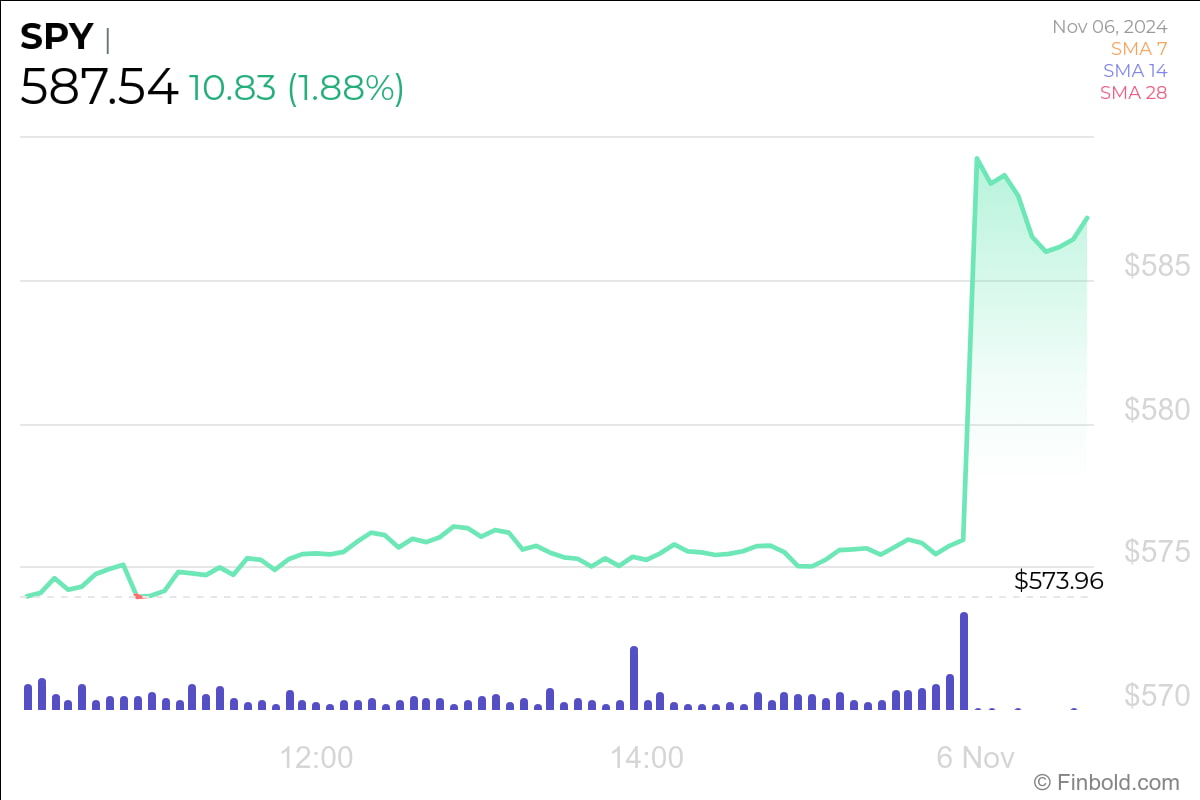

The S&P 500 index (SPY) has soared to sleek all-time highs, smashing data and rallying previous the 5,900 impress for the vital time in historical previous.

This noteworthy surge got right here on the heels of the 2024 U.S. presidential election, which seen Donald Trump reclaim the White House in a historical comeback.

Significantly, the market’s bullish response reflects investor optimism, with Trump’s educated-commerce insurance policies and financial point of curiosity seemingly to make your mind up on up 22 situation the tone for the following four years.

In early trading on Wednesday, November 6, the S&P 500 futures added a staggering $800 billion in market cap. Within the meantime, the U.S. Buck additionally hit its absolute most practical level since July 2024, signaling a broader bullish sentiment all the strategy thru financial markets.

Trump Presidency market performance historical previous

For context, the S&P 500 had previously thrived for the length of Trump’s first term, exhibiting vital enhance with occasional volatility:

- 2017: +19.42%

- 2018: -6.24%

- 2019: +28.88%

- 2020: +16.26%

Trump’s presidency used to be marked by sturdy financial insurance policies, tax cuts, and regulatory rollbacks, which contributed to important market positive aspects. The present rally following his 2024 victory means that investors predict a the same financial ambiance, one centered on enhance and diminished guidelines.

Describe-surroundings opening bell surge

The election results despatched shockwaves thru Wall Aspect street. At the opening bell, indispensable indexes mirrored the market’s enthusiastic response, the S&P 500: Rose 82.1 components, or 1.42%, to prevail in 5,864.89. The Dow Jones Industrial Practical: Climbed 628.5 components, or 1.49%, opening at 42,850.4 and the Nasdaq Composite: Won 333.6 components, or 1.81%, reaching 18,772.76.

With the S&P 500 and Dow Jones scaling sleek all-time highs, the achieve a matter to arises: how a lot extra could per chance this rally delay by the yr-crash?

AI prediction yr-crash outlook for S&P 500

Fascinated about the present trajectory and the market’s optimistic response to the election results, it’s plausible that the S&P 500 could per chance preserve its upward momentum thru December. With investor sentiment buoyed and key sectors love technology, financials, and industrials exhibiting strength, the index can also push even extra into uncharted territory.

In response to AI-driven projections and market traits, the S&P 500 could per chance see extra positive aspects before the yr is out. Taking into memoir historical performance below Trump’s previous term and the screen market local weather, ChatGPT initiatives that the S&P 500 could per chance doubtlessly discontinuance around 6,200 by the crash of 2024.

“Given the sturdy rally and sure market sentiment following Trump’s election accumulate, there could be a excessive probability that the S&P 500 could per chance attain 6,200 by yr-crash. This projection aligns with historical performance patterns and anticipates continued strength all the strategy thru indispensable sectors in the final months of the yr.”

The S&P 500 is utilizing a historical rally, fueled by renewed investor self belief following Trump’s return to the White House. The index’s most up-to-date ascent above 5,900 and the ongoing strength all the strategy thru indispensable sectors insist that there can also be extra upside potential as we head toward yr-crash.

Wall Aspect street will be closely monitoring Trump’s subsequent moves and the Federal Reserve’s coverage signals — every of which could per chance in some method establish whether this rally has the staying vitality to redefine the market’s better limits.

Featured describe by process of Shutterstock