On March 19, Anthony Pompliano, the founding father of Pomp Investments, looked on Bloomberg TV’s “Bloomberg Crypto,” hosted by Sonali Basak and Tim Stenovec, to portion his insights on Bitcoin’s contemporary imprint correction, which has seen the flagship cryptocurrency tumble below $63,000.

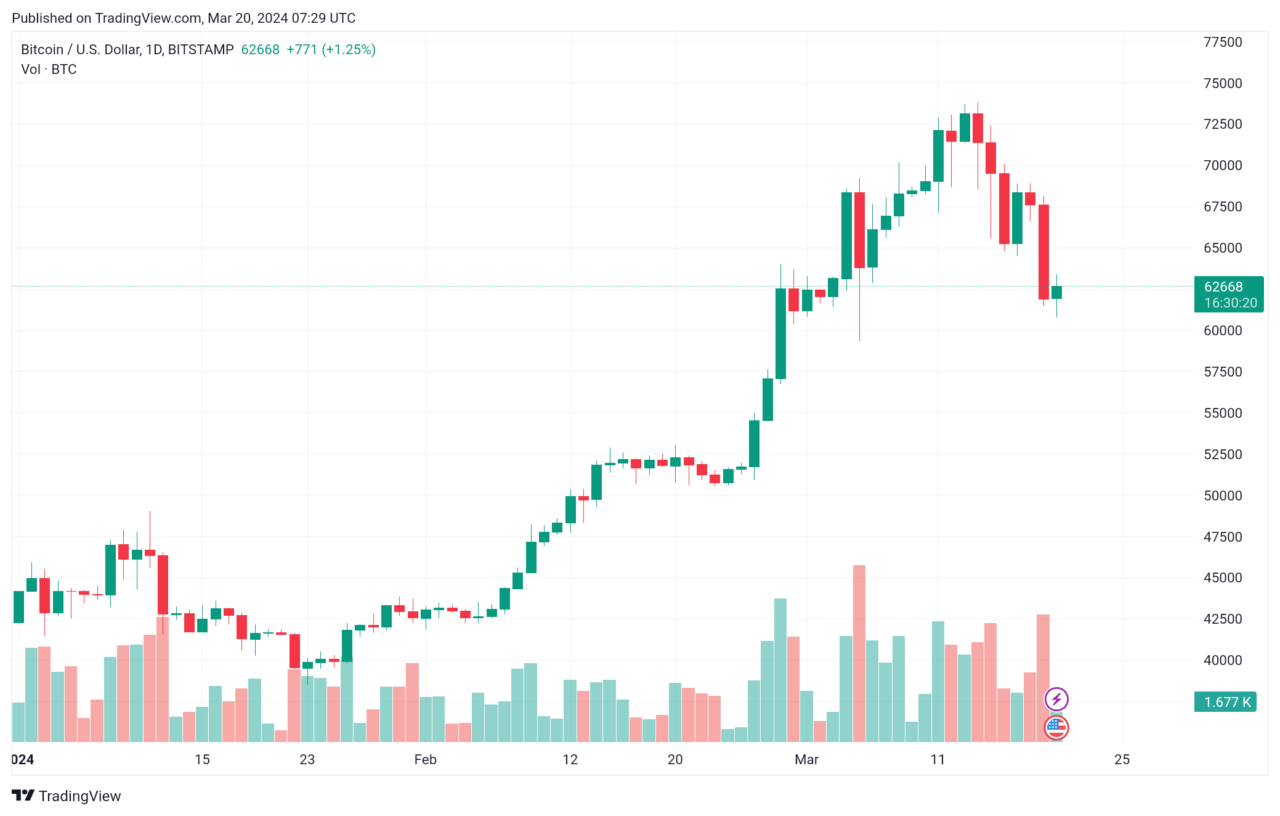

TradingView records reveals that Bitcoin costs peaked at $73,794 on the Bitstamp trade on March 14th, had been falling for the previous six days, and reached a low of $61,447 the day prior to this:

In a conversation marked by Pompliano’s depth of files on Bitcoin’s historical performance and market dynamics, he supplied a reassuring viewpoint on the latest issue of the market and what traders would possibly ask transferring forward.

Pompliano started by contextualizing the sizzling tumble in Bitcoin’s imprint, describing it as a “little drawdown” when when compared with the cryptocurrency’s historical volatility. He eminent that at some stage in previous bull markets, corresponding to in 2017, Bitcoin experienced a couple of corrections of round 30%, whereas the latest correction stood at approximately 13 to 15%. This, in line with Pompliano, indicates that the latest imprint circulation is reasonably gentle and in line with Bitcoin’s unparalleled market behavior.

Further emphasizing the level, Pompliano when compared Bitcoin’s performance with feeble monetary markets. He talked about that over the closing 10 years, Bitcoin has executed a compound annual bid rate (CAGR) of 60%, vastly outpacing the S&P 500’s CAGR of 11%. In the intervening time, he said, over the closing 5 years, Bitcoin’s bid has been even extra pronounced, rising by 1500% when compared to the S&P’s no longer up to double place bigger. This stark distinction highlights Bitcoin’s seemingly for excessive returns, which inherently comes with excessive volatility.

Addressing the concerns about future market volatility, Pompliano urged that the sizzling imprint correction would be seen as a be-cautious call for traders, in particular these modern to the cryptocurrency market. He humorously eminent the “irony” of Wall Boulevard’s contemporary entry into the Bitcoin market thru put ETF approvals, which used to be like a flash adopted by a imprint shatter, quipping, “welcome to Bitcoin.” This volatility, in line with Pompliano, underscores the unpredictable nature of Bitcoin, which has even defied some of its historical traits in contemporary years.

Pompliano concluded by reminding viewers that Bitcoin stays an asset class characterized by foremost volatility, regardless of being the finest-performing asset over the previous decade. He pressured out the importance of acknowledging this volatility as half and parcel of investing in Bitcoin, in particular because the asset continues to navigate uncharted territory.

Featured Image via Pixabay