Ethereum co-founder Vitalik Buterin mentioned he is beginning to “be troubled” about the direction of prediction markets and urged that they shift to become marketplaces to hedge against designate publicity threat for customers.

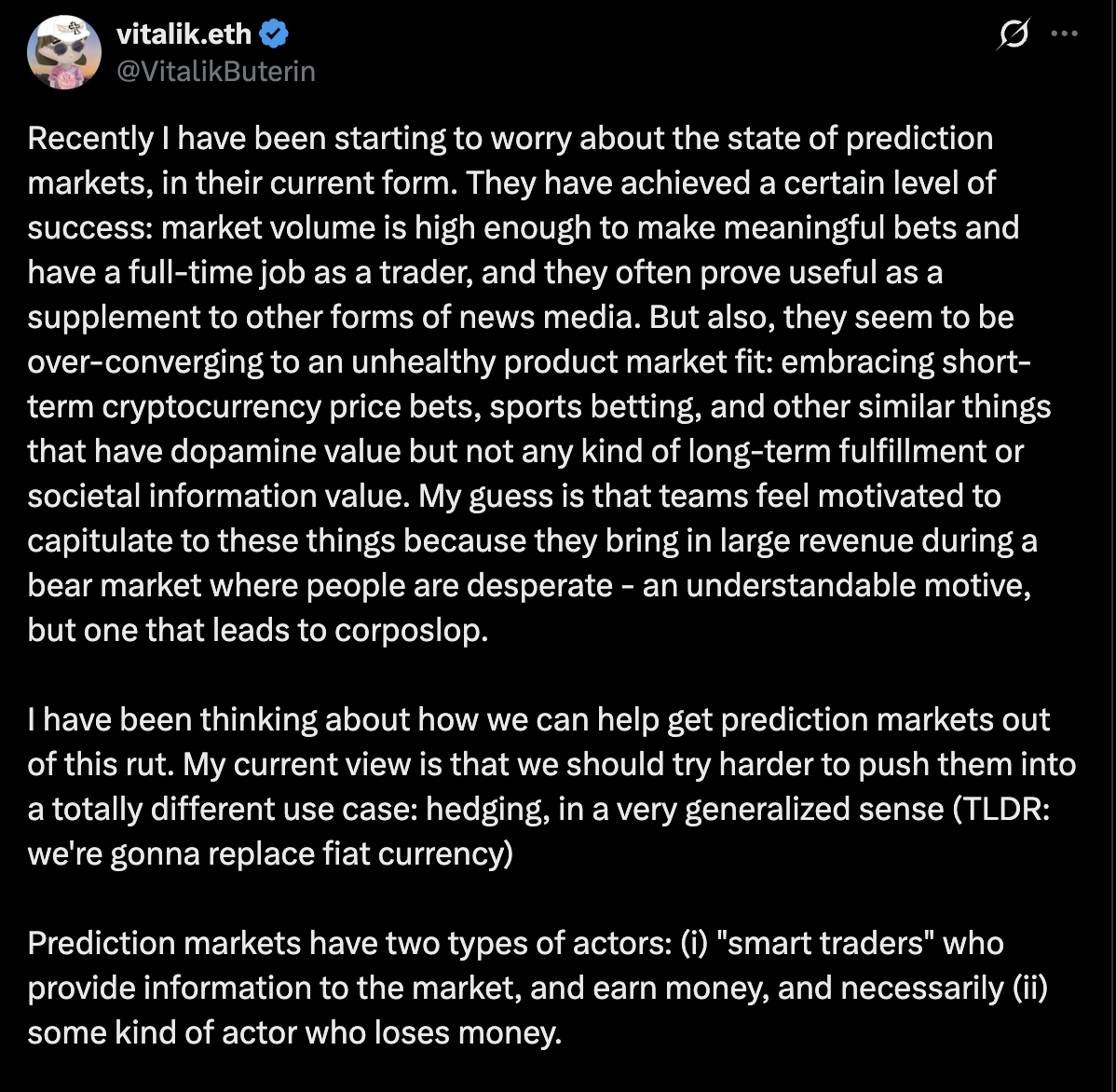

Prediction markets are “over-converging” to “unhealthy” merchandise that are targeted on fast designate making a wager and speculative habits as adversarial to long-term building, Buterin mentioned in an X put up.

As a substitute, onchain prediction markets coupled with AI tremendous-language items (LLMs) must still become identical previous hedging mechanisms to make customers with designate steadiness for items and services, Buterin mentioned. He defined how this kind would work:

“You beget designate indices on all predominant categories of issues and services that folks buy, treating physical items and services in numerous areas as different categories, and prediction markets on every category.

Every particular person, individual or commerce, has a native LLM that understands that particular person’s charges and provides the actual person a personalized basket of prediction market shares, representing ‘N’ days of that particular person’s expected future charges,” he endured.

Folks and businesses can retain a combination of resources to grow wealth and “personalized prediction market shares” to offset the rising price of living created by fiat currency inflation, Buterin concluded.

Prediction markets are critical market intelligence tools, supporters yell

Prediction markets are crowdsourced intelligence platforms that could presumably provide perception into world events and monetary markets, while allowing participants and businesses to hedge against a extensive quantity of dangers, proponents of prediction markets yell.

Prediction markets are extra moral than polls and desires to be handled as a public factual, in keeping with Harry Crane, a statistics professor at Rutgers University.

Crane advised Cointelegraph that opponents of prediction markets within the US executive want to prohibit these platforms because they give insights that could presumably no longer be with out jam omitted or manipulated by centralized entities.

Prediction markets be pleased Polymarket or Kalshi provide an alternative to recordsdata presented in official sources or media studies that could presumably additionally be managed or manipulated to feed obvious narratives by distorting public knowing, Crane mentioned.