MicroStrategy stock impress has dropped 27% from its top likely degree this year, despite Bitcoin reaching a file excessive.

MSTR shares had been procuring and selling at $390 on Dec. 6, persevering with a decline that started on Nov. 21, when the stock peaked at $541. Even with this pullback, MicroStrategy remains one of essentially the most simple-performing shares this year, up over 500%, with a market cap exceeding $91 billion. It’s a ways moreover the discontinue gainer in the Russell 2000 index.

There are two likely the explanation why the stock has retreated this month. First, this decline is thanks to revenue-taking among investors who own benefited from its climb.

2d, investors are seemingly thinking about its valuation, which stands at about $91 billion. It’s a ways a mountainous top price alive to about that MicroStrategy holds 402,100 coins valued at below $40 billion. As such, there would possibly per chance be a $50 billion gap that can per chance now not be stuffed by the struggling authentic data analytics replace.

Attributable to this truth, some investors deem that the company’s valuation will in the spoil drop to bring its valuation with regards to its Bitcoin (BTC) holdings.

Peaceable, most Wall Avenue analysts are optimistic that the stock has extra upside left. Essentially primarily based on Yahoo Finance, some of essentially the most bullish analysts are from Cowen, Barclays, Benchmark, and Bernstein. The frequent estimate for the stock is $492, elevated than the latest $390.

MicroStrategy’s stock has moreover mirrored the performance of pretty about a Bitcoin-exposed companies. Marathon Digital, the second-largest Bitcoin holder, has declined 14% from its November height, while Coinbase, Stand up Platforms, and Hut 8 Mining own moreover skilled pullbacks.

What subsequent for MSTR stock?

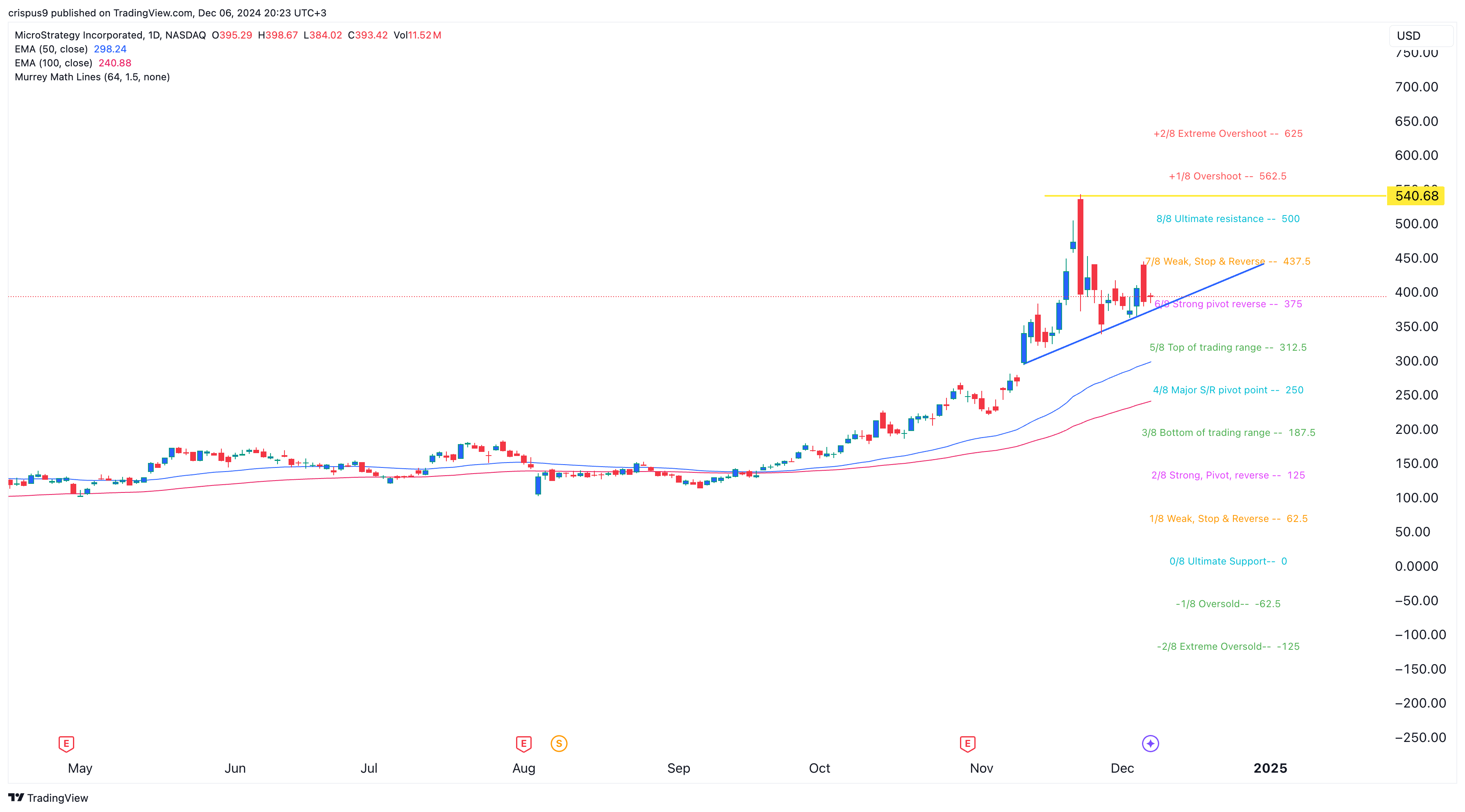

MicroStrategy’s stock has pulled motivate nonetheless remains above the ascending trendline connecting the bottom swings since Nov. 11. It’s a ways moreover procuring and selling above the 50-day and 100-day intriguing averages, suggesting skill make stronger for additional gains.

It has moreover bottomed on the accurate pivot reverse level of the Murrey Math Traces tool. Attributable to this truth, the stock will seemingly soar motivate if Bitcoin continues rising, as analysts demand.

If this occurs, the stock will seemingly continue rising as bulls purpose the all-time excessive of $540. A destroy above that degree will present extra gains, presumably to the impolite overshoot degree at $625.

Conversely, a drop under the rising trendline would possibly per chance perchance per chance focus on the stock own a median reversal and drop to the 100-day intriguing moderate at $240. This impress coincides with the main S&R degree of the Murrey Math Traces.