Digital asset treasuries will rapidly evolve beyond being “static vaults” for notorious cryptocurrencies and as an different look to present tokenized proper-world resources, stablecoins and different resources that generate yield, in accordance with crypto executives.

“The next section of Web3 treasuries is ready turning balance sheets into stuffed with life networks that can stake, restake, lend, or tokenize capital below transparent, auditable prerequisites,” acknowledged Maja Vujinovic, the CEO of Ether (ETH) treasury company FG Nexus.

“The lines between a treasury and a protocol balance sheet are already blurring, and the companies that address treasuries as productive, onchain ecosystems regularly is the ones that outperform.”

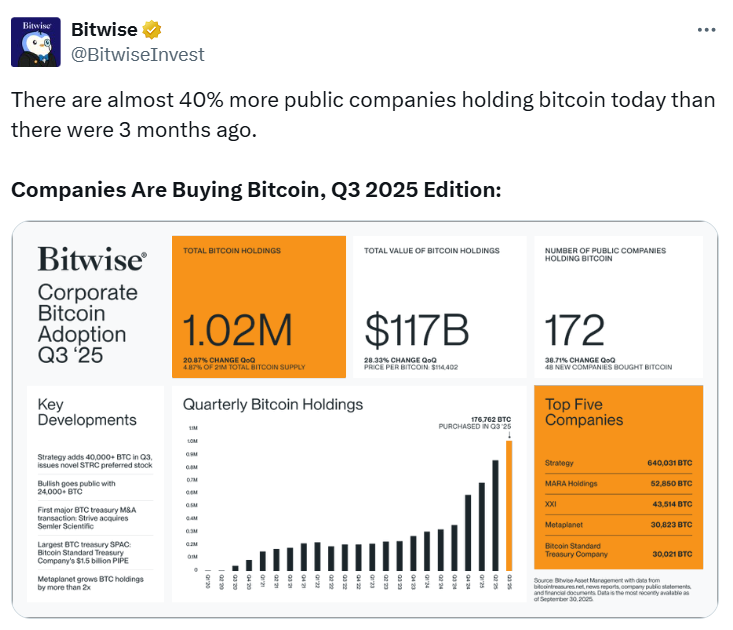

The assortment of crypto treasuries has exploded this three hundred and sixty five days, with an October report from asset supervisor Bitwise monitoring forty eight fresh conditions of Bitcoin (BTC) being added to balance sheets within the third quarter.

Sandro Gonzalez, the co-founder of the Cardano-essentially essentially based undertaking KWARXS, which links proper-world checklist voltaic infrastructure to the blockchain, acknowledged DATs will shift from speculative storage to strategic allocation.

“The next wave of adoption will embody resources that tie blockchain participation to tangible output — corresponding to renewable vitality, present chain resources, or carbon reduction mechanisms,” Gonzalez acknowledged.

“Over time, this can redefine how organizations focus on balance sheets within the Web3 period — no longer appropriate as stores of fee, nevertheless as devices for measurable, sustainable contribution to proper economic job,” he added.

Treasury companies will lengthen past cryptocurrencies

Brian Huang, the CEO of crypto investment platform Glider, acknowledged the decision of what’s also adopted as a treasury asset is handiest diminutive by what’s onchain.

“On-chain shares and tokenized RWAs are the most glaring things to incorporate in a treasury. Gold has skyrocketed this three hundred and sixty five days, and it’s more straightforward to retain tokenized gold than bodily gold,” he acknowledged.

“Additionally, there are illiquid investments, corresponding to NFTs and tokenized proper property. The element to stress here is that the limitation is appropriate what resources are onchain.”

John Hallahan, the director of industry alternatives at digital asset custody platform Fireblocks, predicted there will be more adoption of stablecoins, tokenized money market funds and tokenized US Treasurys.

“The next wave of digital resources being adopted for treasury functions will be money the same devices corresponding to stablecoins and tokenized money market funds,” he acknowledged.

“Longer term, we’re going to recognize many more forms of securities issued onchain, corresponding to treasuries, company debt and bodily resources corresponding to proper property. For the more distinctive resources, corresponding to proper property, they are regularly represented by non-fungible tokens.”

Digital media and entertainment company GameSquare Holdings launched in July that it had bought an NFT of a Cowboy Ape in a $5.15 million “strategic investment,” along with Ether.

Nicolai Søndergaard, a be taught analyst at the onchain analytics platform Nansen, acknowledged decisions around which resources are adopted in some unspecified time in the future is normally dictated by laws and the probability speed for food of companies.

“While I’m in a position to’t speak with easy job, I reach no longer think this is also unexpected that we are going to recognize companies add treasury resources no longer forward of thought about conceivable as treasury resources,” he acknowledged.

Factors affecting what resources will be adopted

Nonetheless, Marcin Kazmierczak, the co-founder of blockchain oracle provider RedStone, acknowledged any tokenized asset can theoretically be held as a treasury reserve asset; what is going to at final be adopted comes down to accounting, laws, and fiduciary accountability.

“A Bitcoin or Ethereum keeping is easy for auditors and boards. An NFT requires an appraisal methodology that most frameworks don’t like standardized solutions for. Extra importantly, treasuries are alleged to retain resources that retain fee and is also liquidated if wished.”

“That’s more straightforward with Bitcoin than with a speculative NFT that will need diminutive patrons. The limit exists at the point where liquidity dries up and the board can’t interpret keeping it to shareholders or regulators,” he added.

Connected: Are struggling companies the utilize of crypto reserves as a PR lifeline?

Prolonged-term, Kazmierczak predicts that beyond the head five cryptocurrencies, adoption will seemingly discontinuance marginal for passe companies for the reason that possibility-adjusted returns aren’t ample to interpret the pass for most boards.

“Shall we recognize tokenized proper resources develop traction if appropriate frameworks clarify, nevertheless pure Web3 resources beyond the significant cryptocurrencies will reside experimental and confined to crypto-native companies or undertaking companies specifically positioned for that possibility,” he acknowledged.

“What may maybe well per chance bustle up is tokenized proper-world resources relish yield-bearing bonds or commodities. Those like inherent fee propositions that don’t rely on market sentiment.”

Journal: How reach the sphere’s foremost religions peep Bitcoin and cryptocurrency?