After gaining over 37% within the closing 7 days, the PUMP designate is refusing to cool off. Despite a cozy +6% pass within the past 24 hours, the token is showing indicators of continued strength, at the same time as broader market momentum fades. The broad search recordsdata from: Is but another breakout brewing, or are we taking a witness at the tail cease of this rally?

Let’s fracture down the on-chain recordsdata, liquidation setups, and chart patterns signaling what comes next.

Influencer Buying and Whale Train Signal Self assurance

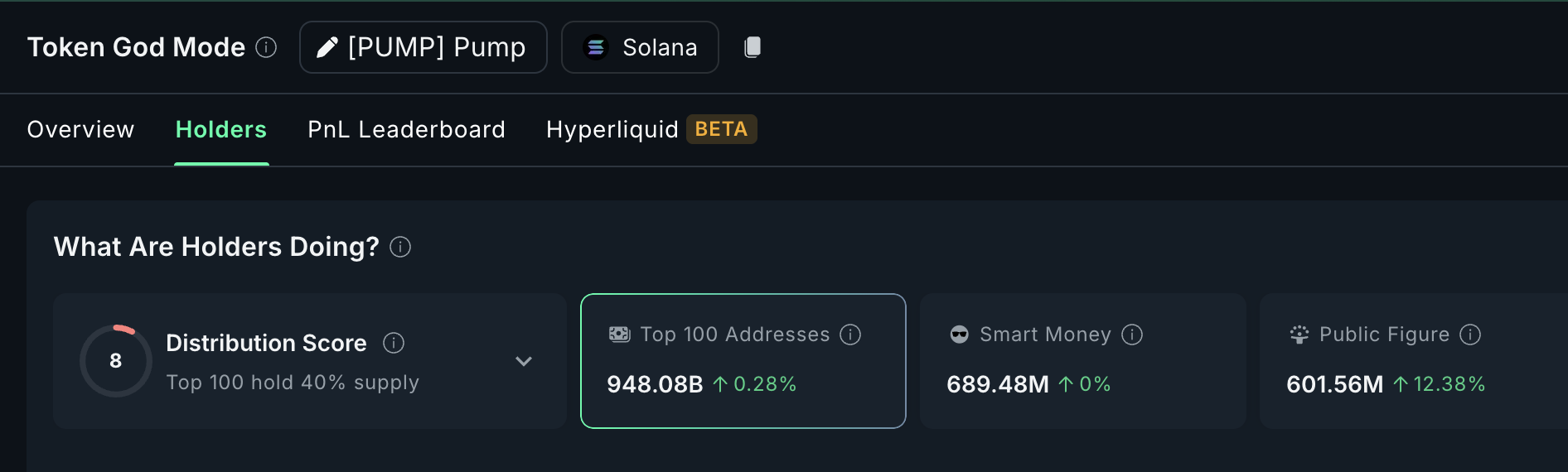

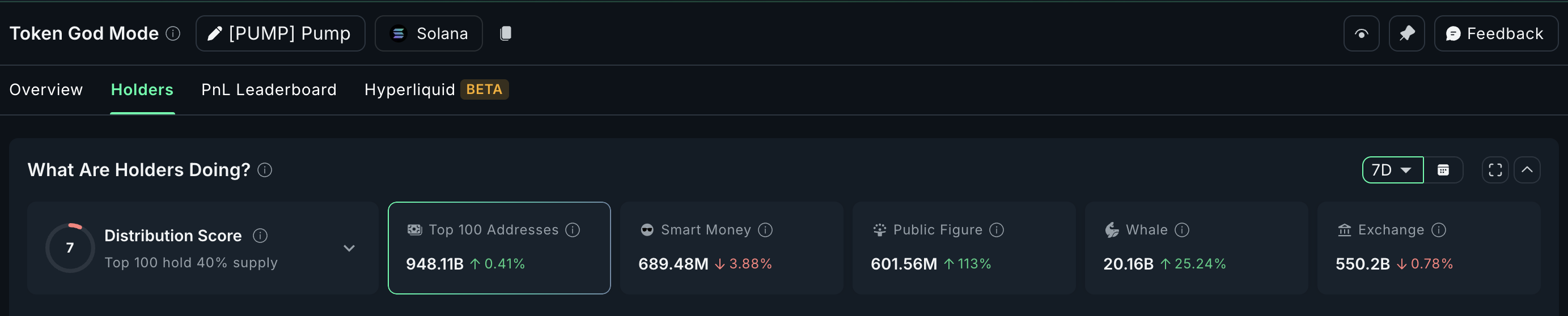

While designate has been consolidating real below the $0.0035 level, top addresses and public figures aren’t letting up. In step with Nansen recordsdata, the cease 100 addresses now defend 948.08 billion tokens, reflecting a 0.28% expand within the past 24 hours. Public resolve wallets, assuredly linked to influencers and known crypto merchants, possess also jumped 12.38%, retaining 601.56 million PUMP.

What’s extra crucial is that whales were quietly accumulating all the plot in which throughout the week. Over the last 7 days, whale holdings possess grown by 25.24%. This isn’t a signal of exhaustion; it’s a signal of conviction.

These colossal gamers are searching out for into strength, suggesting that they leer room for additional upside.

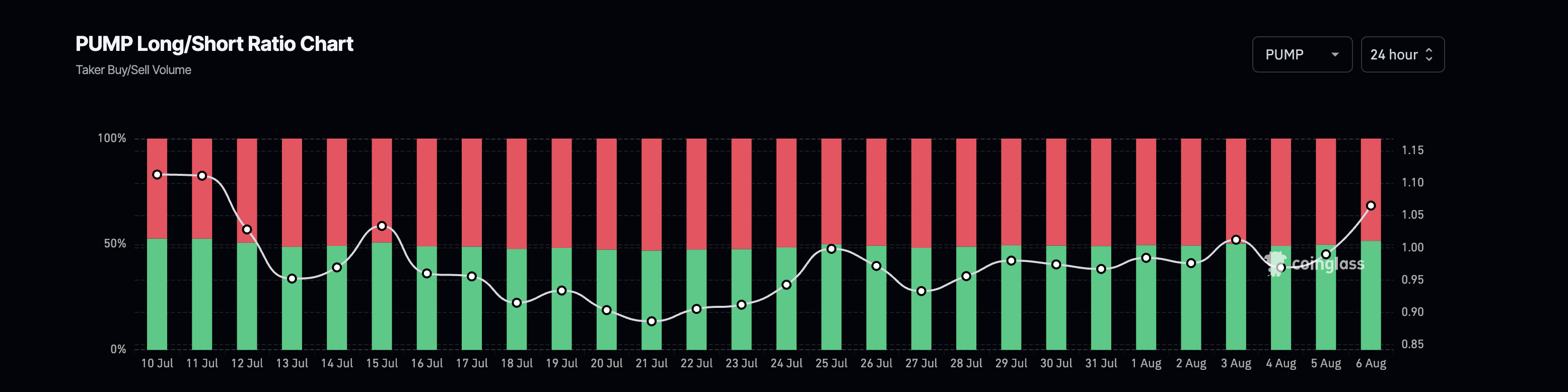

Backing this witness is the derivatives market. The long/short ratio has flipped decisively bullish over the previous couple of days, retaining above 1.05.

That suggests extra merchants are coming into long positions than shorts, and this rising leverage bias is aligning with the dapper money grunt on-chain.

For token TA and market updates: Prefer extra token insights savor this? Join Editor Harsh Notariya’s Day-to-day Crypto Newsletter right here.

Liquidation Intention Unearths The build Shorts Would per chance Accumulate Overwhelmed

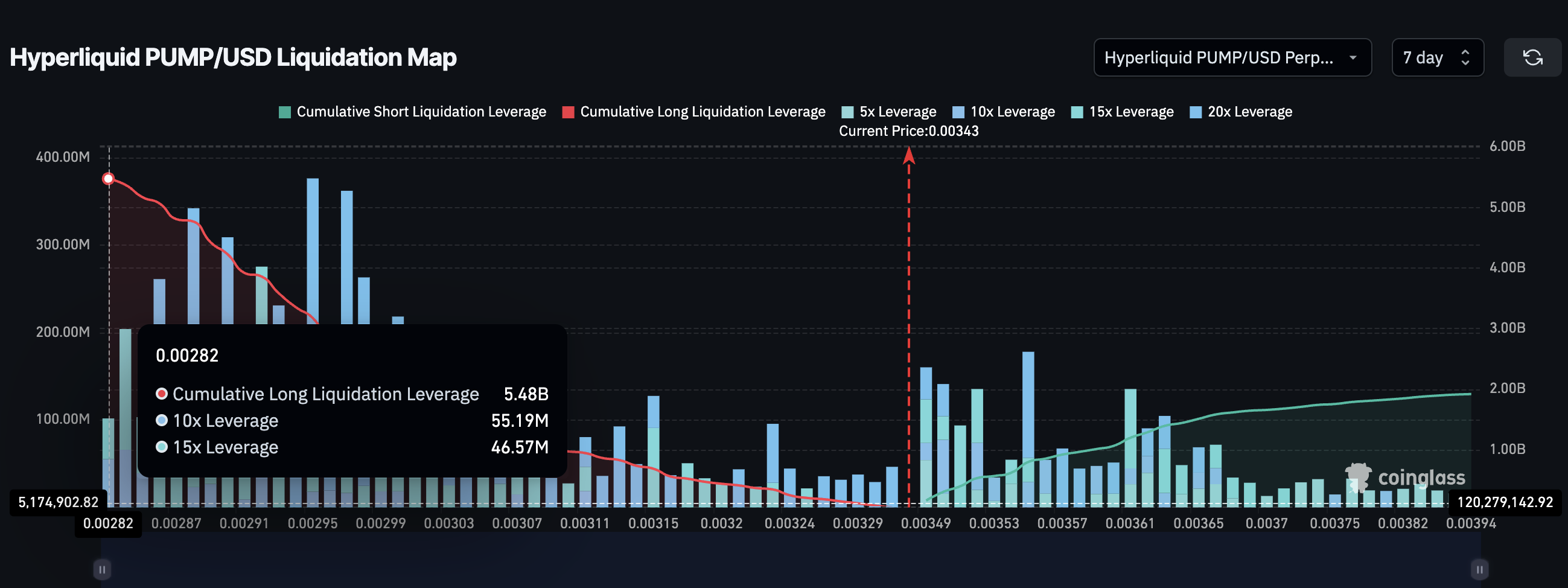

The liquidation design from Hyperliquid helps the same bullish outlook. On the present designate of $0.0034, PUMP is inching nearer to a dense cluster of short positions.

The biggest pileup of short liquidations begins at $0.0035 and intensifies all around the $0.0035 to $0.0039 differ. These designate stages coincide with the build short sellers originate to salvage worn out.

Even when whole short launch hobby sits at $1.92 billion, long positions are for the time being at $5.Forty eight billion, almost three times the dimensions. While fewer shorts exist, the sheer dimension of their publicity makes them inclined. If PUMP pushes above $0.0035, it can presumably furthermore build off a liquidation chain response, forcing shorts to exit and riding the cost greater within the draw.

These liquidation thresholds are extra than real numbers; they’re stress components. And they align almost perfectly with the cost action pattern forming on the chart.

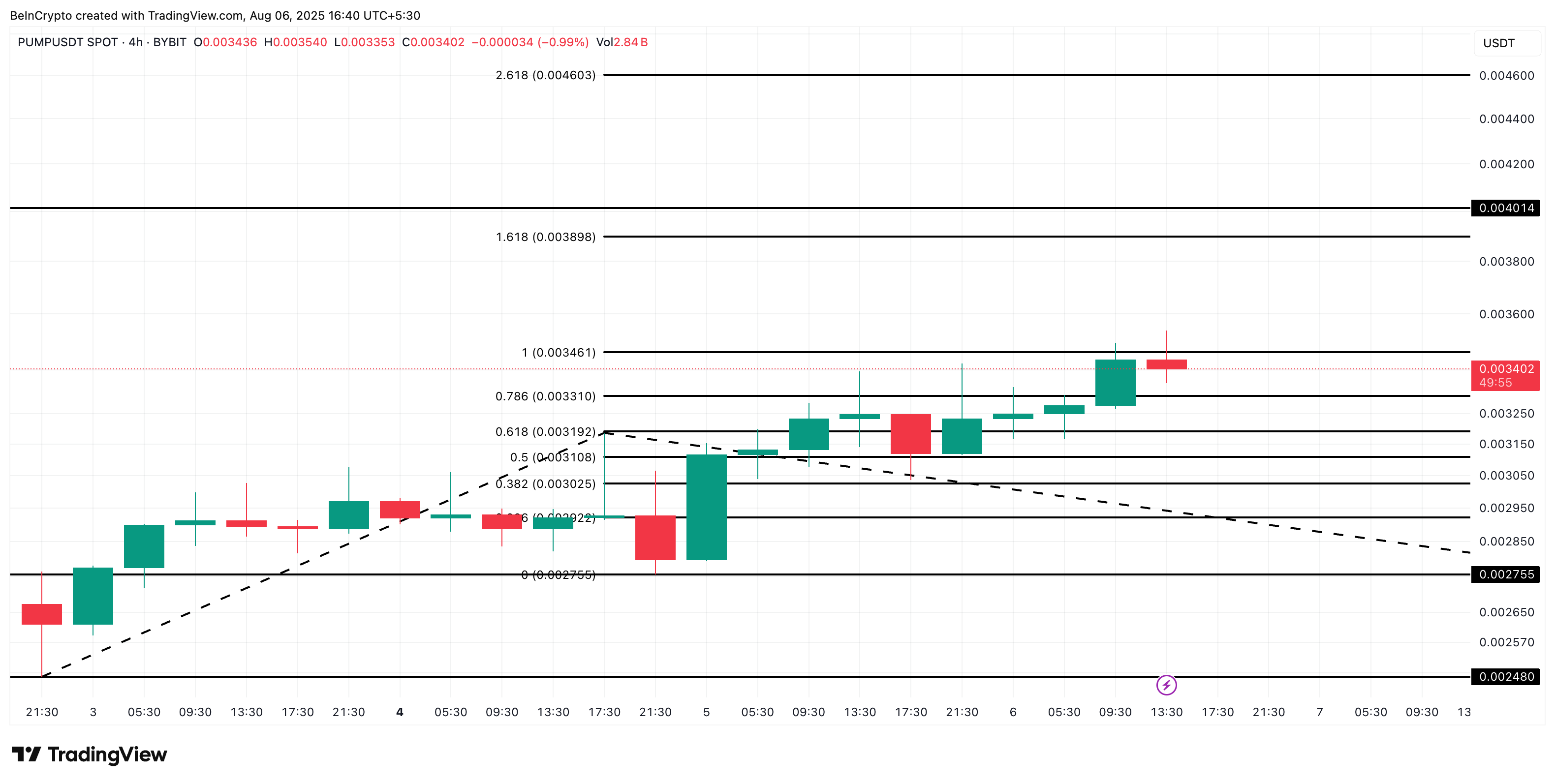

PUMP Heed Eyes Breakout From Ascending Triangle Sample

The PUMP designate is shopping and selling interior an ascending triangle pattern on the two-hour chart. This setup assuredly resolves with a breakout to the upside, especially when backed by greater lows and accumulation, which is what we’re seeing now.

Veil: Two plot back strikes pierced the lower trendline, however both were wick-exclusively breakdowns and no longer tubby-body candle closes. In step with recent technical evaluation principles, a exact triangle breakdown assuredly requires a decisive tubby-body candle shut below the trendline with affirmation quantity. Since that hasn’t took place, the ascending triangle pattern remains exact.

Essentially the most well-known resistance to fracture lies round $0.0035, the build the old breakout was once tried. This designate also overlaps with the liquidation cluster we real discussed, constructing a twin build off point for momentum.

If this level breaks, the following immediate resistance is $0.0038, adopted by $0.0040. The dilapidated would stamp a 15% salvage from the present designate of $0.0034. That level also coincides with a key Fibonacci extension zone and psychological round number that incessantly acts as Magnet Resistance. If momentum continues beyond $0.0040, the following target lies advance $0.0046, representing a 35% rally from this day’s stages.

But merchants must also defend an witness on invalidation. If PUMP fails to defend the ascending trendline strengthen round $0.0033 and breaks, it can presumably invalidate the present bullish constructing. That might presumably furthermore launch the door to a deeper pullback toward $0.0030 and even lower.