Polygon (MATIC) price has declined by 17% within the closing 30 days. Whereas the token has had a chain of recoveries, its price action in most up-to-date weeks has been nothing short of underwhelming.

One quiz merchants will desire to perceive is that if the token will within the end trade towards the brand new escape of play. This on-chain diagnosis dives into the likelihood.

Polygon Sees Mass Departure In Traders

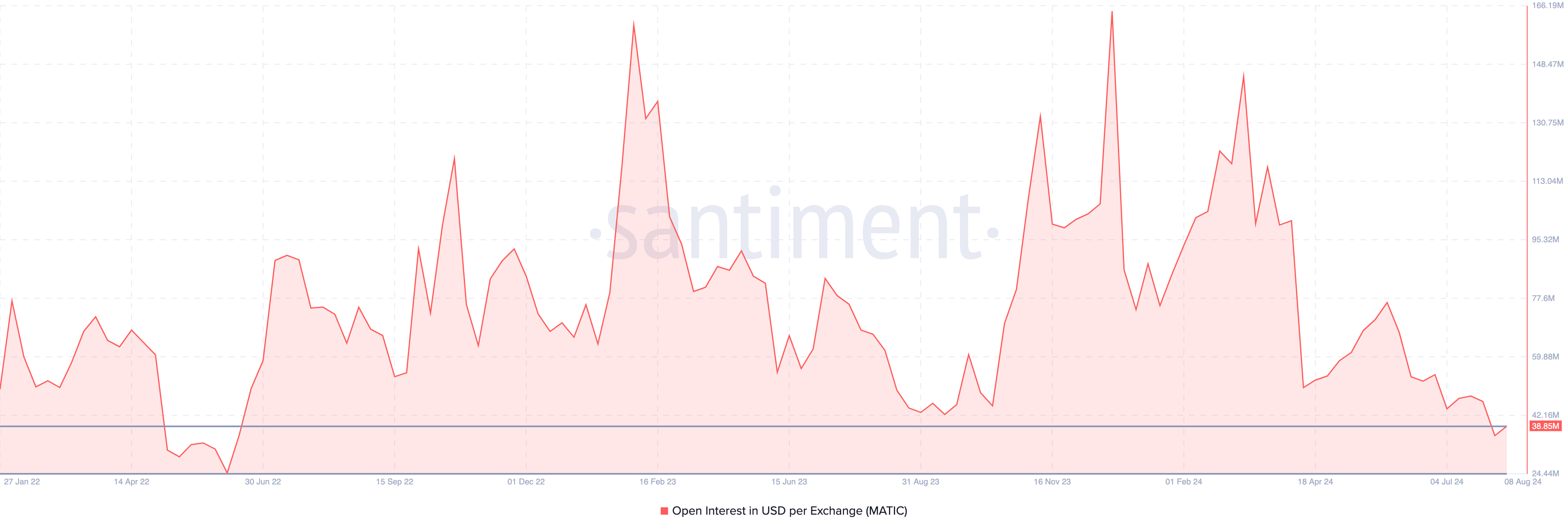

In accordance to Santiment, Polygon’s prospects dwell bleak. One position off of right here is the Start Passion (OI), which is the price of all celebrated contracts within the market. At press time, the OI per trade used to be $38.85 million.

As considered under, the closing time the metric reached this stage used to be in June 2022 – specifically all the strategy via the endure market. For the unaccustomed, a upward push in OI implies that merchants are rising publicity to a cryptocurrency by allocating more liquidity to contracts linked to the token.

In most circumstances, this amplify in catch positioning drives a jump in price. On the opposite hand, a decrease in Start Passion means that merchants are taking money out while doubtlessly impacting price negatively.

Read more: What Is Polygon (MATIC)?

From a procuring and selling level of view, the autumn in this price signifies an amplify in aggressive sellers. If it remains unchanged, this could maybe well lag the pricetag of the Polygon native token extra down.

At press time, MATIC modified palms at $0.42, representing an 85.51% decrease from its all-time high. Pondering the brand new market condition, this decline is alleged to be a “aquire the dip” substitute.

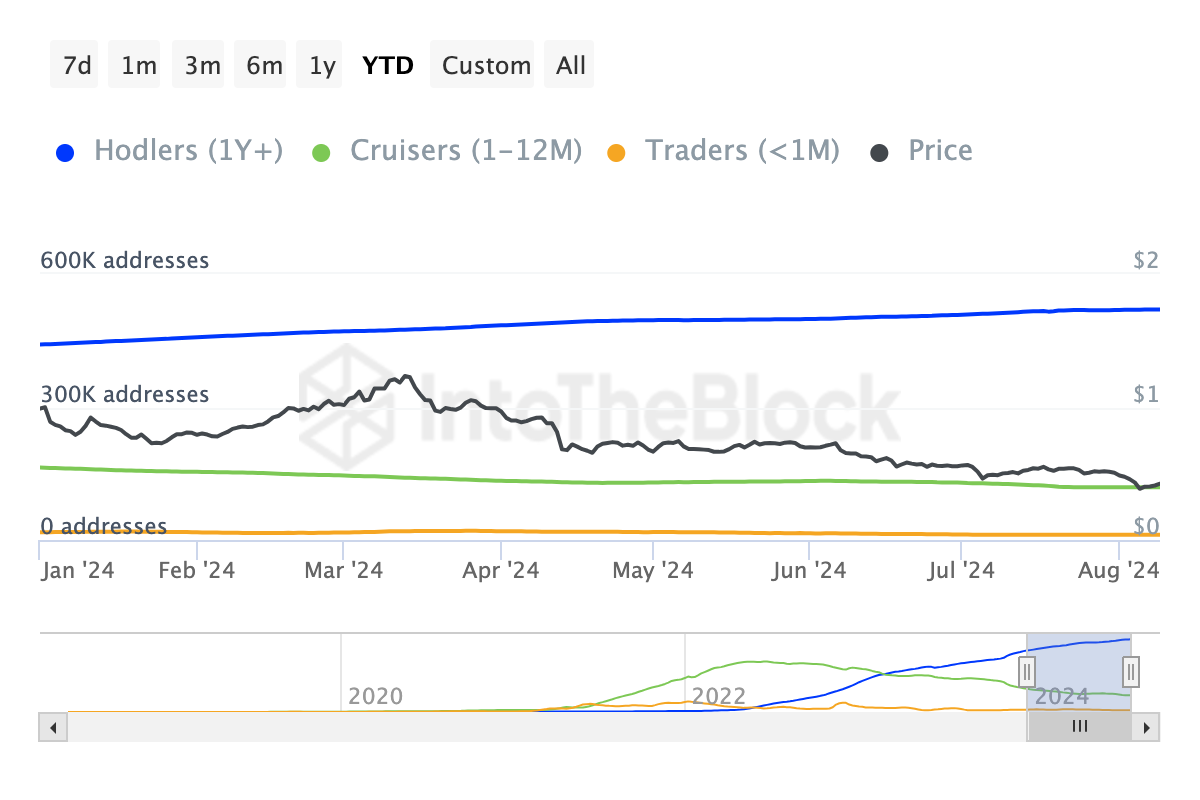

On the opposite hand, the broader market does no longer appear to see it that manner, per files from IntoTheBlock. As of this writing, the blockchain analytics platform presentations that the variety of Cruisers and Traders has declined.

Cruisers are individuals that appreciate held a cryptocurrency between the closing 30 days to 300 and sixty five days. Traders, on the opposite hand, are individuals that held internal the closing 30 days.

If the variety of these contributors increases, it signifies market self assurance in a token’s doable. Nonetheless because it reduced, it methodology that a natty phase of the market is skeptical about MATIC’s short to mid-time period doable.

MATIC Ticket Prediction: Brace for Every other Decline

The day after day MATIC/USD chart finds that bulls were ready to enhance a few of doubtlessly the most up-to-date losses. On the opposite hand, the token faces an uphill fight because it lingers under the $0.46 mandatory enhance. Furthermore, the Chaikin Money Meander with the circulate (CMF), worn to distinguish between durations of accumulation and distribution, is exact down to -0.12.

When the CMF ranking increases, accumulation outpaces distribution, thereby bettering the probabilities of a price amplify. Since the indicator’s reading dropped, it means that selling pressures outweigh the aquire facet.

On the opposite hand, the Relative Strength Index (RSI) registered a leap from what it used to be a few days help. The RSI measures momentum and space overbought and oversold areas. If the reading is 70.00 or under, the crypto involved is overbought.

Conversely, a reading at 30.00 or under methodology the crypto is oversold. From the image under, Polygon turned oversold when the market crashed earlier within the week. Nonetheless without reference to the diminutive amplify it had, the RSI remains under the neutral line, suggesting that momentum remains bearish.

Read more: 15 Most effective Polygon (MATIC) Wallets in 2024

Would possibly peaceable this protect the identical, MATIC might maybe well obtain it powerful to leap off doubtlessly the most up-to-date lows, maybe leading the crypto price under $0.40.

On the opposite hand, this prediction might maybe well very effectively be invalidated if investor sentiment changes from bearish to bullish. If this happens, MATIC price might maybe well retest $0.44 and doubtless reach $0.50.