PENGU tag has dropped roughly 10% in the closing 24 hours after turning into Solana’s biggest meme coin. No matter its fresh popularity, the asset’s momentum has slowed, with technical indicators suggesting seemingly consolidation or extra arrangement back.

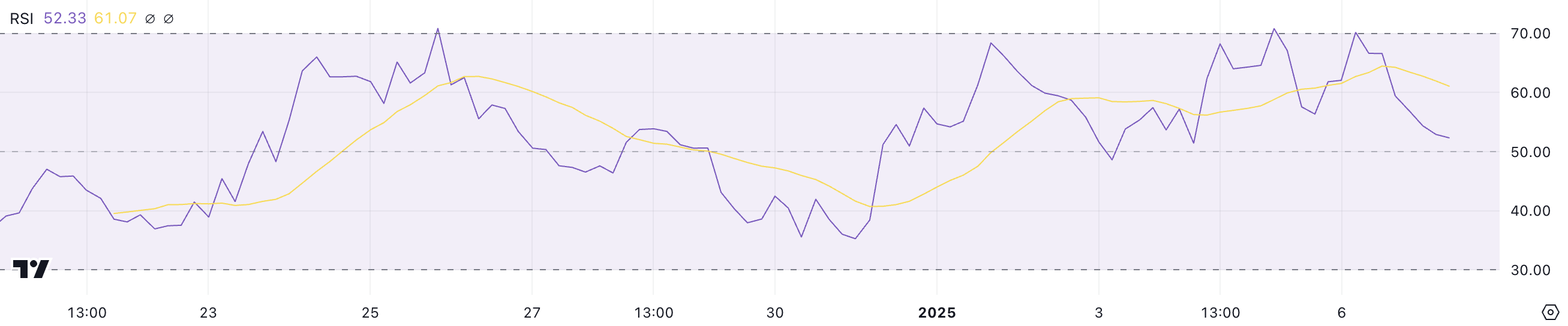

The Relative Strength Index (RSI) has fallen sharply from 70 to 52.3, indicating reduced purchasing for tension. If PENGU’s hype reignites, on the other hand, it goes to procure upward momentum and test key resistance ranges.

PENGU RSI Is Going Down Immediate

The Relative Strength Index (RSI) for PENGU is currently at 52.3, a predominant descend from the day gone by’s overbought stage of 70. RSI is a extensively veteran momentum indicator that measures the charge and magnitude of tag changes on a scale from 0 to 100.

Values above 70 normally present overbought conditions, suggesting a seemingly for a pullback, while values below 30 signal oversold conditions, in most cases pointing to a conceivable restoration. An RSI around 50 indicates neutral momentum, the set purchasing for and selling pressures are moderately balanced.

With PENGU’s RSI now at 52.3, the indicator suggests a period of consolidation in the quick term. This stage displays reduced purchasing for assignment in contrast to fresh highs but quiet maintains a fairly bullish bias. If the RSI holds regular or moves better, it goes to signal a resumption of upward momentum.

Conversely, a extra descend below 50 could present a waning bullish sentiment, doubtlessly leading to extra tag consolidation or minor declines. If that occurs, PENGU will doubtless be surpassed by BONK as Solana’s biggest meme coin.

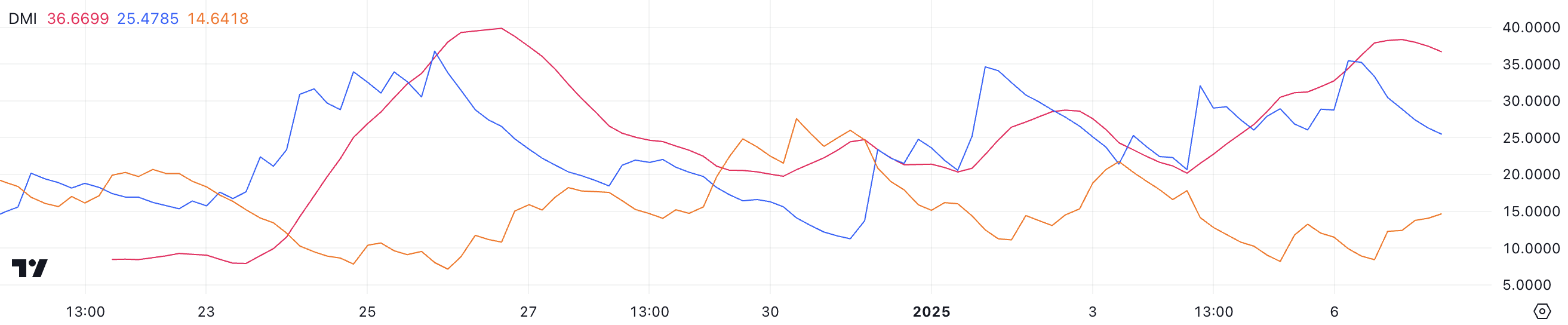

PENGU DMI Chart Reveals the Downtrend May maybe well well Obtain Stronger

PENGU Moderate Directional Index (ADX) is currently at 36.6, rising very much from 20 apt three days prior to now. The ADX measures the energy of a pattern on a scale from 0 to 100, with values above 25 indicating a discover pattern and below 20 suggesting historic or absent momentum.

A rising ADX signifies increasing pattern energy, no matter whether or now not the pattern is bullish or bearish.

Meanwhile, the directional indicators present insight into the pattern’s nature. The +DI, which represents purchasing for tension, has declined to 25.4 from 35 a day prior to now, indicating weakening bullish momentum. Conversely, the -DI, reflecting selling tension, has increased to 14.6 from 8.4, signaling rising bearish assignment.

If the +DI continues to descend and the -DI rises extra, PENGU tag might per chance per chance well face increased selling tension, confirming a bearish reversal in the quick term.

PENGU Trace Prediction: Will It Topple Below $0.03 Again?

PENGU EMA lines currently point out a bullish setup, but fresh tag circulation indicates the coin is doubtless to be coming into a downtrend. If the bearish momentum intensifies, PENGU might per chance per chance well test the toughen at $0.034.

Failure to lend a hand this stage could lead to extra declines, with $0.0296 and $0.0251 rising as key ranges to explore. The latter is approach PENGU’s historic lows.

On the replacement hand, PENGU has garnered critical consideration in fresh weeks, coming into the tip 10 ranking amongst the largest meme coins. If the hype surrounding the coin revives, PENGU might per chance per chance well retest the $0.0439 resistance.

A breakout above this stage, coupled with renewed bullish momentum, could propel PENGU tag above $0.05 for the first time.