The headline US Interior most Consumption Expenditures (PCE) inflation has increased to 2.3%, reported the Bureau of Financial Diagnosis on Friday.

Furthermore, the core PCE inflation in the US has increased to 2.7% after declining for 2 months.

Following the originate, Bitcoin (BTC) worth fell a cramped bit in opposition to $106K make stronger, triggering a selloff in the wider crypto team.

Alternatively, it appears to be like that the sizable investors tend to continue shopping at dips after momentary holders and derivatives traders liquidate their holdings.

US PCE Inflation Comes in at 2.3%

The U.S. Bureau of Financial Diagnosis released the Federal Reserve’s most standard inflation gauge, US PCE data, on June 27.

On a year-over-year foundation, headline PCE inflation increased to 2.3% from the revised 2.2% old month. Equally, core PCE inflation edged as much as 2.7%, better than the 2.6% estimate.

The US PCE inflation rises to 0.1% month-over-month, matching the features for the old two months.

Whereas, the core PCE index, which excludes unstable food and energy costs, increased 0.2%, better than the 0.1% estimate.

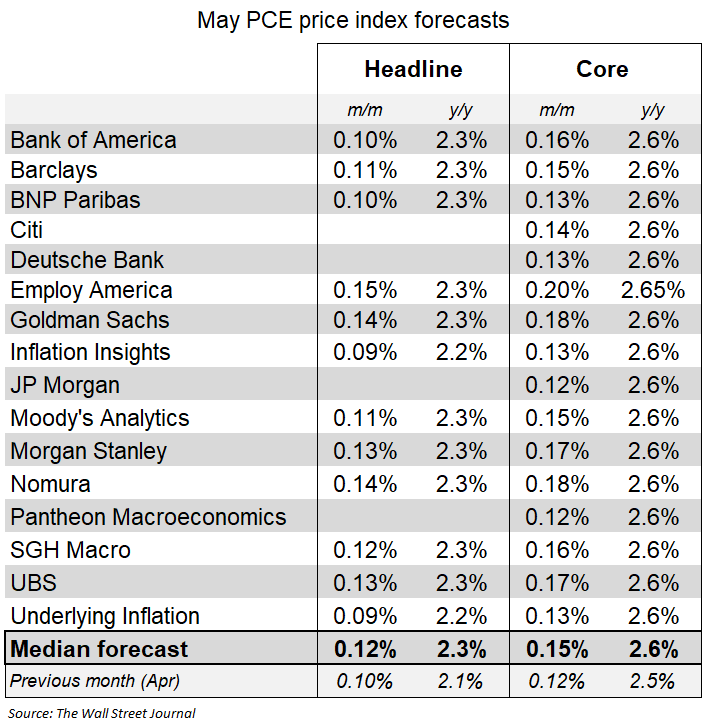

Wall Avenue Expectations of US PCE Inflation

Cut Timiraos, chief economics correspondent at the Wall Avenue Journal, acknowledged,

“Economists who translate the CPI and PPI into the PCE inquire of of a third consecutive chilly monthly core inflation studying in Can also simply.”

Wall Avenue giants, alongside side Goldman Sachs, Bank of The USA, Morgan Stanley, UBS, Barclays, and others, predicted a 2.3% headline US PCE inflation studying. As well they estimated core PCE inflation to magnify to 2.6%.

The monetary products and services companies pointed to US tariffs because the explanation at the abet of the upward thrust in inflation. Throughout the congressional testimony, Fed Chair Jerome Powell also claimed that the reluctance to slash hobby rates became due to US tariffs.

US Fed to Defend Ardour Charge Unchanged

US Federal Reserve Chair Jerome Powell and different FOMC participants warned about an uptick in inflation to some% by the stay of the year. They beget cited tariffs and the recent Israel-Iran battle as causes for rising inflation.

Alternatively, the CME FedWatch tool showed a 71.3% likelihood for the Fed price slash in September. The facts instructed 75 bps in total price cuts by the Federal Reserve this year if inflation data and uncertainty in the markets remained proper in the arriving months.

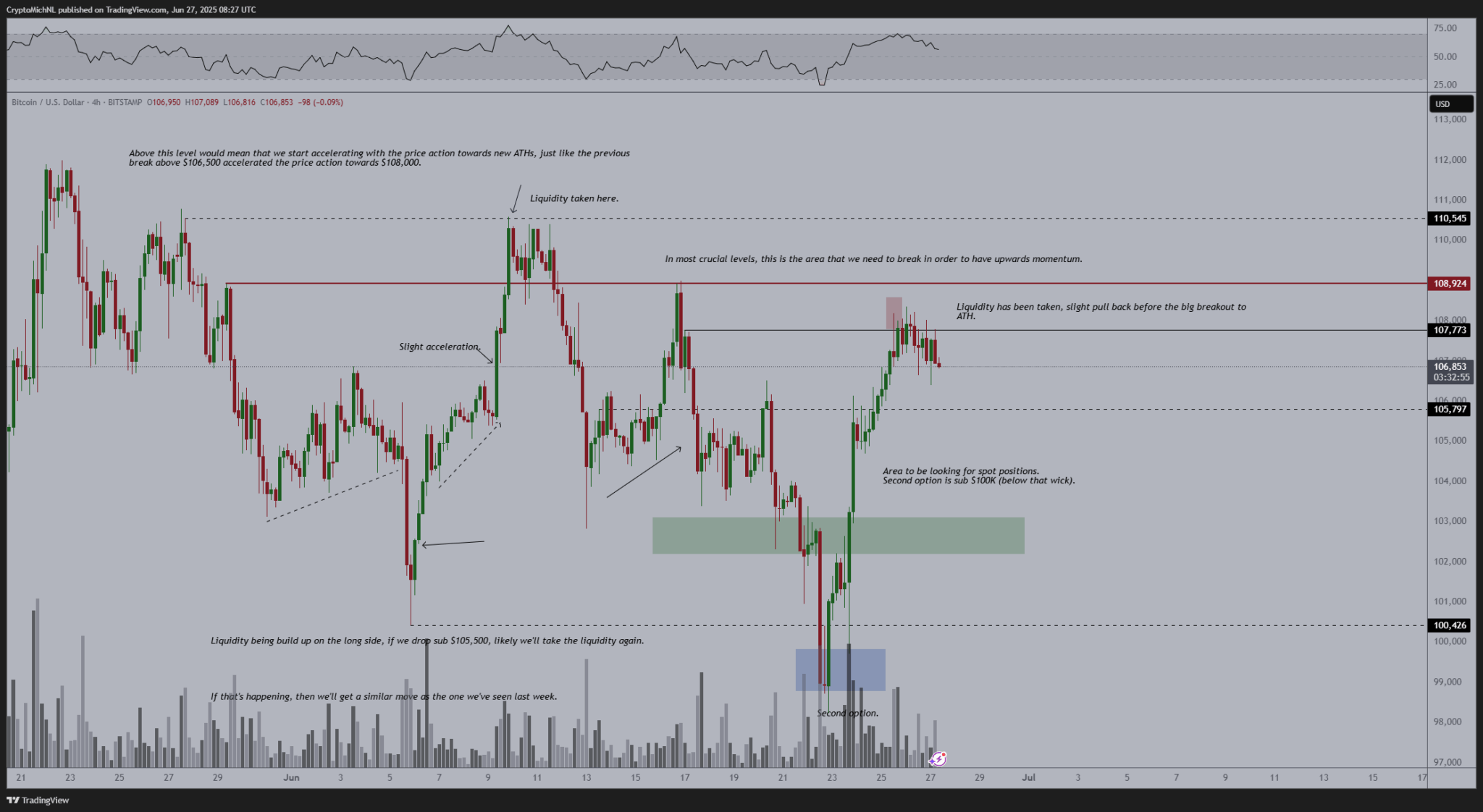

Bitcoin (BTC) Imprint Drops A cramped bit of

BTC worth at the present time slipped below $107K after the US PCE inflation data, with the worth at $106,679 at the time of writing. The 24-hour low and excessive beget been $106,519 and $107,973, respectively.

Furthermore, the shopping and selling volume has decreased by 15% previously 24 hours, indicating hobby among traders in spite of uncertainty.

Amid this, standard analyst Michael van de Poppe identified that BTC worth would possibly perchance look a exiguous consolidation before the next breakout.

On the different hand, analyst Daan Crypto Trades warned that there are some sizable liquidation clusters located across the recent worth. Traders wish to sustain an query on these, as they would perchance perchance act as a momentary liquidity grab.