Remittance apps are exhibiting a slowing pattern in 2024, while stablecoins expanded their provide to new facts. As crypto ownership grows, remittance gateways could possibly well moreover merely lose their positions.

Remittance app downloads like slowed down in 2024 after several years of top process. They expanded within the previous 5 years, but basically the most modern traits present a reversal of usage.

Matthew Sigel, head of digital resources research at VanEck, believes the shift could possibly well moreover earnings stablecoin usage. Acquiring stablecoins is feasible by decentralized buying and selling and, in some circumstances, could possibly well moreover merely now no longer require an preliminary checking story. Stablecoin transfers are mighty faster and like almost negligible charges and no commissions.

The pattern of using stablecoins for spoiled-border capabilities has been noticed within the previous few years but accelerated for the length of the bull market of 2024. Many of the stablecoin process is driven by retail remittances, with a smaller portion of wholesale spoiled-border transfers.

Interest in crypto-primarily primarily primarily based remittances could possibly well moreover merely raise within the impending months, as the election of Donald Trump has brought support talks of a remittance tax. Stablecoins are smooth traceable, but the particular destination and spending could possibly well moreover merely dwell now no longer easy to determine.

In the previous, initiatives fancy Ripple aimed for a portion of the remittance market. This time, Ripple hosts RLUSD, a newly minted stablecoin with minimal transaction charges. Solana has also resulted in an raise in USDC usage. The steadiness of stablecoins could possibly well moreover merely shift as the Euro Region decreases reliance on USDT and specializes in compliant cash and tokens fancy USDC.

Remittance market expands, but stablecoins come up

The remittances market is anticipated to amplify by 3.93% in 2025, maintaining a same tempo to its 2024 boost. On the opposite hand, stablecoins doubled their provide and increased their process mighty extra dramatically within the previous twelve months, both on centralized and decentralized exchanges.

The ultimate remittance flows are focusing on India, Mexico, China, and the Philippines, that are also about a of basically the most crypto-friendly regions. The provision of stablecoins on a pair of chains has averted the excessive gasoline charges on Ethereum, pondering a viable replacement to the commissions of remittance apps.

In 2024, estimated remittances to basically the most in fashion destination countries reached $685B. India got $129.1B, changing into the chief within the category.

Stablecoins like the capability to rob a portion of the remittance market

Stablecoins effortlessly surpass these amounts, exhibiting a capability to preserve up a huge part of the remittances market. According to VISA’s statistics dashboard, stablecoins carried $28.7T in total transfers, in conjunction with all computerized trades. While it’s far now no longer easy to estimate which transactions were true remittances, the final volumes present the ceiling is excessive, and stablecoins can have a immense part of the remittance market.

For the previous twelve months, the stablecoin market has viewed an increased usage of TRON-primarily primarily primarily based and BSC-primarily primarily primarily based USDT, which enables for negligibly low charges.

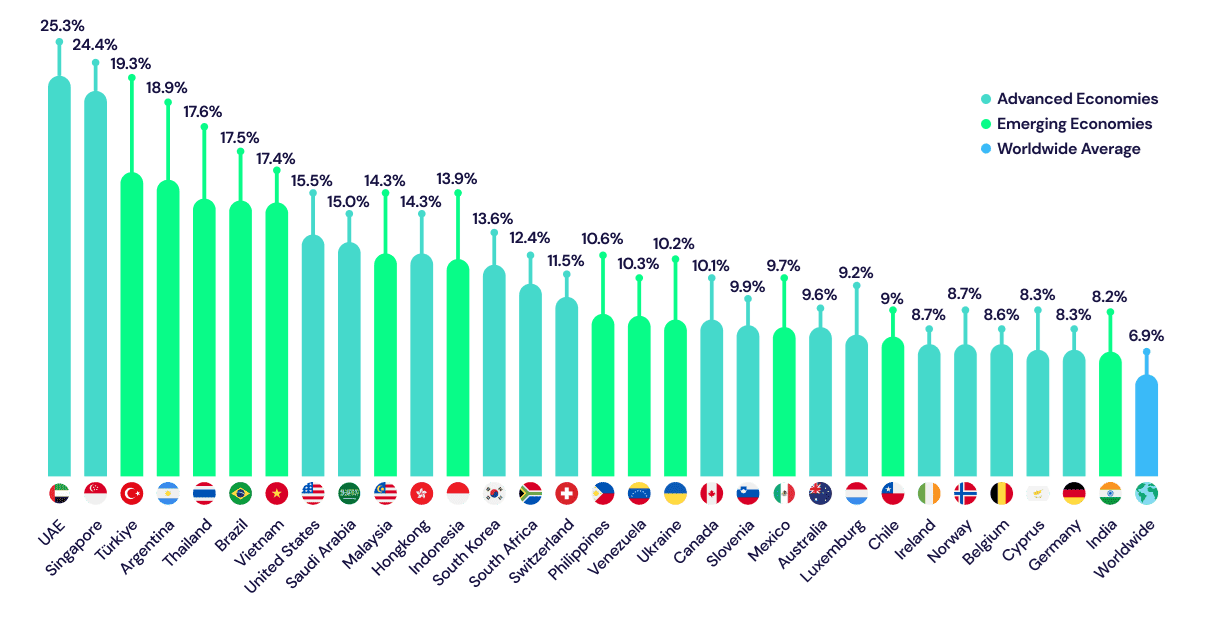

The remittance market meets competition from the growing community of crypto owners, reaching 560M within the previous twelve months. In 2024, the sequence of owners expanded by round 6.8%, spreading to a pair of regions the put remittances are broadly earlier.

The stablecoin market modified into one element in expanding crypto adoption, as users flocked to USDT, USDC, and other resources for a pair of capabilities.

Stablecoin provide grows to new top

The provision of stablecoins persisted to amplify in 2025, reaching 200.7B as of January 7. The prediction for the impending twelve months is to double the provide, rising their impact over the market.

According to VISA insights, extra than 65% of stablecoin actions are now no longer connected to DEX or centralized markets, as a substitute earlier for other untracked payments. A selection of these payments could possibly well moreover merely substitute remittances despatched by fintech apps.

The true keep of stablecoins could possibly well moreover merely be laborious to predict, and fintech-primarily primarily primarily based remittances are anticipated to develop. Stablecoins could possibly well moreover merely smooth require exchanging into a currency except there could be standard adoption of state USDT or USDC usage.

From Zero to Web3 Professional: Your 90-Day Occupation Originate Opinion