The Optimism (OP) build displays signs of restoration, which would possibly perhaps maybe evolve into a necessary rally if supported by investor self assurance.

Then again, a intrepid resistance looms forward that would possibly perhaps maybe also stall its development forward of reaching $3.50.

Optimism Is Building Momentum

Following a considerable correction aligned with broader market trends, Optimism’s build rebounds from the $3.00 beef up stage. This downturn diminished market price, as highlighted by the Market Label to Realized Label (MVRV) ratio.

This ratio, which evaluates investor earnings or losses, currently signifies a 30-day MVRV of -20% for Optimism, suggesting contemporary losses that would trigger investor accumulation.

Historical records suggest that OP’s restoration in overall begins throughout the MVRV fluctuate of -9% to -20%, deemed a possibility zone. At some level of such classes, investors are extra inclined to withhold onto their sources, growing a conducive ambiance for a potential rally.

As Optimism aims to retake $3.50 as a beef up stage, the route to restoration is backed by necessary potential earnings.

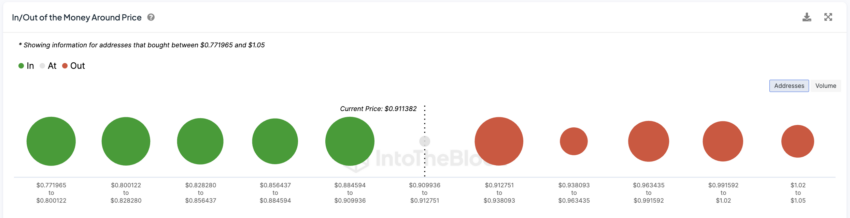

The Global In/Out of the Money (GIOM) indicator displays roughly $360 million worth of OP, spanning between $2.88 and $3.44, is poised to generate earnings because the cost climbs.

OP Label Prediction: Resistance

Optimism’s scramble towards reclaiming $3.50 as beef up is promising, buoyed by the prospect of turning contemporary investments winning. This optimism amongst investors is expected to lower selling stress, aiding the asset’s restoration.

Then again, the route is no longer with out barriers. A dense resistance zone above $3.44, the place about 293 million OP, valued at over $925 million and acquired between $3.44 and $4.65, lies in wait. Overcoming this barrier will necessitate stronger bullish momentum.

Must tranquil Optimism bump into difficulties in breaking thru this resistance, the capability for profit-taking would possibly perhaps maybe trigger a pullback, potentially riding the cost below the $3.22 beef up stage and tough the optimistic outlook.