Ripple has around 40.1 billion XRP, locked in escrows and never allotment of the token’s circulating provide. The corporate unlocks 1 billion tokens month-to-month and retains a share of them for its treasury reserves and sell-offs.

Finbold has tracked these unlocks, identifying patterns that impression the asset’s lengthy-term fee.

On March 1, Ripple unlocked one other 1 billion XRP, valued at $630 million, conserving 200 million, in conserving with prior months. This amount is now price roughly $126 million, with every token priced at $0.63 by press time.

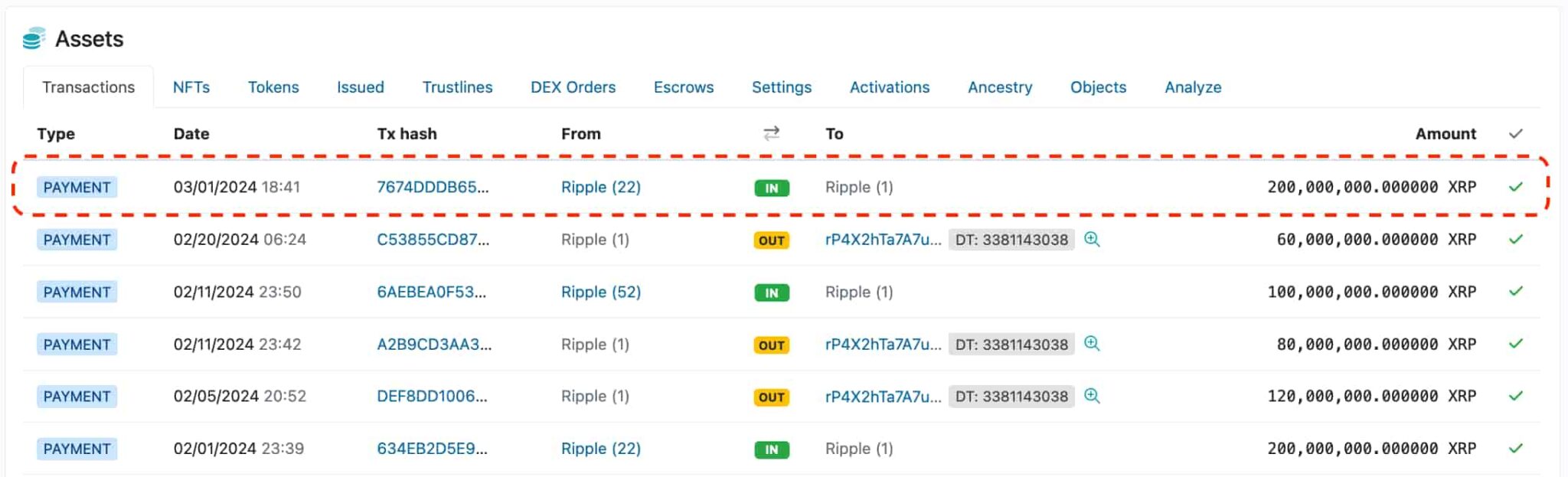

In particular, the company ready this month’s selling job by sending the 200 million XRP from ‘Ripple (22)’ to ‘Ripple (1)’. The institution controls both accounts, with the worn being the unlocked escrow tackle and the latter old as its treasury reserves.

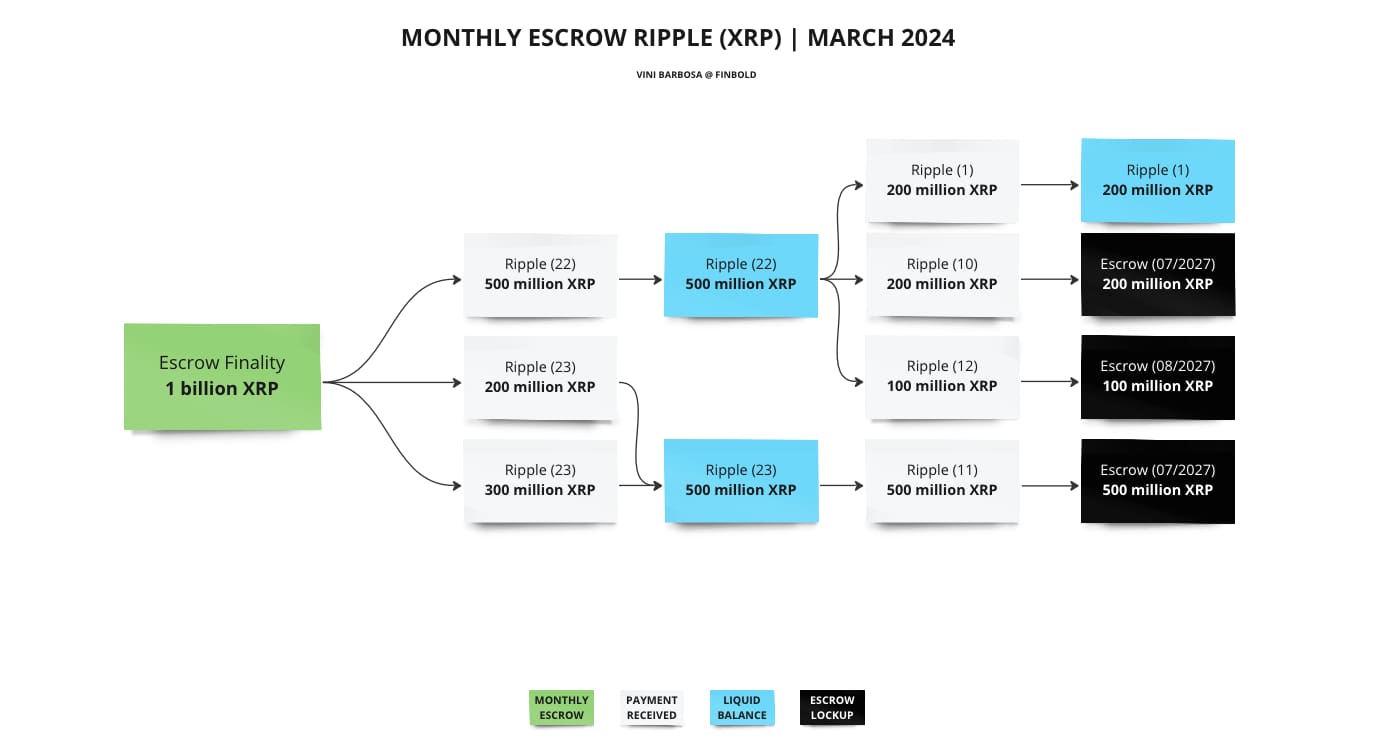

Ripple’s XRP escrow job for March’s sell-off

Similarly to what came about in outdated months, escrows gain reached finality at some level of the ‘Ripple (22)’ and ‘Ripple (23)’ accounts. Notably, this became once the closing time the institution old these two addresses, with out a escrows left on them for April.

The worn unlocked 500 million XRP on March 1, despatched 200 million to ‘Ripple (1)’, 200 million to ‘Ripple (10)’, and 100 million to ‘Ripple (12)’. Curiously, Ripple uses the latter two accounts to re-lock XRP in contemporary escrows and is the usage of ‘Ripple (12)’ for the principle time.

Therefore, ‘Ripple (10)’ will liberate this 200 million XRP in July 2027, while the contemporary escrow memoir will liberate 100 million in August 2027.

Later, ‘Ripple (23)’ despatched the unlocked 500 million to ‘Ripple (11)’, also fully locked in an escrow to July 1, 2027.

What’s subsequent for April sell-offs?

Extra, the market might maybe soundless begin taking a survey at ‘Ripple (10)’ and ‘Ripple (11)’ starting in April, to command Ripple’s sell-offs.

It is miles a necessity to achieve that the company often liquidates its holdings in strategic moments. If fact be told, the sell-offs signify a relevant weight of the token’s 24-hour shopping and selling quantity, able to influencing short-term word creep.

Moreover, the institution has demonstrated it will dump extra portions of XRP, in addition to every month’s unlocks. In February, an additional 100 million became once deployed for that intent from a dormant pockets in Ripple’s maintain watch over.

Disclaimer: The negate on this position might maybe soundless no longer be judicious funding recommendation. Investing is speculative. When investing, your capital is at wretchedness.