Merchants in Polygon (MATIC) could presumably well fetch been pressured to rob issues into their savor palms. From the commentary on-chain, this potential motion will be linked to MATIC’s underwhelming performance.

At press time, one MATIC is worth $0.49, representing an 11.61% lower over the closing 30 days. Will the token dwell on one other onslaught?

Polygon Institutional Current Position Fades

Info from blockchain analytics platforms reveals that it’d be irritating for MATIC to leap. Here’s for the reason that sequence of tokens ready to be offloaded is much better than these waiting to snipe the token at lower prices.

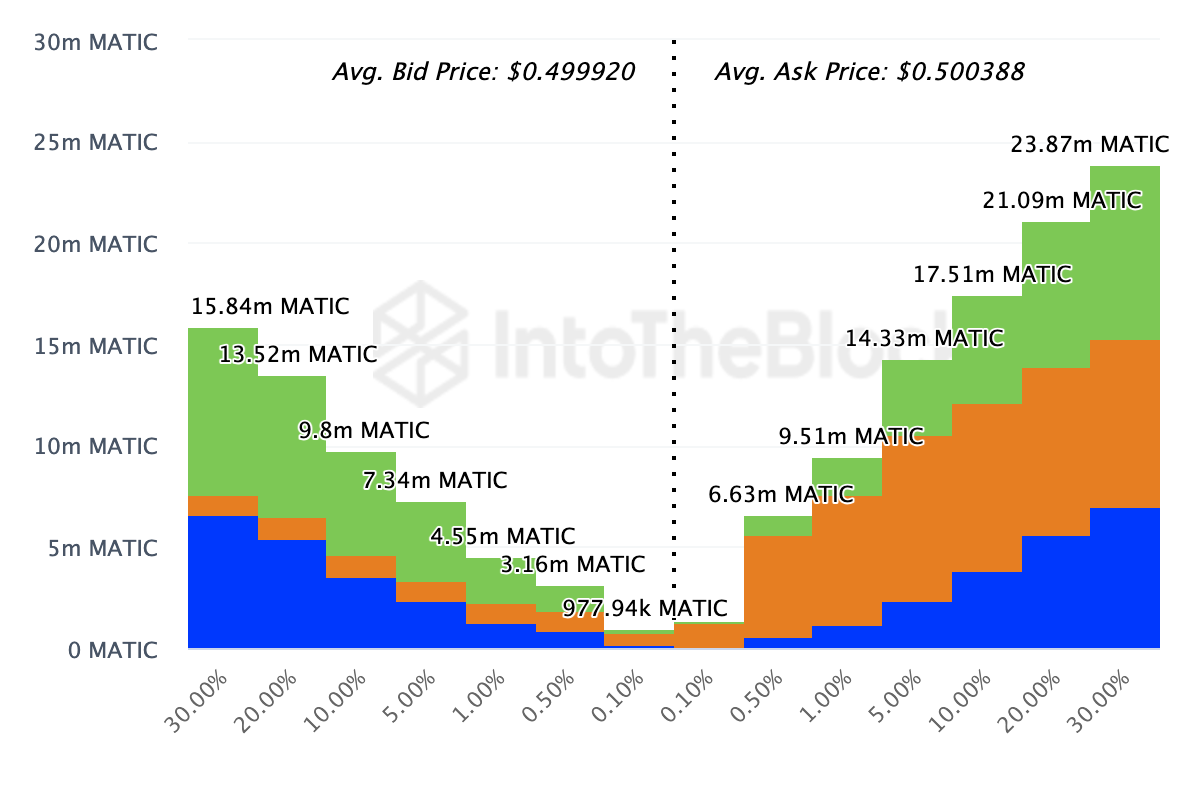

Utilizing the Trade On-Chain Market Depth, an indicator that tracks the listing books of the tip 20 exchanges, BeInCrypto seen that merchants are nice looking to promote 90.32 million tokens once MATIC hits $0.50. Here’s evident from the ask (promote) section of the listing e book.

Conversely, the final bids (aquire orders) role for $0.49 are a bit over 55 million tokens. The adaptation between the aquire and promote orders reveals that more merchants are willing to rob away the Polygon native token from their portfolio.

Read more: 15 Handiest Polygon (MATIC) Wallets in 2024

If this residing remains the same over the next couple of days, MATIC’s impress could presumably well also abilities one other indispensable descend.

Furthermore, the big holders’ netflow has reduced by 220% in the closing seven days. Spruce Holders’ netflow measures whales and institutional ardour in a cryptocurrency. An broaden implies rising accumulation, whereas a lower suggests distribution.

At one point, MATIC used to be once an institutional accepted. But this contemporary decline implies that the ecosytem has changed, and merchants are skeptical of HODLing MATIC.

Would possibly per chance presumably presumably impartial tranquil MATIC continue to face big institutional distribution, its impress could presumably well also come across one other spherical of capitulation.

MATIC Brand Prediction: More Losses on the Radar

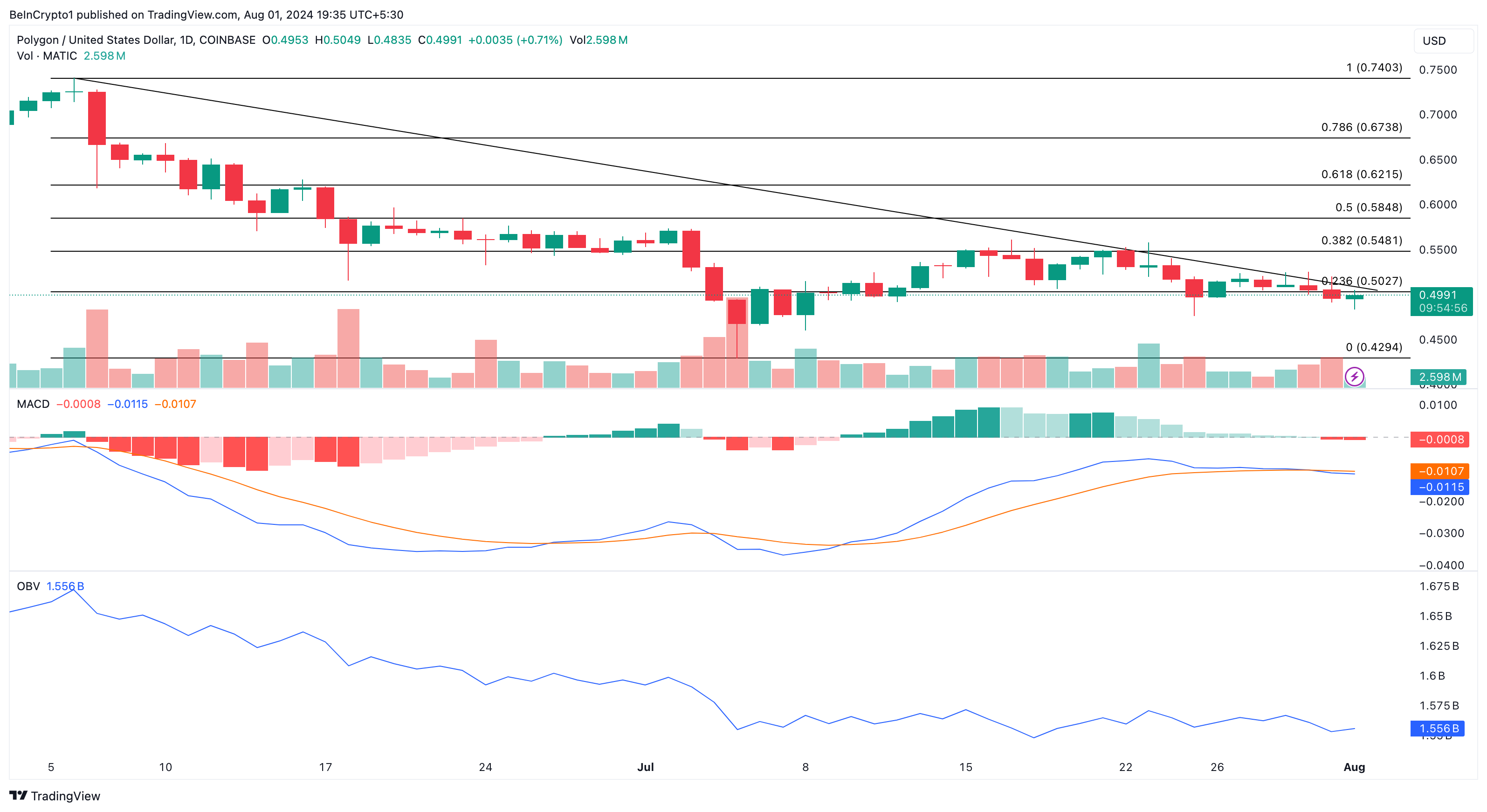

Per the each day chart, MATIC has yet to atomize above the descending trendline since June 6. The incapacity to switch past the residing suggests that the token remains in bearish territory. If MATIC fails to upward push above this trendline, then the associated price could presumably well also fight to enhance.

Moreover to, the Transferring Common Convergence Divergence (MACD) is unfavourable. The MACD uses the difference in transferring averages to measure momentum. When the reading is definite, momentum is bullish

When it is unfavourable, momentum is bearish. If this pattern continues, MATIC’s impress could presumably well also continue to tumble. The On Steadiness Quantity (OBV), which measures procuring for and selling stress, gave the same indications.

Read more: Polygon (MATIC) Brand Prediction 2024/2025/2030

At press time, the OBV traits downward, indicating that sellers fetch been liquidating MATIC in big numbers. If this continues, the MATIC impress could presumably well also head in direction of $0.42. On the quite a complete lot of hand, a resurgence in procuring for volume could presumably well perhaps stop the downtrend and presumably result in the associated price reaching $0.54.