The on-chain knowledge platform Token Terminal says BlackRock would possibly maybe well maybe originate its possess blockchain, much like Coinbase’s Layer-2 (L2) network, Unhealthy.

The assumption follows a behold into the asset supervisor’s holdings across asset courses.

Token Terminal: Why BlackRock Blockchain Is a Risk

BlackRock categorizes its crypto holdings into three groups: crypto property take care of Bitcoin (BTC), stablecoins take care of USDC, and tokenized property take care of BUIDL. This files comes from the on-chain knowledge platform Token Terminal, which analyzed the asset supervisor’s crypto device.

BlackRock reportedly identifies three certain advantages of Bitcoin as an asset. First, it is far web-native, making it globally accessible. 2d, Bitcoin’s efficiency in unsuitable-border transactions is highlighted. Lastly, its mounted provide cap positions it as a hedge in opposition to inflation.

Read extra: What’s Tokenization on Blockchain?

Highlighting the position of BlackRock’s iShares Bitcoin ETF (trade-traded fund), IBIT, Token Terminal anticipates the firm will in an identical device productize all main crypto property. Critically, while BlackRock has already carried out this with Ethereum, possibilities of a Solana ETF remain slim for now.

On the different hand, the on-chain knowledge platform attests to BlackRock’s belief within the different of blockchain technology to beef up capital markets. It cites spherical-the-clock operational capital markets, improved transparency and investor obtain entry to, lower charges, and sooner settlement. This investigation led Token Terminal to discontinue that the firm would possibly maybe well maybe originate its possess blockchain, as Coinbase did with Unhealthy L2.

“We think that BlackRock will within the kill originate its possess blockchain, and observe a identical playbook that Coinbase has feeble with Unhealthy. This would possibly permit BlackRock to listen to the recordkeeping of its holdings across asset courses ($10T AUM) to a single, world, interoperable, and transparent ledger,” Token Terminal concludes.

Conceivable Implications of BlackRock Blockchain For TradFi

BlackRock’s originate of a blockchain would ticket a fundamental shift within the passe finance (TradFi) sector, signaling a transfer in opposition to decentralized alternate choices. Equivalent to how Coinbase transformed into a Web3 gateway with Unhealthy, BlackRock’s blockchain initiative would possibly maybe well maybe elevate the firm from a passe asset supervisor to a frontrunner within the digital asset dwelling.

Whether or now not BlackRock will originate its possess blockchain stays unknown, as the firm did by hook or by crook respond to BeInCrypto’s query for commentary. On the different hand, such a transfer would warrant determined regulations.

“As out of the ordinary as we would fully treasure to peek this, except regulations and compliance spherical this are determined, it obtained’t be occurring within the quick time period at all. Right here is given the need for compliance. There’s one thing: a total blockchain ecosystem would possibly maybe well maybe be inconceivable, however how would they solve for compliance?” one X user commented.

Leveraging blockchain technology, BlackRock would possibly maybe well maybe streamline its operations, within the bargain of charges, secure higher transparency, and give a enhance to security across its intensive financial services and products. This device has the doable to revolutionize transactions and obtain a extra efficient and procure financial ecosystem.

Furthermore, such a venture would begin up fresh alternatives for its purchasers and traders to acquire entry to a substantial assortment of digital property. They would additionally be exposed to extra seamless and user-friendly funding alternatives. This would possibly democratize obtain entry to to financial products and toughen BlackRock’s position as a frontrunner within the digital asset management dwelling.

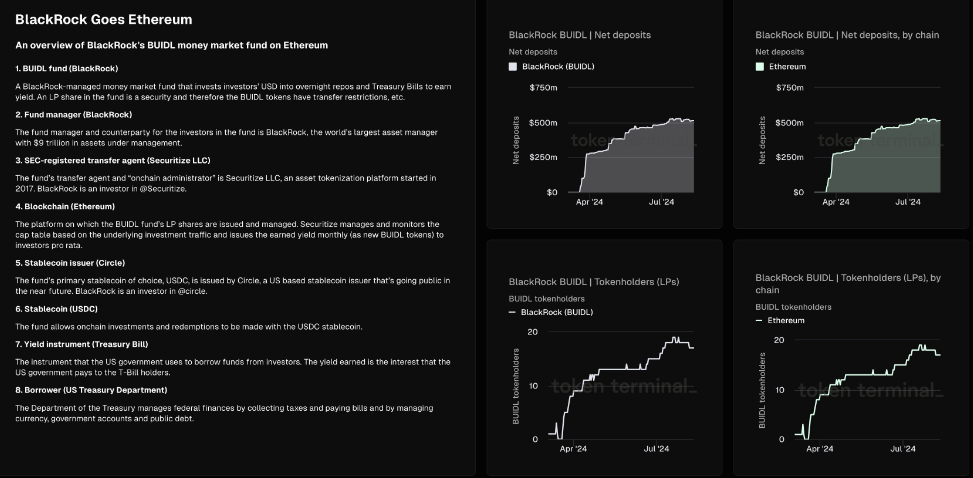

The firm has already region a fresh customary in tokenizing staunch-world property (RWAs) with the success of BUIDL, BlackRock’s USD Institutional Digital Liquidity Fund. BUIDL lately grew to grow to be the biggest tokenized fund, showcasing the mutter and increasing integration of blockchain technology in passe finance (TradFi).

Read extra: How To Spend money on Steady-World Crypto Property (RWA)?

Whereas the life like establish a question to for such tokenized products stays in its nascent phases, boom segments proceed to inform promising ardour. BlackRock’s BUIDL and Franklin Templeton’s BENJI level to this attain.