On July 31, the Federal Starting up Market Committee (FOMC) will meet to resolve on the Federal Reserve curiosity rate design. Looking ahead to macroeconomic impacts, Finbold became to man made intelligence (AI) devices for insights on Bitcoin (BTC) rate and the cryptocurrency market.

In each and each contemporary meeting, the FOMC approaches the day this can in the waste commence chopping the curiosity rate, as beforehand promised. Analysts demand this upcoming match will make certain for likelihood property worship cryptocurrencies and shares, including Bitcoin.

As of this writing, Bitcoin trades at $67,500, and the entire crypto market cap is at $2.36 trillion.

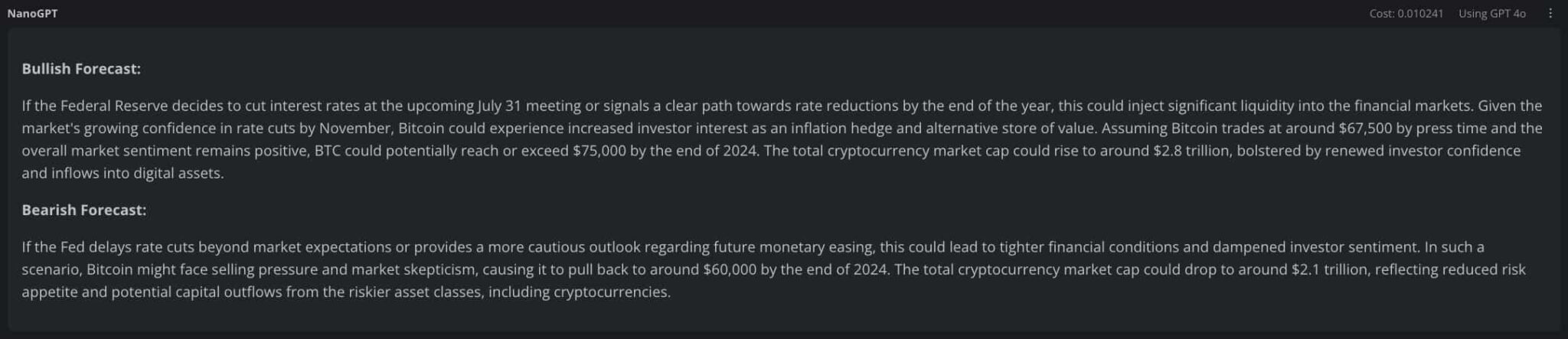

ChatGPT-4o bearish and bullish Bitcoin rate prediction

Taking a watch forward to the FOMC meeting, the OpenAI‘s superior mannequin ChatGPT-4o has traced two Bitcoin rate predictions.

The bullish forecast sees a capacity for Bitcoin to exceed $75,000 by the pause of 2024. Attributable to this truth, riding cryptocurrencies to round $2.8 trillion in capitalization, bolstered by renewed merchants’ confidence and influx into the condominium.

On the diversified hand, a bearish forecast sees a pullback to round $60,000 – a key psychological toughen. This scenario would play out if the Fed delays rate cuts beyond market expectations, essentially based completely on the AI mannequin.

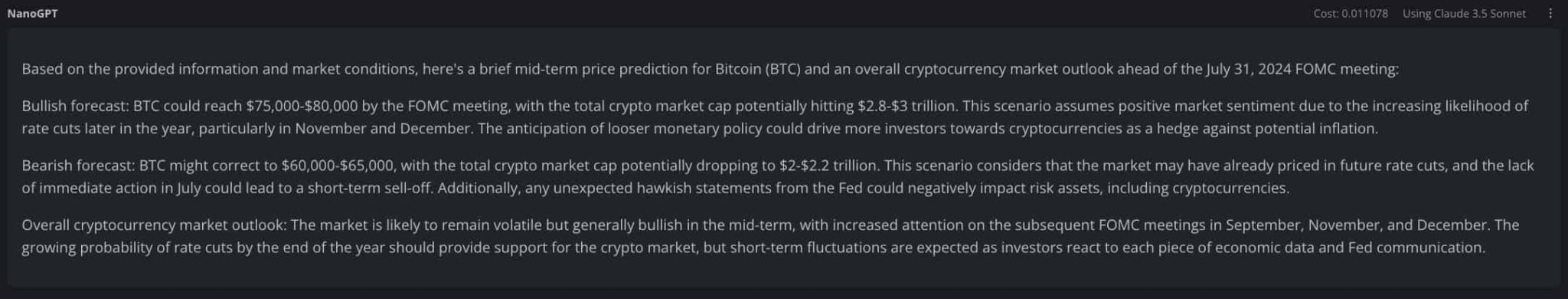

Claude 3.5 Sonnet forecasts earlier than Fed’s curiosity rate decision

Finbold furthermore consulted Anthropic‘s most superior AI mannequin, Claude 3.5 Sonnet, known for surpassing ChatGPT-4o in most benchmarks. Curiously, Claude AI’s Bitcoin rate prediction is unbiased like that of its competitor, despite the indisputable truth that a bit extra optimistic.

The bullish forecast draws a range between $75,000 and $80,000 for the main cryptocurrency. It furthermore sees a $2.8 and $3 trillion market cap range for the entire index.

Conversely, Claude 3.5 Sonnet’s bearish scenario puts BTC between $60,000 and $65,000 in a $2 trillion to $2.2 trillion market.

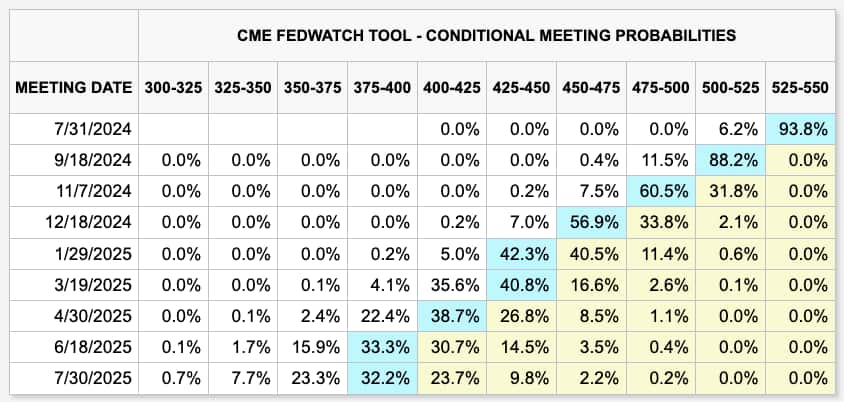

2024 FOMC meetings: Passion rate decision expectations

Following July 31’s meeting, the FOMC can gather three diversified meetings to extra resolve on the United States curiosity rates. The following meetings will happen in September, November, and December, with a excessive likelihood of a pair of rate cuts.

Significantly, the market says it has a 6% likelihood of a 25 bps rate cut on July 31’s meeting and a 100% likelihood for the following meetings to assemble an curiosity rate decrease than the unusual 525-550 bps, with an increasing likelihood of getting a decrease than 500 bps curiosity rate by the pause of the One year.

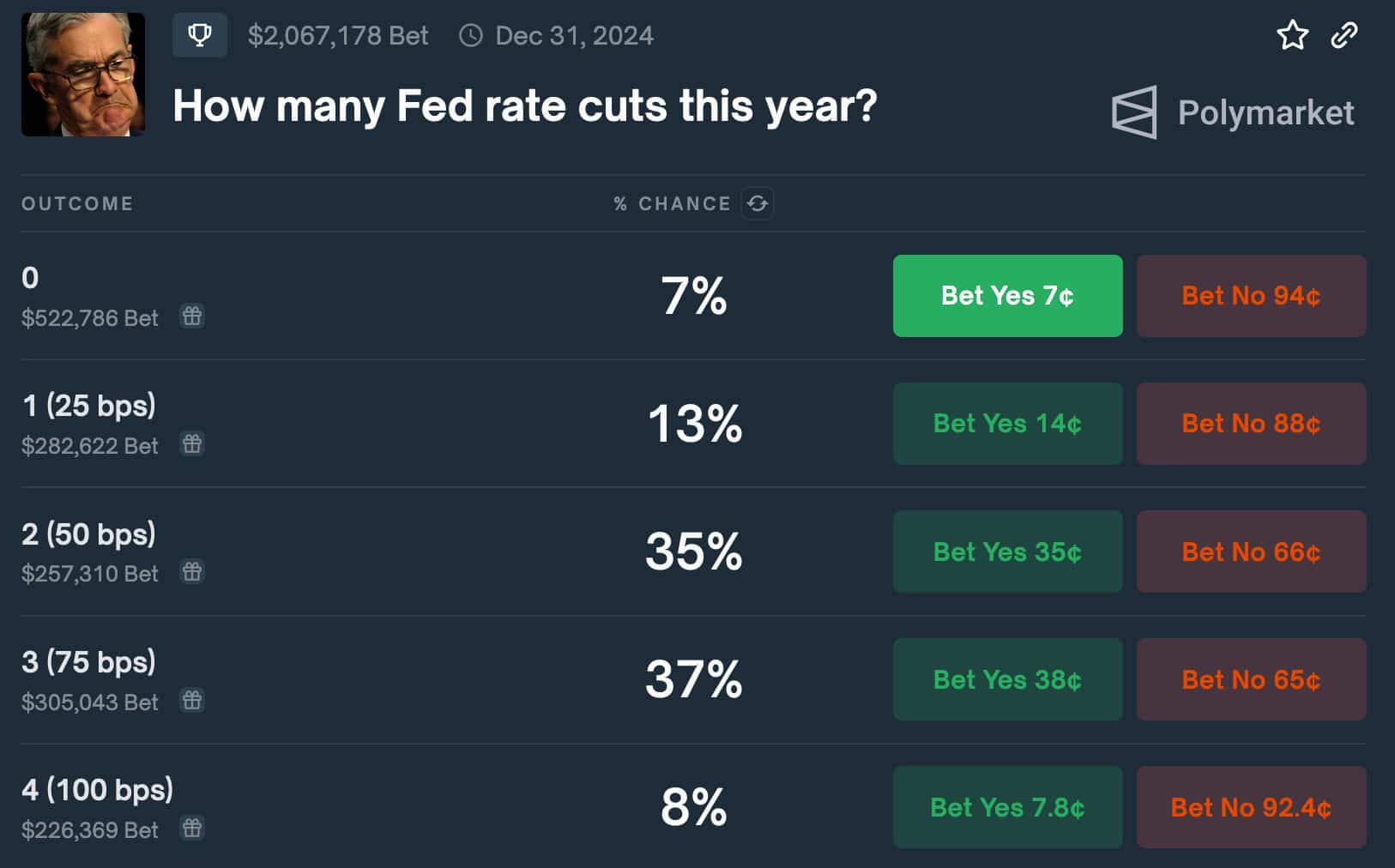

Furthermore, the popular prediction market Polymarket bets there’s a 35% and 37% likelihood of the Fed chopping rates by 50 bps and 75 bps, respectively, in 2024. Prediction markets had been proven to be precise instruments for forecasting future events.

On the other hand, it’s wanted to worship that markets tend to price issues upfront and not after the events happen. Thus, it’s imaginable that these reported expectations are already priced in for Bitcoin and cryptocurrencies. A deviation from these predictions, alternatively, might presumably well truly gather a enormous affect on the charts.

Disclaimer: The allege on this unbiased ought to gentle not be thought-about investment recommendation. Investing is speculative. When investing, your capital is at likelihood.