Memecoins POPCAT, WIF, and MUBARAK maintain each posted double-digit features in the past 24 hours, persevering with their bounces from fresh pullbacks. Which undoubtedly one of them reveals the ideal bullish doable?

Popcat (POPCAT) set aside is up 15% in the past 24 hours, in the intervening time trading spherical $0.42, with 24-hour trading quantity surging over 80% to $70 million.

After the steep pullback from $0.60, the set aside lately bounced from the important thing toughen level at spherical $0.35 and is now persevering with this recovery as it checks its 20 EMA, which acts as a dynamic resistance.

Alternatively, it’s crucial to utter the fresh shift in market construction. Sooner than the pullback, POPCAT’s set aside did no longer fabricate a new excessive elevated, forming a decrease excessive. This used to be adopted by the ruin of the neckline of a double high sample and then the formation of a decrease low at $0.33.

How the set aside reacts to the 20 EMA resistance will be serious in figuring out whether or no longer the fresh ruin in construction indicators the launch of a broader downtrend or if the pullback used to be honest a liquidity take at a decrease toughen level.

Momentum is honest, with the RSI at 47. Alternatively, it’s pointing upwards and honest about to interrupt above its transferring sensible, potentially forming a golden pass – a bullish signal.

Dogwifhat (WIF) set aside is up 12%, in the intervening time trading at $0.96, with the 24-hour trading quantity surging over 80% to $428 million.

In an identical kind to POPCAT, WIF set aside has lately damaged the uptrend construction, forming a decrease low at $0.80. Alternatively, three days in the past, the set aside strongly rebounded from that level and is now persevering with its recovery, having honest rotten above the 20 EMA.

With the continuation of the soar from $0.80, the memecoin‘s set aside has now reclaimed the outdated elevated low at spherical $0.95. If WIF maintains this upward momentum and closes above the 20 EMA, it can presumably possibly signal the resumption of an uptrend.

On the momentum aspect, MACD bearish crossover remains to be in space. Alternatively, histogram is destructive but showing cutting back purple bars, suggesting bearish momentum is weakening. RSI is 52, convalescing from honest territory, but restful diagram below its transferring sensible.

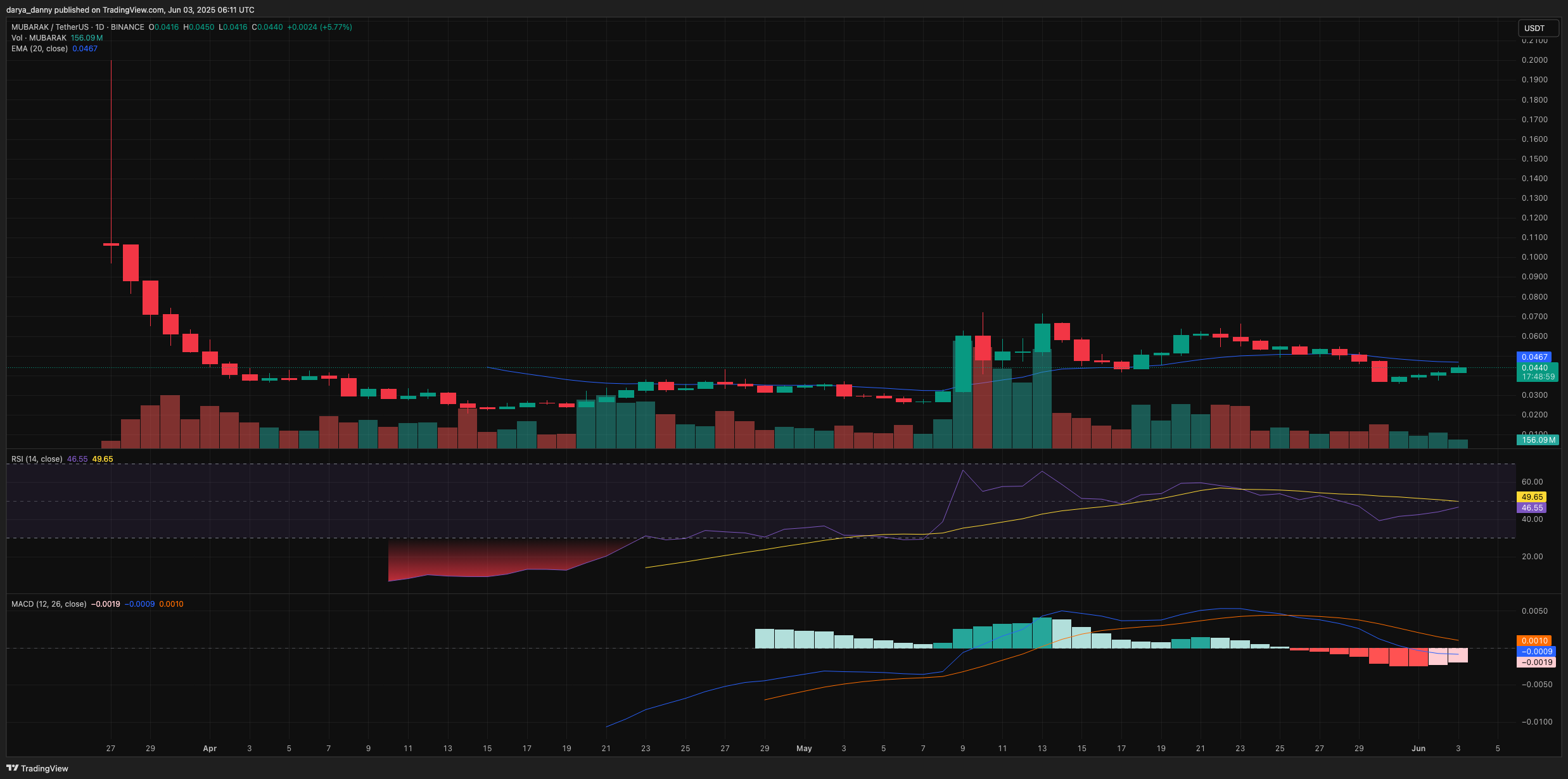

Mubarak (MUBARAK) set aside is up 12% in the past 24 hours, in the intervening time trading at $0.044, with the trading quantity surging 80% to $55 million.

Since breaking out of its outdated vary on Would possibly possibly well also 9, MUBARAK set aside has been consolidating in the $0.04 – $0.07 vary. Now not too lengthy in the past, the set aside dipped below $0.04, but then bounced and reclaimed the $0.0430 toughen level.

Alternatively, quantity remains to be inclined, and the set aside has yet to interrupt above the EMA 20, which is appearing as its dynamic resistance. Despite this, bearish momentum is fading, as indicated by the declining MACD histogram and an upward-sloping RSI.

A ruin above the 20 EMA with trusty quantity would seemingly verify bullish momentum and commence the course towards a retest of the $0.06 – $0.07 resistance at the tip of the vary.