Solana (SOL) fair no longer too long within the past confronted a steep decline of over 7% within the previous 24 hours, pushed by a shift in market sentiment following the beginning of the Nonfarm Payroll (NFP) file on August 2.

No topic this decline, Solana has demonstrated sturdy efficiency within the decentralized finance (DeFi) sector. Primarily based on DeFiLlama, Solana outpaced Ethereum (ETH) in overall buying and selling quantity for July, leading day after day buying and selling on 17 days.

Solana’s DeFi protocols accounted for 30% of all crypto decentralized alternate (DEX) quantity in July, processing $56.849 billion in transactions, when put next to Ethereum’s 28.12% piece and $Fifty three.867 billion.

Extra of Solana’s favorable context

Adding to the optimism, the U.S. Securities and Change Commission (SEC) fair no longer too long within the past amended its criticism in opposition to Binance, casting off allegations that Solana is an unregistered security.

This factual vogue, alongside with speculation about a seemingly Solana alternate-traded fund (ETF), has bolstered self assurance in Solana.

Solana has also seen vital yell in its stablecoin usage. Data from Allium on Visa’s stablecoin dashboard reveals that USDC transaction quantity on Solana has exceeded $8 trillion since final 365 days, underscoring Solana’s rising utility and transaction effectivity.

Furthermore, Solana has was a leading platform for meme coin launches attributable to its decrease charges when put next to Ethereum.

On this context, Finbold has leveraged OpenAI’s developed synthetic intelligence (AI) platform, ChatGPT-4o to give insights into how Solana is inclined to replace by August 31, brooding about key factors influencing Solana’s future price trajectory.

ChatGPT-4o Solana price prediction

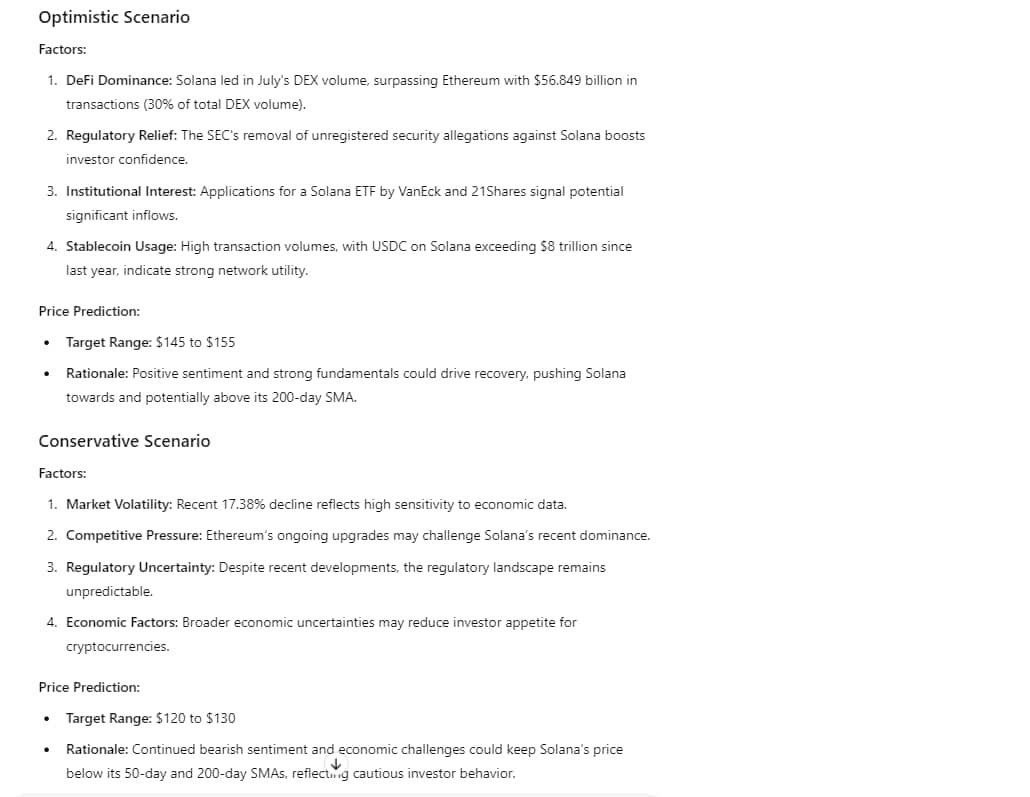

Curiously, the AI chatbot has been critically bullish in its Solana price projections, offering both optimistic and conservative situations for the prediction.

In an optimistic scenario, Solana would possibly perhaps perhaps well also rise to $145 to $155 by August 31, 2024. This optimism is pushed by Solana’s outperformance in DeFi buying and selling volumes, lowered regulatory risks from the SEC, potential institutional inflows from ETF applications, and excessive USDC transaction volumes.

These factors, combined with solid neighborhood and developer toughen, counsel a recovery and yell toward its 200-day straightforward bright moderate (SMA).

In a more conservative scenario, Solana would possibly perhaps perhaps well vary between $120 to $130 by August 31, 2024. This cautious outlook considers most up-to-date market volatility, competitive stress from Ethereum, ongoing regulatory uncertainties, and broader economic challenges.

Primarily the most up-to-date price being below both the 50-day and 200-day SMAs indicates potential continued downward stress, reflecting cautious investor sentiment.

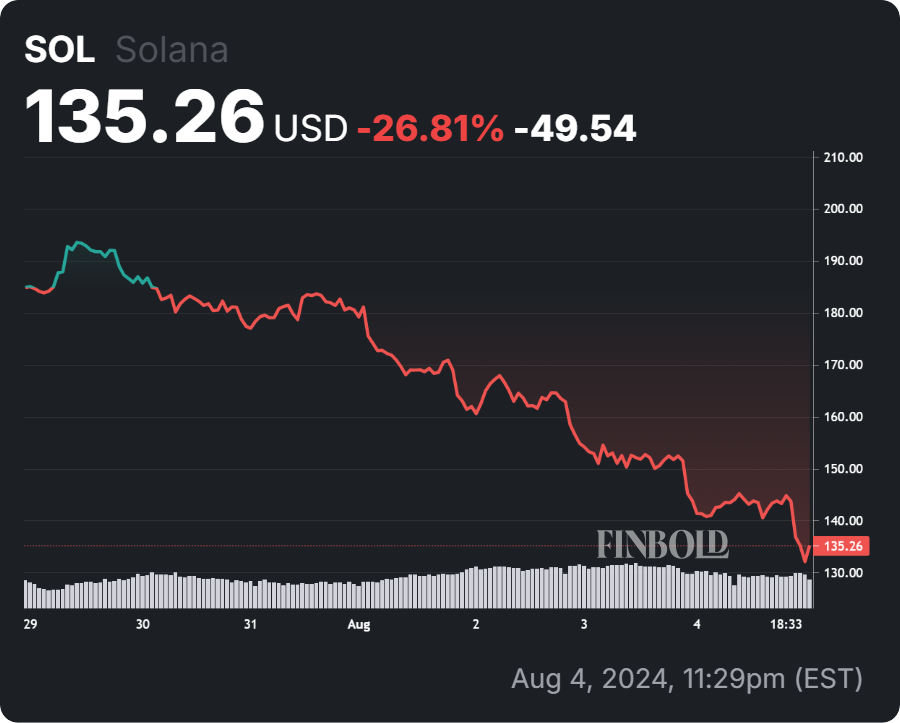

SOL price diagnosis

At press time, Solana used to be buying and selling at $135.52, with losses of over 6.35% within the final 24 hours. On the weekly chart, SOL is down over 27%.

Total, Solana’s price trajectory by August 31, 2024, will seemingly be influenced by its solid DeFi efficiency, regulatory developments, and broader market conditions. The optimistic scenario suggests a seemingly recovery and yell, whereas the conservative outlook highlights the dangers of continued market fears and economic uncertainties.

Investors will like to peaceful closely video display these factors and market indicators to manufacture advised decisions.

Disclaimer: The philosophize material on this station will like to peaceful no longer be considered investment recommendation. Investing is speculative. When investing, your capital is in wretchedness.