Finbold turned to synthetic intelligence (AI) to venture a median Bitcoin (BTC) price target for the stop of 2025 following the news that Mt. Gox, a defunct cryptocurrency change, would postpone repayments to its collectors by one other year.

Entities linked with Mt. Gox restful shield watch over around 34,689 BTC, valued at around $3.98 billion as of the time of writing, in line with Arkham.

Whereas the resolve is proper a quarter of the 142,000 BTC provide the change held in mid-2024, analysts are restful questioning how the lengthen would possibly maybe well also impression Bitcoin’s price within the next months, now that a dump is no longer any longer in consideration.

BTC price prediction

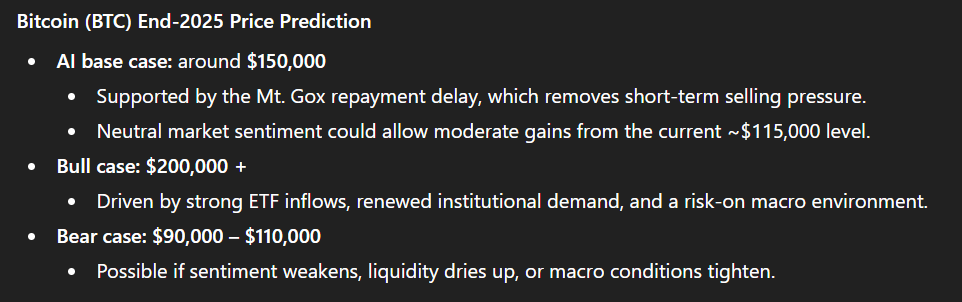

Constant with OpenAI’s main mannequin, ChatGPT-5, Bitcoin would possibly maybe well also alternate around $150,000 by the stop of 2025, assuming the Mt. Gox compensation lengthen can back selling stress and the market sentiment can stay just within the arrival months.

A more bull case, however, would possibly maybe well also glimpse the asset trading at $200,000, equipped institutional change-traded flows (ETF) also bag in a “chance-on” macro atmosphere, now that the crypto has began to enhance.

Nonetheless, the AI also cautioned in opposition to overly bullish expectations. That is, Mt. Gox provide lengthen reduces one chance part, however it’ll’t guarantee that inflows or ask will bag. Likewise, the time horizon is simply too immediate for the fat impression of the new time limit to be totally appreciated.

Accordingly, a endure-case scenario would possibly maybe well also end result in a much decrease price within the $90,000–$110,000 fluctuate.

BTC price prognosis

On the time of writing, BTC used to be trading at $114,970, up 1.30% within the previous 24 hours, carefully monitoring the broader crypto market’s 1% keep.

The rebound comes amid a aggregate of technical enchancment, aforementioned macroeconomic relief, and renewed institutional inflows.

Most considerably, Friday’s Consumer Tag Index (CPI) list came in softer than anticipated at +0.3% vs. +0.4%, boosting expectations of a Fed rate gash on October 29.

Within the meantime, a non eternal U.S.-China alternate truce over the weekend paused new tariffs and eased rare-earth restrictions, additional bettering chance sentiment.

Apart from to to Mt. Gox trends, traders are anticipating the effects of the subsequent Fed meeting scheduled this Wednesday and the November 1 Washington–Beijing summit, two events that can maybe also resolve Bitcoin’s non eternal trajectory.

Featured image through Shutterstock