Polygon, actually one of the most predominant layer-2 networks in the crypto industry, has lost market share as competition in the sphere has risen. POL, its token, has also plunged by 43% from its December high, whereas its ranking in the crypto sector has deteriorated. It’s now the 35th greatest crypto, worse from the build it used to be a couple of years ago and has lost market share to Snide and Arbitrum.

Polygon has lost market share to Snide and Arbitrum

Polygon used to be potentially the predominant layer-2 community in the crypto industry. Its know-how presents an Ethereum scaling solution that helps lower transaction costs and boost speeds.

In accordance with its internet home, Polygon has over 28,000 aesthetic contract creators and has handled over 2.4 billion transactions. It also has over 219 million extra special addresses in its ecosystem.

No longer too prolonged ago, alternatively, Polygon has lost market share across rather rather a couple of industries savor gaming, NFTs, and Decentralized Finance (DeFi).

One of many acceptable ways to gauge a layer-1 or layer-2’s success is to pay attention to the total amount of cash locked in its platform. In accordance with DeFi Llama, Polygon now has $954 million locked in its ecosystem, with AAVE, Polymarket, Uniswap, and Spiko being the greatest names in the ecosystem.

In contrast, varied layer-2 solutions savor Arbitrum and Snide possess over $3 billion in resources, figures which possess grown in the previous few months. Whereas Polygon used to be launched in 2017, Arbitrum and Snide possess been created in 2021 and 2023.

One erroneous technique to behold at a layer-2’s community success is to pay attention to the amount of earnings its stablecoins. Here’s important since stablecoins are what vitality the blockchain industry.

Polygon has a stablecoin market cap of $1.67 billion, whereas Snide and Optimism possess over $3 billion every. That is a signal that they’re extra energetic networks than Polygon.

Polygon DEX volume has fallen

One other metric to behold when pondering a chain’s success is to behold on the quantity of resources traded on in its DEX networks. Records presentations that its DEX networks handled over $365 million in the closing 24 hours, mighty lower than what varied chains handled.

Solana’s 24-hour volume used to be almost $30 billion, whereas Snide and Arbitrum had $2.11 billion and $2.7 billion, respectively.

Polygon’s 30-day volume used to be $4.9 billion. Whereas here’s a moral number, it used to be mighty lower than Snide’s $51 billion and Arbitrum’s $24 billion. It has also been overtaken by a slightly contemporary community savor Sui, which processed $4.1 billion in resources.

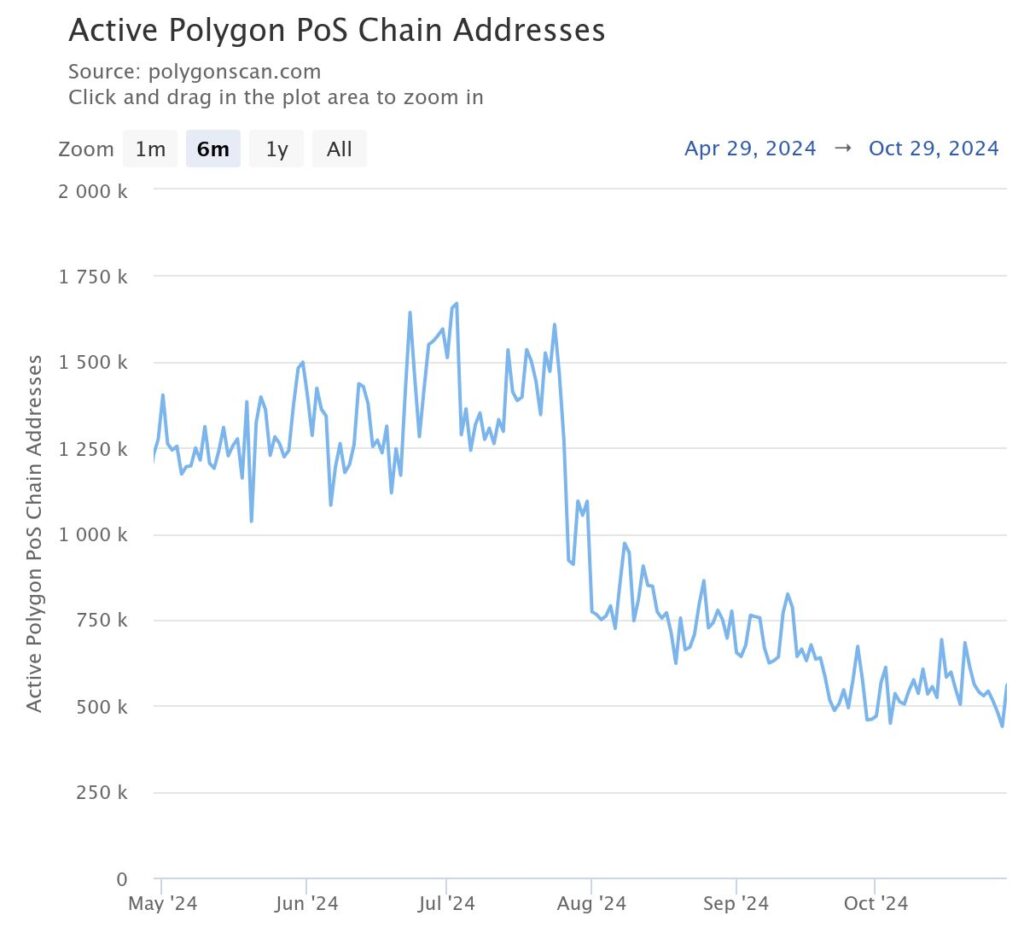

Extra knowledge presentations that the Polygon community has persisted to deteriorate. As confirmed beneath, the desire of energetic Polygon energetic chain addresses has fallen, transferring from 1.665 million in July closing twelve months to 558,000. This decline came about even as cryptocurrency pieces jumped, with Bitcoin reaching an all-time highon Monday.

The desire of deployed contracts on Polygon has also dropped to its lowest level in December closing twelve months. There possess been over 36,000 contracts, down from 358k in October.

Polygon impress forecast

The 4H chart presentations that the POL token has crashed from closing twelve months’s high of $0.7671 to basically the most modern $0.4355. It has moved beneath the 61.8% Fibonacci Retracement point and the 50-duration transferring average.

Polygon has also formed a descending triangle sample whose lower facet is at $0.4132. A falling triangle sample is a highly stylish bearish signal up the market. Therefore, the coin will seemingly continue falling as sellers target the next target at $0.3897, its 78.6% Fibonacci Retracement point.

The post Polygon impress prediction as POL forma a abominable chart sample regarded first on Invezz