- Render is making an are attempting to ruin above a key rectangle channel’s $5.155 resistance stage.

- A winning trudge above this resistance might perhaps well send Render in direction of the $6.097 stage.

- A major uptick within the 30-day MVRV might perhaps well cause Render to gape excessive selling tension.

Render is down 2% on Wednesday because it attempts to ruin above the $5.155 key resistance stage. This trudge might perhaps well build of dwelling off a rally and cause a primary uptick in average good points for traders who bought it all the draw by the closing 30 days.

Render attempts trudge above key resistance

Render fell below the $5.155 resistance stage of a key rectangle channel on Wednesday after temporarily shifting above it earlier on Tuesday. In the past month, Render has sustained several sideways moves inside of this channel.

Whereas the AI token is calling to retest the $5.155 resistance but again, it is restricted by the 200-day Easy Engaging Life like (SMA). A protracted trudge above the 200-day SMA might perhaps well flip the $5.155 resistance into a beef up and stage a rally in direction of the $6.097 stage. Conversely, if it sees one other rejection around $5.155, it might perhaps well decline in direction of the $4.274 beef up stage.

RENDER/USDT 4-hour chart

The Relative Energy Index (RSI) is at 52, correct above the fair stage, indicating bullish momentum. The Stochastic Oscillator (Stoch) is below the fair stage at 47.

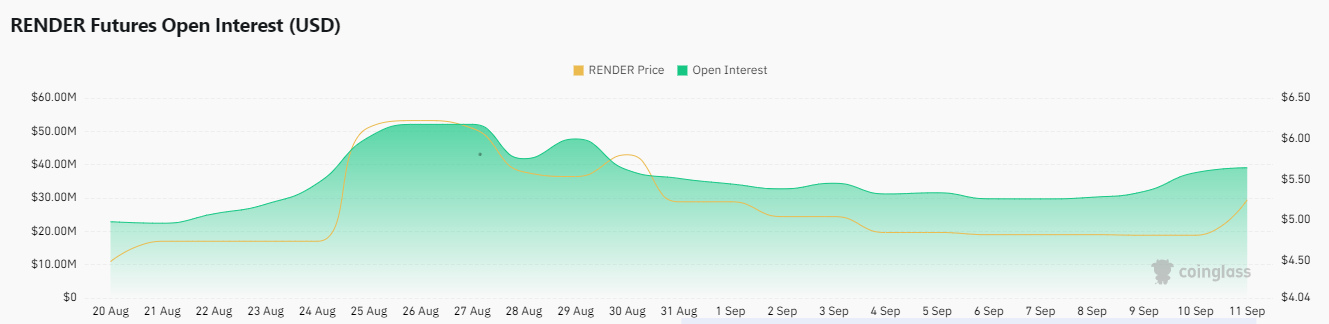

Render’s Futures Commence Interest (OI) has also been rising, increasing from $30.22 million on September 8 to $39.08 million on Wednesday. Commence passion is the total replacement of unsettled long and immediate contracts inside of a derivatives market. The rising OI indicates that traders are increasingly inserting bets on the price of Render. If costs are rising alongside it, the OI helps a bullish trudge.

RENDER Commence Interest

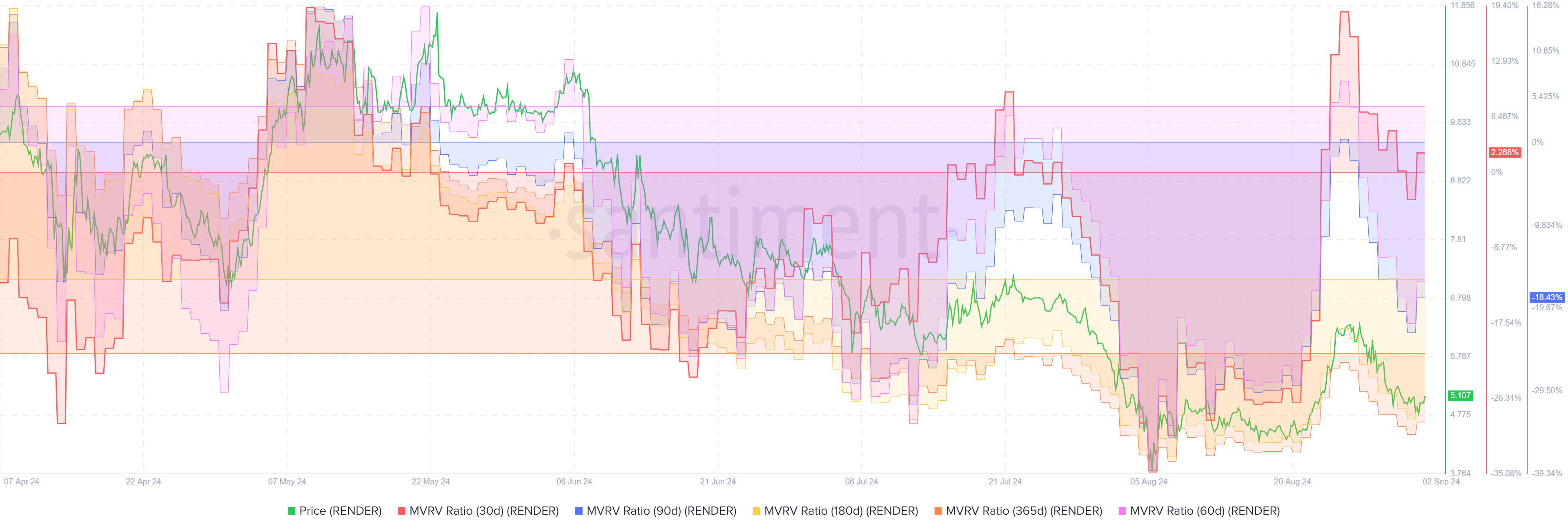

On the month-to-month time physique, Render is trading at a 9% accomplish. However, its 60-day, 90-day, 180-day and 365-day Market Designate to Realized Designate (MVRV) reveals traders who sold Render within the past three months and upward are protecting their tokens at a median loss, that blueprint they’re less likely to promote at novel costs.

The MVRV indicates the average earnings or loss of all addresses that bought a token inside of a particular time physique.

RENDER 30-day, 60-day, 90-day, 180-day, 365-day MVRV

In the meantime, Render’s 30-day MVRV ratio indicates that traders who sold within the past month are perfect seeing a median accomplish of two%. Subsequently, this cohort of traders is less likely to cause any selling tension currently with any such exiguous earnings margin. However, a rally in direction of $6.097 might perhaps well cause huge earnings-taking amongst this cohort and a subsequent tag correction.

A day-to-day candlestick shut below $4.74 would invalidate the thesis.