Polymarket settling its greatest historical making a bet pair has caused a straight away withdrawal of tag from the platform. The making a bet market on the winner of the US election raised whole tag locked to file ranges, but now, Polymarket faces the ultimate outflow of tag since its inception.

Polymarket lost as much as 50% of its tag locked after settling the making a bet market on the winner of the US presidency. The making a bet platform now carries a reported $181M in initiate passion, sharply down from $511M on November 6. Even the zero charges and the immense repute of the platform did now now not dwell the outflows.

The inability of passion in Polymarket neatly suited after the election follows a pattern comparable to PolitiFi tokens, which had been sold on the real news as they lost their memetic tag.

Even now, Polymarket continues to raise a real quantity of political bets, though at a fundamental smaller scale. The inflow of whales on Trump’s ‘Certain’ token used to be the necessary source of jabber, though dinky-scale bets additionally fed off the hype. At one level, inflows from whales reached $70M, even with out at the side of unreported multi-accounting.

In the immediate aftermath of the US elections, Polymarket has reverted to sports actions as its high making a bet express. A model of bets are quiet on hand but at fundamental lower trading volumes and initiate passion.

Polymarket suggests forthcoming airdrop

Because the holders of a hit bets space to withdraw their earnings, Polymarket despatched out a message hinting at a doable airdrop. The message did now now not work to dwell outflows, in particular for whales cashing out. Nonetheless, it may possibly well also match with some customers. Some think the doable airdrop ay even be on hand to customers with somewhat dinky bets.

The Polymarket airdrop has been anticipated for a whereas, comparable to expectations for Pump.enjoyable. The speculative markets were among one of most certainly the greatest-performing apps. Nonetheless, Polymarket’s repute could well also were boosted by its zero-rate operation, which can possibly well also additionally mean it’s operating at a loss.

Polymarket did now now not initiating an airdrop or native token for the length of the hype segment of the US elections, even supposing customers continually requested about every. A token initiating sooner than the election would occupy made the new token inclined to a rupture. So Polymarket could well also were neatly suited to lengthen the airdrop.

As with assorted airdrops, the real prerequisites are unknown, however the messages customers got counsel withdrawing now could well also disqualify their wallets.

One doable job for the Polymarket airdrop will most certainly be the requirement to support liquidity on the platform. As of now, one of most certainly the greatest identified criterion is interacting with the platform.

Previously, about a of the Polymarket express has been tied to expectations of an airdrop. There occupy additionally been indicators that airdrop farmers were seeking to stable their situation. One amongst one of the most energetic cohorts of wallets are these with dinky bets, but a smooth turnover. In the case of volumes, the ultimate POLY airdrops could occupy to quiet trip to whales even if it additionally benefits excessive-frequency traders.

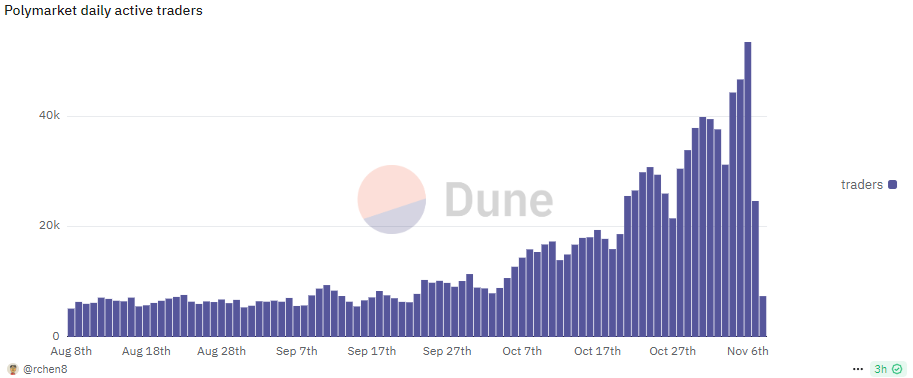

Day-to-day trader counts down after US elections

Small-scale traders additionally joined whales in the singular focal level on Polymarket’s greatest making a bet pair. With the action now settled, smaller markets are failing to absorb the bets as each day energetic traders are in actual fact again to early October ranges.

The whales of the pre-election interval were largely raking of their gains. One indispensable exception is the trader Theo4, printed as the French trader who finished outsized gains of over $47M.

The Theo4 pockets, which is quiet at the tip of the Polymarket leaderboard, made one closing bet two days previously. Theo4 sold ‘No’ tokens with regards to Kamala Harris a hit the neatly-liked vote. The market is with regards to resolution and could occupy to quiet add one more a hit situation.

Theo4 sold the ‘No’ token at $0.28. The token is already at $0.ninety nine and could occupy to quiet most certainly be resolved on November 8 for the 7,503 shares the French trader holds. The assorted identified sage and the necessary winner, Fredi9999, stopped making new bets bigger than two weeks previously.