Ethereum (ETH) has been outpacing its opponents in contemporary weeks thanks to increasing institutional interest and alternate-traded fund (ETF) inflows.

At press time, ETH used to be trading at $3,674, up almost 62.39% in the previous month, with a market cap of roughly $444.54 billion, as per CoinMarketCap.

Basically based mostly on Finbold’s AI set apart prediction model, ETH set apart might perchance perchance attain $3,800 by August 31 (a +3.41% lengthen from the sizzling set apart).

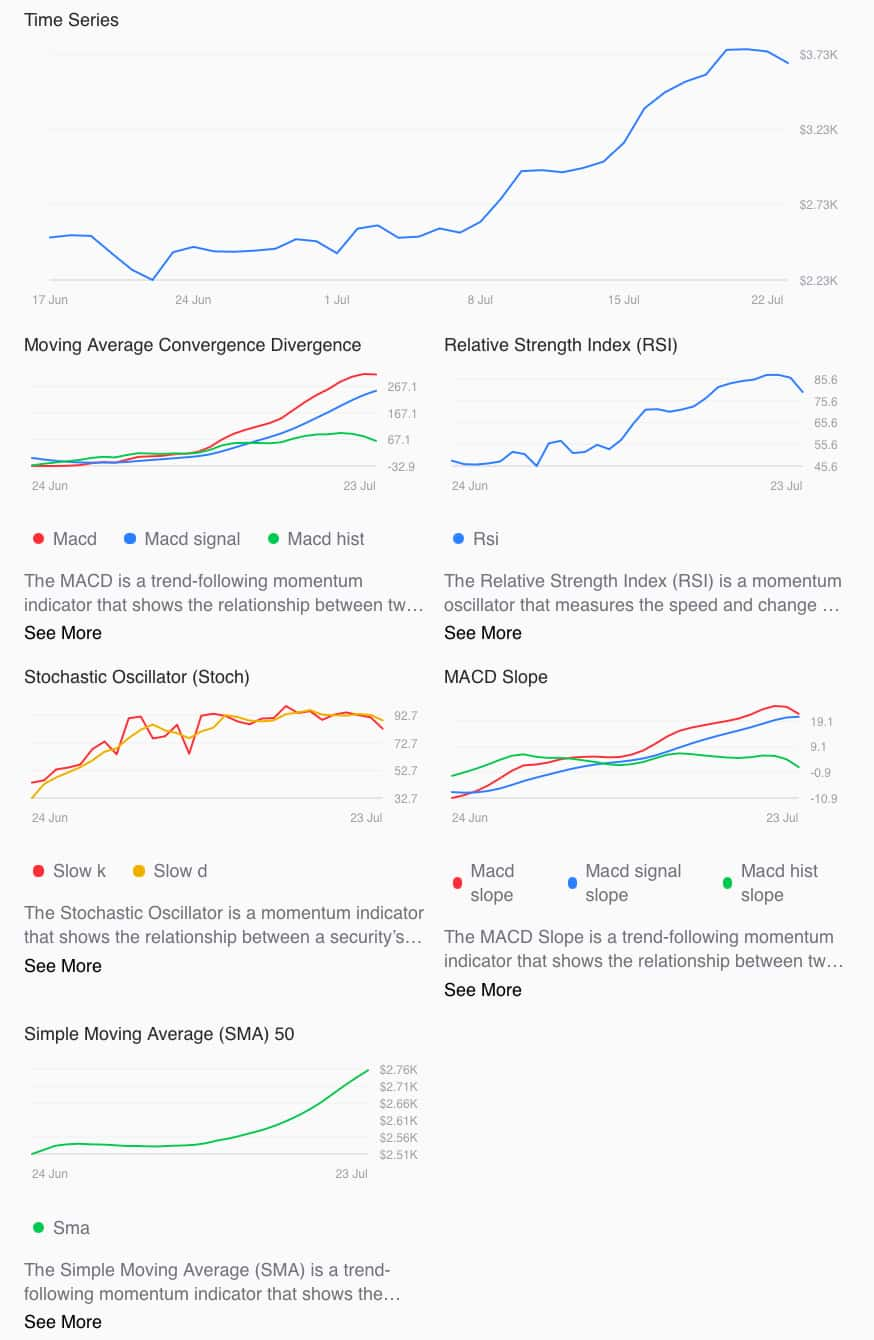

The prediction is according to numerous technical indicators, including the Spicy Sensible Convergence Divergence (MACD), Relative Energy Index (RSI), Stochastic Oscillator, MACD Slope, and 50-day Easy Spicy Sensible (SMA).

ETH continues to alternate smartly above its 50-day SMA of $2,752, which implies the momentum remains broadly bullish. Nonetheless, the MACD line, standing at 311.498, with a sign line at 250.056 and a favorable histogram discovering out of 61.443, signifies valid underlying buying stress.

Likewise, whereas the MACD sign line is rising and thus implying persevered upward momentum, the MACD histogram slope has flattened to 1.138, hinting that the tempo of the momentum is slowing.

Immediate indicators are signaling overextension. The 7-day RSI is hovering shut to 80, down from a high of 87 ideal month. While smooth in overbought territory, the declining RSI alongside rising prices aspects to a bearish divergence customarily considered as foreboding a consolidation or a pullback.

In an identical plot, the Stochastic Oscillator remains elevated between 83 and 89, extra supporting the gawk that ETH can be nearing a short peak.

Ethereum trading quantity

Within the period in-between, Ethereum’s 24-hour trading quantity has dropped extra than 20%, now sitting at $37.28 billion, according to CoinMarketCap.

Total futures birth interest (OI), i.e., the total series of energetic contracts (futures or alternate choices) that haven’t been settled or closed, has also dropped by 3.16% in the day prior to this, as indicated by CoinGlass records. This will sign a short squeeze unwind.

Taken alongside the mixed technical indicators, these numbers beef up a cautiously optimistic outlook and a modest doable upside, as predicted by the AI.

Featured describe by Shutterstock