Because the cryptocurrency market expands, new instruments and facets are repeatedly launched, creating advantages for merchants. Yield-bearing tokens absorb confirmed solid possible for prolonged-time frame returns, largely as a outcome of their basis in decentralized finance (DeFi) protocols. Notably, as DeFi initiatives evolve, extra users are adopting yield-bearing tokens, as they provide the twin perfect thing about acting as collateral for borrowing and enabling structured financial products securely stored in custody.

One indispensable participant on this sector is Pendle, a token in the initiating launched on the Ethereum network, designed to provide an environment pleasant market for yield-bearing belongings. Pendle operates by dividing these tokens into predominant and yield substances, thereby improving liquidity for buying and selling. Supporting a few blockchain networks—including Ethereum, Arbitrum, and BNB Chain—Pendle’s utility token, PENDLE, grants holders added advantages. When PENDLE is locked as vePENDLE, it boosts liquidity and grants governance rights to users, fostering a extra dynamic ecosystem.

As financial growth continues, merchants are an increasing kind of vigilant, looking out for excessive-possible alternatives. Pendle has captured attention as a doubtlessly a hit venture, particularly as it gains traction available in the market. While the token affords promising potentialities, cautious funding is recommended, pondering the volatility and uncertainties at some stage in the cryptocurrency landscape.

The rising cryptocurrency market affords new instruments for merchants, with yield-bearing tokens gaining traction as a outcome of their DeFi basis. These tokens give a design shut to prolonged-time frame returns, relieve as collateral, and allow right financial products. Pendle, launched on Ethereum, boosts liquidity by dividing tokens into predominant and yield substances and operates on networks enjoy Ethereum, Arbitrum, and BNB Chain. Its utility token, PENDLE, provides price when locked as vePENDLE, granting governance rights and liquidity perks, riding innovation in DeFi. Because the financial system expands, Pendle represents a unbelievable, even supposing cautious, funding different for these pursuing excessive returns in digital belongings.

What Is PENDLE Token?

Pendle (PENDLE) is a decentralized finance (DeFi) protocol that enables users to tokenize and trade future yields on DeFi belongings all over a ramification of blockchains, including Ethereum, Arbitrum, and BNB Chain. By technique of a course of is named yield tokenization, Pendle permits yield-bearing belongings to be divided into predominant tokens (PT) and yield tokens (YT), each and each serving obvious capabilities. Most most considerable tokens symbolize the ownership of the underlying asset, while yield tokens signify the asset’s future yield. This growth facilitates various yield administration programs, permitting users to make alternatives comparable to mounted yield, prolonged yield, and hedging in opposition to possible declines in yield.

Pendle’s twin-token mannequin affords users flexibility in yield administration. To illustrate, users ought to aquire YT to make bigger exposure to possible yields or sell YT for rapid liquidity, which permits various programs enjoy longing, shorting, and hedging. Additionally, the protocol’s liquidity provision characteristic permits users to make a contribution belongings to the platform in return for additional yield, supporting Pendle’s operations and enabling smoother trades all over its network.

The platform also integrates mechanisms for optimizing and hedging yields, helping users prepare yield fluctuations extra successfully. Pendle’s governance and staking framework additional enhances its utility, with the native token, PENDLE, empowering users to take part in protocol governance and decision-making. By locking PENDLE as vePENDLE, users make governance rights and can enhance liquidity provision rewards. Overall, Pendle’s protocol growth affords an infrastructure for buying and selling, managing, and hedging future yields, turning in a platform optimized for a ramification of yield administration programs and aimed at expanding alternatives within decentralized finance.

Pendle Finance Boosts DeFi with Yield Take care of an eye fixed on and Trading Choices

Pendle Finance brings a really expert potential to yield administration, specializing in maximizing particular person administration in decentralized finance (DeFi). Unlike old programs, Pendle permits yield-focused programs, including yield buying and selling and hedging, to provide users with extra flexibility. This characteristic permits users to absorb interaction in yield-earning techniques by having a bet on yield fluctuations or taking a transient space, providing varied profits alternatives in the rising DeFi home.

By supporting yield-based fully buying and selling, Pendle opens new avenues for earning and optimizing returns. Its platform permits users to trade and stake tokens, doubtlessly generating dividends and various financial returns. By technique of yield-generating tokens, users can salvage entry to liquidity, enabling them to trade ownership of their yield for rapid profits. Pendle’s system also incentivizes liquidity providers, who can manufacture additional profits by contributing to its liquidity swimming pools.

Token swaps create no longer want to be 1-to-1, no longer with Pendle round 🫡

With our newly upgraded Swap Widget, you would possibly perhaps be in a neighborhood to now swap up to 1, 2, 3 tokens to ANY token of your different ⚡

Most effective that you would possibly perhaps be in a neighborhood to accept as true with rates in DeFi city with elegant the clicking of a button pic.twitter.com/yTJe5f3UMt

— Pendle (@pendle_fi) October 31, 2024

In Pendle’s ecosystem, liquidity swimming pools feature through easy contracts, permitting users to manufacture rewards proportionate to their staked amount and duration. When users deposit belongings, they’re transformed to the SY token commonplace, making them enjoy minded with a few blockchain networks. The SY tokens can then be entered into Pendle’s liquidity pool, permitting users to right and administration their yield.

Deposits within Pendle are split into Most most considerable and Yield tokens. The Most most considerable tokens, representing the real asset price, cease staked till maturity, at which level they’re unlocked for particular person withdrawal. Yield tokens, which clutch the prolonged mosey yield of a staked asset, would possibly perhaps additionally be exchanged on Pendle’s automatic market maker (AMM) for various belongings or held for future buying and selling.

Pendle Technical Diagnosis

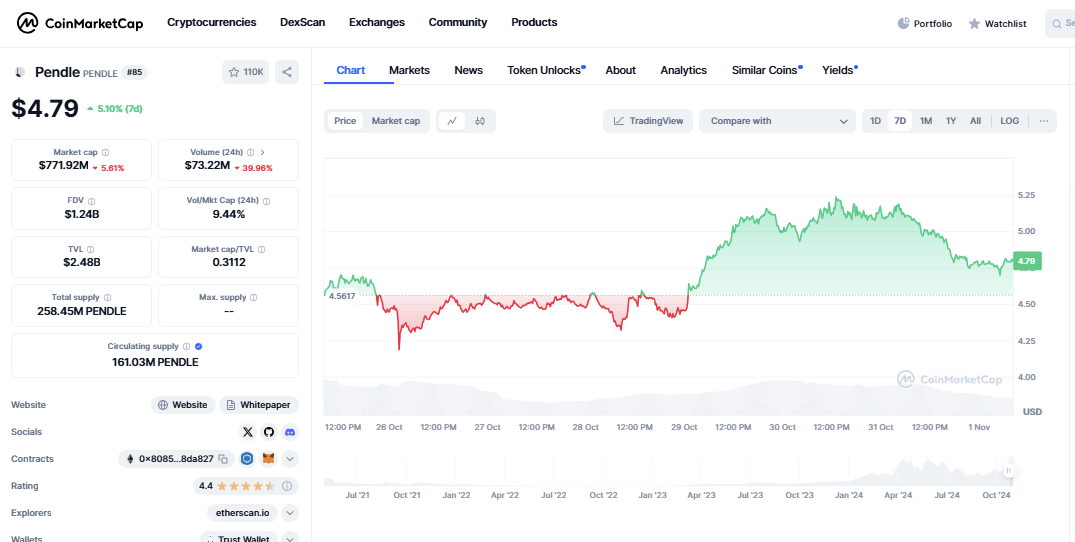

Pendle (PENDLE) has confirmed spectacular performance over the last week, rising to $4.seventy nine as of November 1. Despite coping with a unstable market, Pendle’s price increased by 5.10%, reflecting solid investor ardour on this yield administration-focused DeFi token.

On the other hand, while the price rose, Pendle’s market cap and buying and selling volume saw declines in the previous 24 hours. The market cap stands at $771.92 million, representing a 5.61% plunge. Trading volume reached $73.22 million, down by 39.86%. Pendle’s fully diluted valuation (FDV) remains at $1.24 billion, suggesting the aptitude price if all tokens had been to enter circulation.

Source : coinmarketcap

Source : coinmarketcapUndoubtedly one of Pendle’s key strengths is its total price locked (TVL), which for the time being stands at $2.48 billion. This large TVL highlights the excessive level of funding within its ecosystem, drawing attention from liquidity providers. The market cap to TVL ratio sits at 0.3112, a promising indicator for these looking out for yield alternatives at some stage in the DeFi sector.

Pendle’s circulating provide consists of 161.03 million tokens out of a total provide of 258.45 million. This circulation helps the quiz for liquidity and staking, that are needed to Pendle’s price proposition in decentralized finance. Over the previous week, Pendle’s price motion displayed initial fluctuations, in rapid dipping to $4.56. Following this dip, Pendle rallied, peaking above $5 sooner than stabilizing at its fresh price of $4.seventy nine.

Pendle Nears Key $5 Resistance with 61.8% Fibonacci Level in Focal level

Pendle (PENDLE) is showing signs of a possible breakout as it edges nearer to key resistance ranges. Trading at approximately $4.seventy nine on November 1, the token is design the 61.8% Fibonacci retracement level, which has historically been a crucial level for price action. Technical prognosis displays a solid upward style over fresh weeks, positioning Pendle within a consolidation triangle, which implies a buildup of stress possible to manual to a breakout.

The chart indicates that Pendle has been on an upward trajectory since early October, with give a design shut to forming in all places in the $3.00 price. The worth has examined resistance a few times in the new triangle pattern, which stretches relieve several months, hinting at a that you would possibly perhaps be in a neighborhood to accept as true with breakout if buying momentum continues. Key resistance ranges lie at approximately $5.00, aligned with the 50% Fibonacci retracement level, and additional up at $7.515, the 23.6% retracement level.

The Relative Strength Index (RSI), for the time being at 61.14, signals that Pendle is nearing overbought territory nonetheless serene has room for additional upward motion. An RSI above 70 would uncover an overbought situation, doubtlessly prompting a pullback. On the other hand, the new RSI studying suggests fashionable momentum, leaving the door originate for persevered gains if buying stress remains solid.

Pendle’s price action has fashioned a sequence of bigger lows, adding to the bullish outlook. If the token can ruin throughout the easier boundary of the triangle pattern, it will switch in opposition to the subsequent resistance level at $5.00, doubtlessly signaling the initiate of a stronger upward style. On the other hand, failure to ruin above this resistance would possibly perhaps unbiased lead to a consolidation duration round fresh price ranges or a retest of the $3.00 give a design shut to level.

Pendle Designate Prediction

| Designate Prediction | Doable Low($) | Moderate Designate($) | Doable High($) |

| 2024 | 3.98 | 4.62 | 5.00 |

| 2025 | 4.01 | 5.78 | 6.23 |

| 2026 | 6.01 | 7.02 | 8.56 |

| 2027 | 7.56 | 8.11 | 9.99 |

| 2028 | 5.29 | 6.08 | 7.63 |

| 2029 | 9.46 | 10.00 | 11.53 |

| 2030 | 11.01 | 13.2 | 15.56 |

Pendle Designate Prediction 2024

In 2024, Pendle’s price is expected to alter from $3.98 to $5.00, with a median of $4.62. This make bigger would be attributed to a broader acceptance of decentralized finance (DeFi) and a possible recovery in crypto markets after fresh years of volatility. As Pendle is a DeFi-focused token, growth in DeFi would possibly perhaps pressure quiz and make bigger its price.

Pendle Designate Prediction 2025

For 2025, the projected price spans from $4.01 to $6.23, with a median price of $5.78. The make bigger can outcome from enhanced utility and upgrades at some stage in the Pendle ecosystem, presumably attracting extra users and institutional merchants. Elevated adoption would possibly perhaps stem from Pendle’s routine potential to yield administration, making it extra precious as DeFi continues to veteran.

Pendle Designate Prediction 2026

In 2026, Pendle’s price is expected to rise additional, with a low of $6.01 and a excessive of $8.56, averaging round $7.02. The fashionable growth displays a strengthening in DeFi’s space at some stage in the broader financial landscape. At this level, extra old merchants would possibly perhaps gaze Pendle as a precious asset, contributing to its quiz and worth balance.

Pendle Designate Prediction 2027

By 2027, Pendle’s projected price vary is $7.56 to $9.99, with a median of $8.11. This make bigger is possible to be driven by Pendle’s ability to adapt to technological trends in blockchain, presumably expanding its partnerships and integrating with various DeFi platforms.

Pendle Designate Prediction 2028

In 2028, Pendle is expected to alter between $5.29 and $7.63, with a median price of $6.08. Though a chunk of lower than the earlier year, this duration would possibly perhaps unbiased gaze Pendle consolidating and stabilizing its price. This year would possibly perhaps focal level on strengthening its market heinous, with adoption from extra retail merchants and improvements in its yield administration mechanisms.

Pendle Designate Prediction 2029

For 2029, Pendle’s price is forecasted to make bigger, ranging from $9.46 to $11.53, with a median price of $10.00. This growth would be attributed to an increasing feature for DeFi in mainstream finance, where Pendle’s yield-generating capabilities would possibly perhaps unbiased appeal to both institutional and retail merchants.

Pendle Designate Prediction 2030

In 2030, Pendle’s projected price peaks between $11.01 and $15.56, with a median of $13.2. This crucial rise displays Pendle’s possible as a prolonged-time frame funding, possible driven by its sustained utility in yield administration.

FAQ’s

Essentially based fully on our price prediction, the Pendle token has been repeatedly expanding and is de facto a correct funding in the prolonged mosey.

By the tip of this financial year , the price is anticipated to reach $8.56

Essentially based fully on trajectorical potentialities in our price prognosis, the price will hit above $15 by 2030.