Polkadot (DOT) is a effectively-identified cryptocurrency with innovative technology and a stable ecosystem. Nonetheless, present market fluctuations accept as true with raised considerations about its future. May maybe maybe maybe the associated price of DOT break to zero? Let’s take a investigate cross-take a look at at this Polkadot Build Prediction article in additional ingredient.

How has the Polkadot (DOT) Build Moved Lately?

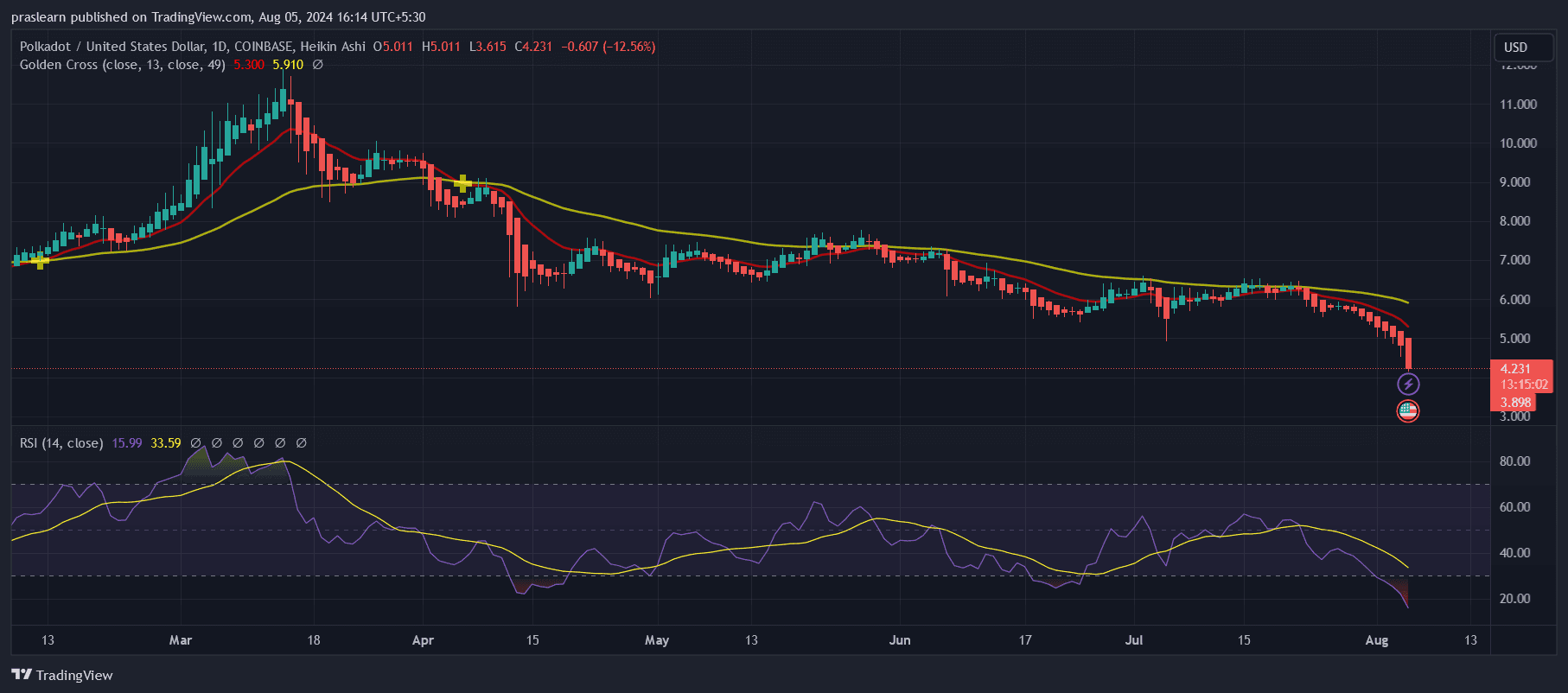

As of in the present day time, Polkadot (DOT) is priced at $3.89, with a 24-hour procuring and selling volume of $1.20 billion, a market cap of $3.84 billion, and a market dominance of 0.21%. All the design through the last 24 hours, the DOT ticket has declined by 22.02%.

Polkadot achieved its high ticket of $54.98 on November 4, 2021. Its lowest ticket used to be $2.82, recorded on August 22, 2020. Since reaching its all-time excessive, the bottom ticket Polkadot has hit is $3.59 (cycle low), and the absolute top ticket since then used to be $11.86 (cycle excessive). At the moment, market sentiment for Polkadot is bearish, and the Misfortune & Greed Index signifies a reading of 26, reflecting a speak of apprehension.

The circulating provide of Polkadot stands at 987.58 million DOT, out of a maximum provide of 1.00 billion DOT.

Polkadot Build Prediction: Why is DOT Build Crashing?

The present break in Polkadot’s (DOT) ticket will likely be largely attributed to mounting fears of a US recession. This fear used to be induced by disappointing job market records from the United States, which confirmed the creation of handiest 114,000 new jobs in July, vastly below the anticipated 175,000. This figure represents the weakest job boost since December of the outdated 12 months, fueling considerations a couple of most likely financial slowdown.

Prominent investors are voicing their apprehensions. Charles Edwards of Capriole Investments has drawn parallels between the present financial indicators and folks preceding previous recessions.

Additionally, Warren Buffett’s Berkshire Hathaway has divested a huge fragment of its Apple holdings, further unsettling market self perception. The arena market is additionally feeling the impact of the Monetary institution of Japan’s decision to raise its key passion price, a gallop that historically indicators forthcoming recessions.

In gentle of those traits, investors are increasingly possibility-averse, main to a nice sell-off in the crypto market, with Polkadot being no exception. The aggregate of financial uncertainty and diminished investor self perception is setting up a bearish outlook for DOT, contributing to its present ticket decline.

Will Polkadot (DOT) Build Crash to 0?

The ask of whether Polkadot’s (DOT) ticket will break to zero requires a nuanced analysis pondering each and each its present performance and market indicators. No topic the present downturn, DOT’s performance relative to its token sale ticket remains definite, indicating that it has maintained some level of worth since its preliminary launch.

Moreover, Polkadot enjoys excessive liquidity attributable to its gigantic market cap, which generally helps more stable procuring and selling conditions and reduces the probability of a total collapse.

Nonetheless, present records finds a troublesome ambiance for DOT. The worth has fallen by 24% at some level of the last 12 months and is in the period in-between procuring and selling vastly below its 200-day straightforward engaging life like, signaling a prolonged downtrend.

With handiest 11 inexperienced days in the previous 30, the token’s present performance has been used, and it is some distance down 93% from its all-time excessive. Even supposing DOT has outperformed Seventy nine% of the pinnacle 100 crypto assets at some level of the last 12 months, it aloof lags at the assist of major gamers fancy Bitcoin and Ethereum, which highlights its relative below-performance.

Given these factors, while a total break to zero appears no longer going in the prompt interval of time attributable to its liquidity and historical performance, the bearish market sentiment and prolonged downtrend raise considerations.

Persisted financial uncertainty and investor warning might well maybe exacerbate the decline, but predominant structural or traditional problems would likely must come up for DOT to formula a nil valuation.