- The SEC’s withdrawal strengthens Ripple’s authorized space and boosts XRP’s possibilities of securing ETF approval.

- Ripple’s possible substandard-charm could perhaps perhaps additionally redefine authorized precedents for cryptocurrency classification and regulation.

As currently mentioned in a Reuters update, Ripple Labs has presented that the U.S. Securities and Trade Commission (SEC) has withdrawn its charm in the longstanding case against the firm. This case, initiated in December 2020, accused Ripple of advertising XRP as an unregistered security.

The withdrawal signifies a pivotal victory for Ripple and the broader cryptocurrency trade, doubtlessly surroundings a precedent for future regulatory approaches. As properly as, Ripple’s Chief Appropriate Officer Stuart Alderoty emphasized:

Ripple is now in the driver’s seat, and we’ll evaluate how most attention-grabbing to pursue our substandard-charm. Regardless, as of late is a day to have a shining time.

Ripple’s Strategic Appropriate Maneuvers

In a tweet, Stuart Alderoty, additionally expressed optimism referring to the SEC’s choice but emphasized that Ripple is evaluating its choices in terms of a substandard-charm. This substandard-charm pertains to a $125 million penalty and an injunction restricting Ripple’s institutional XRP sales.

This day, Ripple strikes forward—stronger than ever. This landmark case direct a precedent for the home crypto trade.

With the SEC dropping its charm, Ripple is now in the driver’s seat and we’ll evaluate how most attention-grabbing to pursue our substandard charm. Regardless, as of late is a day to… https://t.co/NLgmiRrcjx

— Stuart Alderoty (@s_alderoty) March 19, 2025

Ripple’s Appropriate Approach Animated Forward

As beforehand highlighted by CNF, Professor Reiners pressured out the want for Congress to take care of the regulatory gap in the crypto spot market. With the SEC no longer actively urgent expenses against Ripple, the firm is in a valuable stronger space to deliberate on its authorized standing.

Ripple’s next strikes could perhaps perhaps additionally involve further pursuit of a substandard-charm, that could perhaps perhaps additionally just lead to a definitive choice from the next court on whether funding contracts require negate contracts.

Alternatively, Ripple could perhaps perhaps additionally just establish to forgo an charm and as a replacement negotiate a settlement with the SEC to carve help the relaxation sparkling and injunction. This could perhaps well additionally present increased regulatory clarity for Ripple and XRP appealing forward.

XRP ETF Possibilities Brighten and Market Reacts Favorably

In line with ETF.com, the SEC’s choice has positively impacted the aptitude approval of XRP Trade-Traded Funds (ETFs). Lots of valuable firms, alongside with Franklin Templeton, have filed applications for XRP ETFs, reflecting growing institutional hobby.

The selection of Ripple’s authorized challenges enhances the likelihood of those ETFs receiving regulatory approval, doubtlessly broadening investor get entry to to XRP.

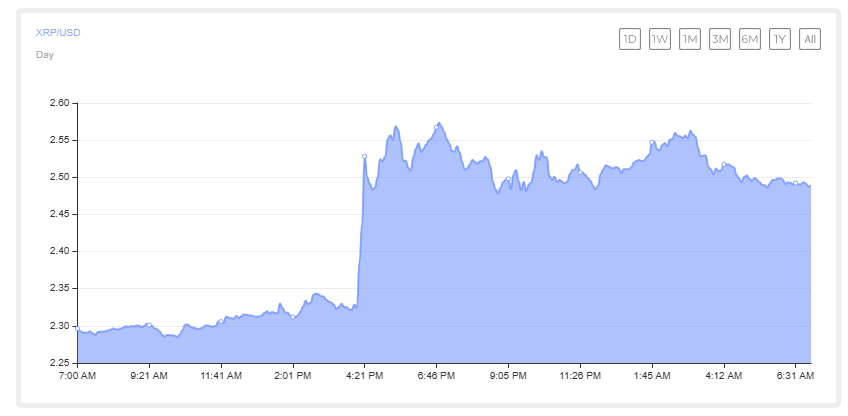

The cryptocurrency market has responded positively to those traits. XRP’s observe surged roughly 9.05% previously day and 12% previously week, reaching nearly $2.56 following the announcement. This uptick reflects renewed investor self assurance in XRP’s regulatory clarity and future potentialities. Take into memoir XRP observe chart beneath.