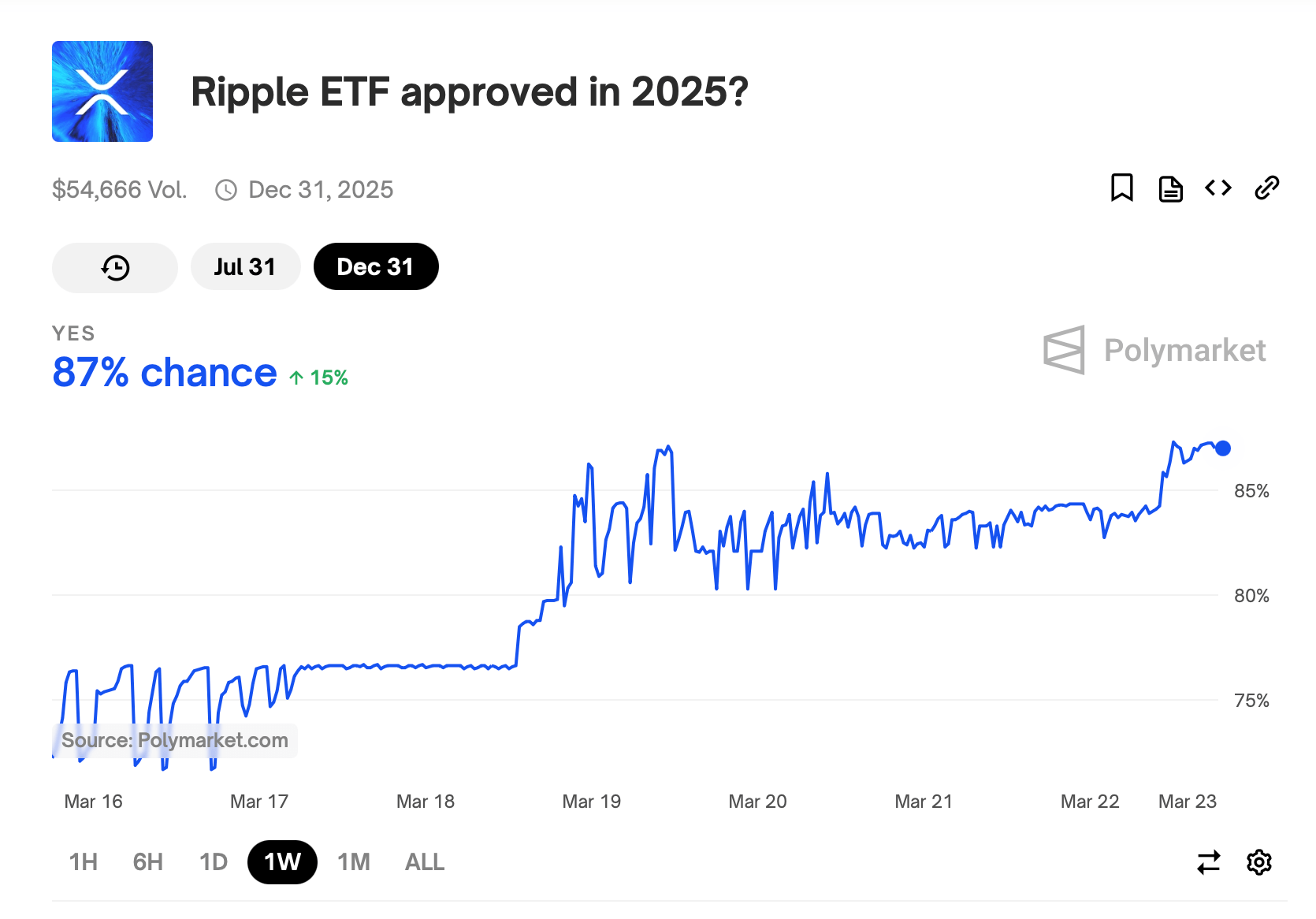

A Polymarket wager amassing $54,666 in buying and selling volume suggests an 87% likelihood that a station XRP alternate-traded fund (ETF) will genuine regulatory approval by 2025.

XRP ETF Mania Hits 87% Self belief: Polymarket Traders Wager Massive on 2025 Approval

In January 2024, the U.S. Securities and Replace Commission (SEC) cleared the system for more than one station bitcoin ( BTC) alternate-traded funds (ETFs), followed by ethereum ( ETH) ETFs in July. These approvals marked pivotal moments for digital asset accessibility, aligning with broader shifts in regulatory scrutiny.

Since Donald Trump assumed the Forty seventh presidency, a wave of quite a variety of crypto asset ETF registrations has flooded the SEC’s pipeline, encompassing XRP, LTC, HBAR, SOL, ADA, MOVE, APT, DOT, and SUI. A Polymarket wager at this time displays an 87% likelihood that a station XRP alternate-traded fund (ETF) will doubtless be greenlit by 2025, nearing the bet’s top self assurance stage since its inception.

This optimism surged after it modified into printed that the SEC modified into dismissing its lawsuit against Ripple Labs, a decision that sharply elevated market expectations.

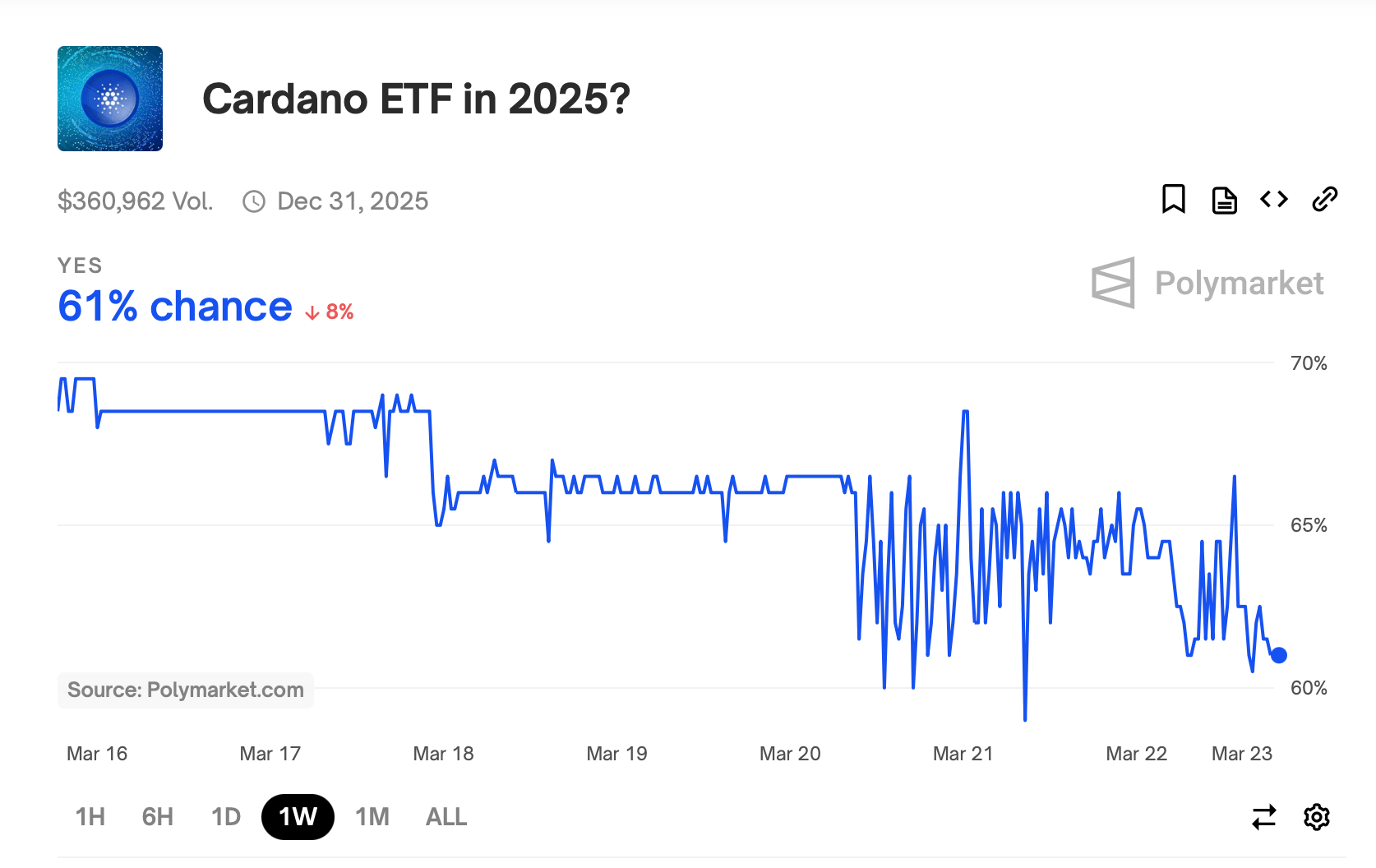

Individually, a Polymarket bet monitoring a doable cardano ( ADA) ETF approval in 2025 reveals a 61% likelihood as of March 23. Grayscale submitted an utility with the SEC for a station ADA ETF.

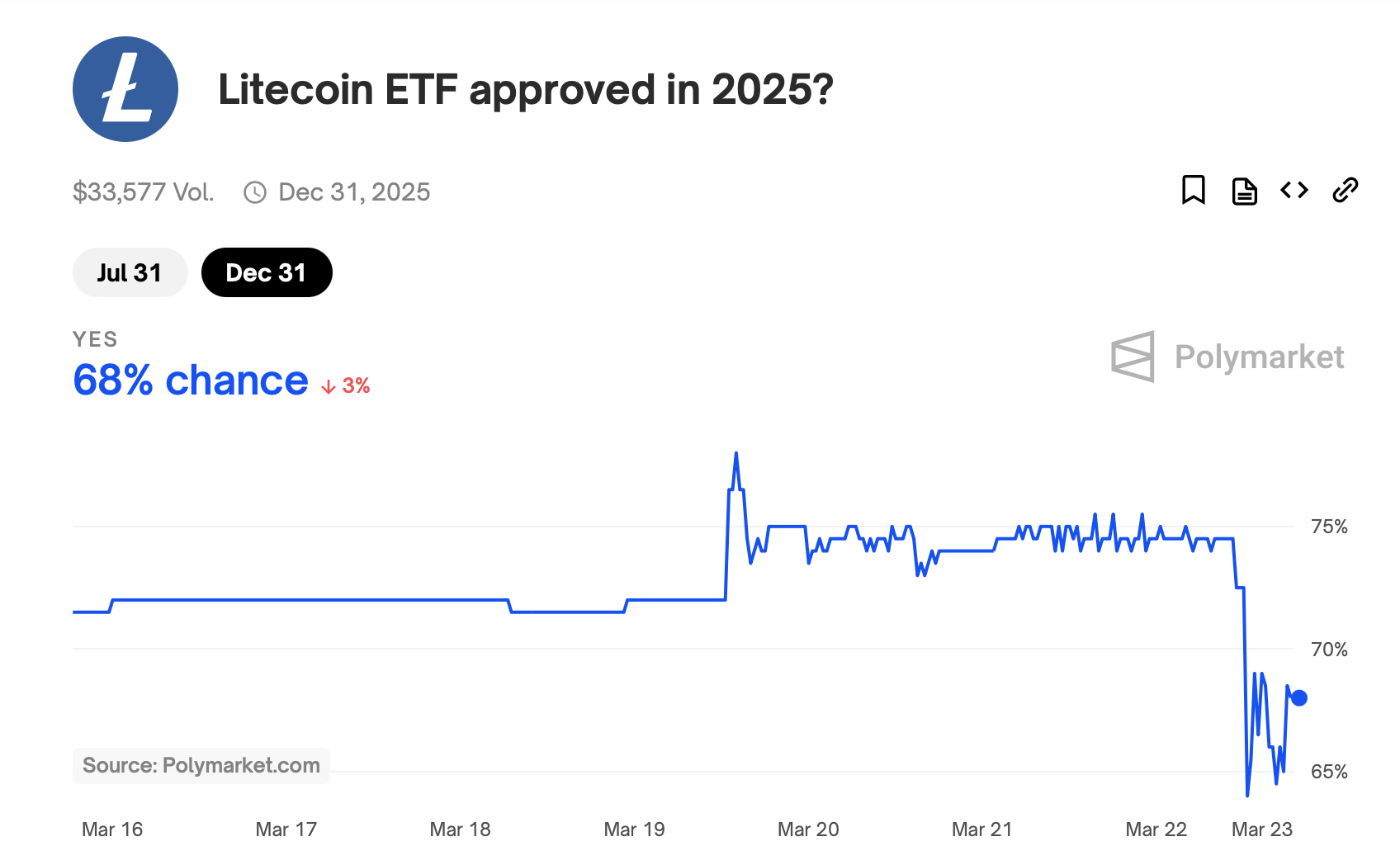

Litecoin ( LTC) is also on the platform, with a $33,577-traded bet reflecting a 68% likelihood of an LTC ETF approval as of March 23. Firms cherish Coinshares, Canary Capital, and Grayscale are competing to genuine regulatory clearance for an LTC product.

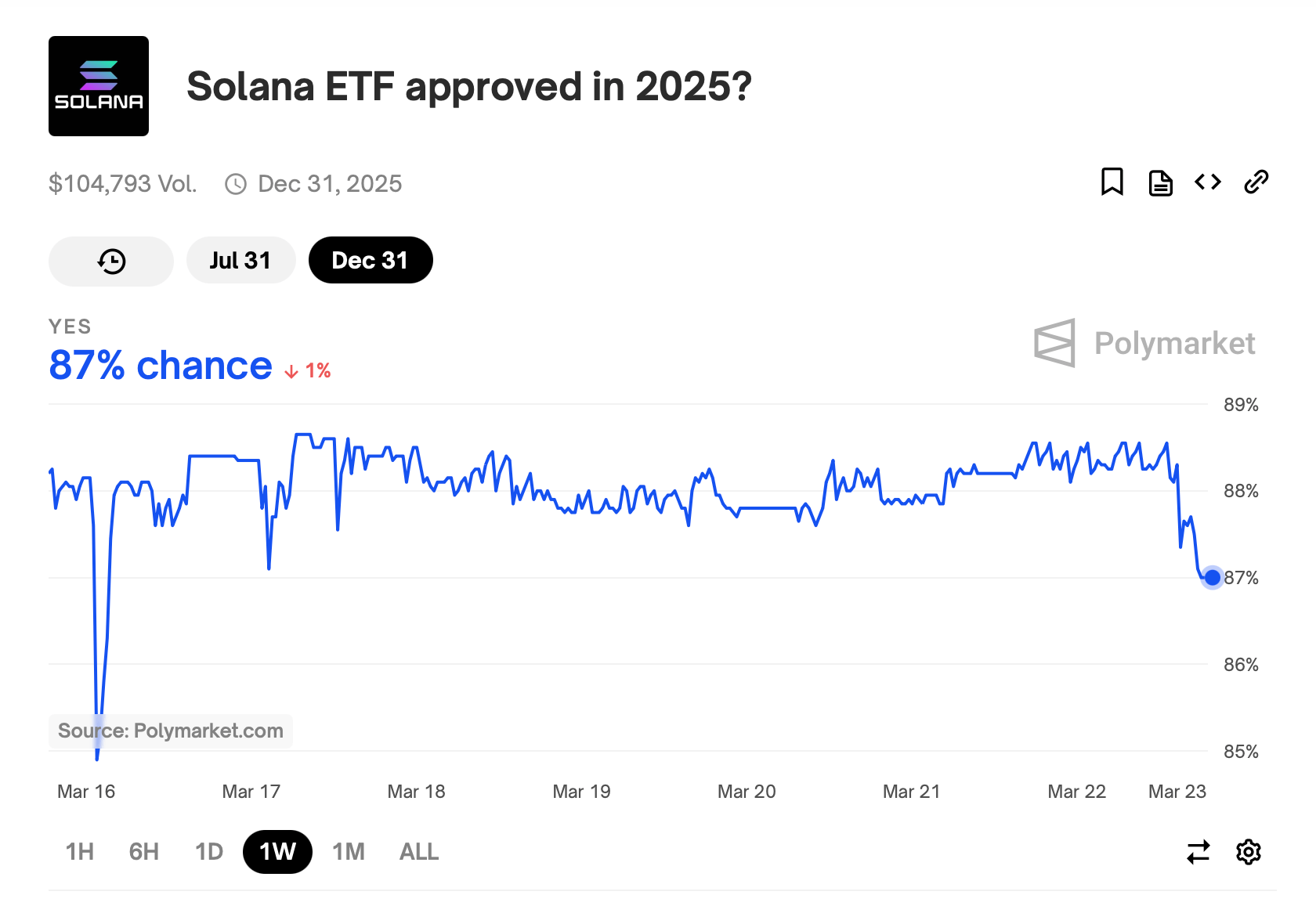

Meanwhile, a solana ( SOL) ETF proposal, backed by a $104,793-volume Polymarket wager, holds an 87% approval likelihood in step with bettors. A roster of financial firms, at the side of Vaneck, Grayscale, 21shares, Bitwise, Franklin Templeton, and Canary, are in search of to debut a SOL ETF.

Notably, the prediction marketplace hosts no animated bets for DOT, HBAR, MOVE, APT, or SUI ETFs. The rising hobby in crypto ETFs highlights a pivotal shift in direction of mainstream adoption, driven by regulatory readability and institutional backing.