite hand, the token would perchance presumably well face resistance at $0.60, which is a significant psychological stage. Curiously, the Stochastic Relative Strength Index (Stoch RSI) has shown an upward pattern.

Stoch RSI measures a cryptocurrency’s momentum in accordance with the streak and magnitude of mark changes. The indicator on the total indicators an overbought attach of residing when the reading hits 80.00 and an oversold attach of residing when it drops beneath 20.00.

Read extra: Ripple (XRP) Trace Prediction 2024/2025/2030

For XRP, the Stoch RSI for the time being reads 87.24, signaling an overbought attach of residing. This would presumably well doubtlessly result in a pullback, pushing the worth lend a hand to $0.55. On the opposite hand, if shopping for stress builds or the broader altcoin market rallies, XRP’s mark would perchance presumably well bounce in the direction of $0.63.