Ondo Finance (ONDO) is up nearly 7% in the closing 24 hours, trying to reclaim a $3 billion market cap after a sharp 38% correction correct thru the final 30 days. The most up-to-date worth restoration suggests a seemingly pattern shift, but key resistance stages can also quiet be broken for confirmation.

Indicators love the DMI and CMF demonstrate that selling stress is fading whereas purchasing for interest is rising. If ONDO breaks past $0.90, it would possibly presumably also rally toward $1.08 and even $1.20. Nonetheless, failure to again momentum can also lead to one more tumble under $0.70.

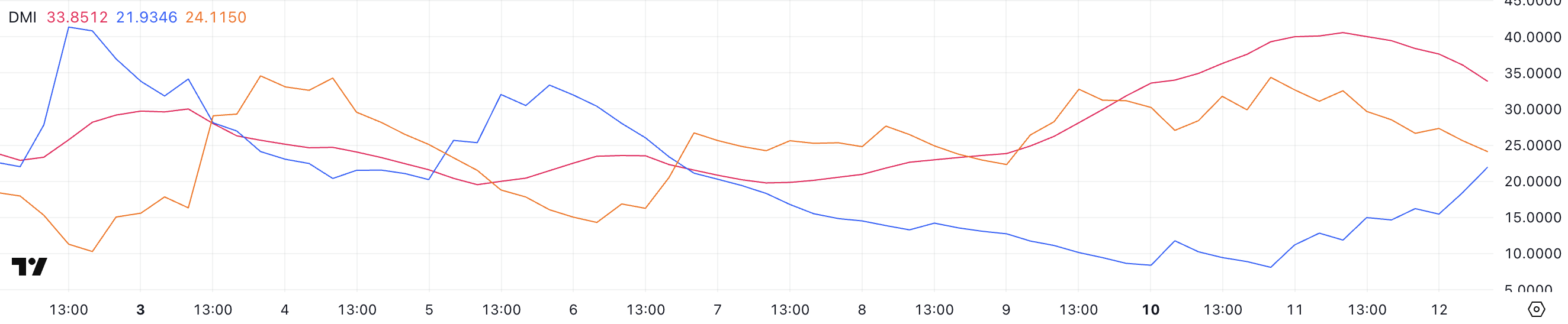

ONDO DMI Shows The Downtred May maybe Revert Soon

ONDO’s ADX is for the time being at 33.8, down from 40.5 the outdated day. Which ability whereas the downtrend stays stable, its intensity is starting to weaken.

The ADX (Moderate Directional Index) measures pattern strength on a scale from 0 to 100, with values above 25 signaling a stable pattern and values under 20 suggesting a aged or non-trending market.

Since Ondo Finance ADX is quiet effectively above 25, the bearish pattern stays dominant, however the decline suggests that momentum can be slowing.

In the intervening time, the +DI has climbed to 21.9 from 11.18, whereas the -DI has dropped from 34.3 to 24.11, exhibiting that selling stress is fading whereas purchasing for stress is rising.

Nonetheless, since -DI stays a miniature bit above +DI, the downtrend is quiet in space. If +DI continues rising and crosses above -DI, it would possibly presumably also verify a shift in momentum, doubtlessly signaling a pattern reversal.

Until then, Ondo Finance stays in a downtrend, but bulls are gaining floor.

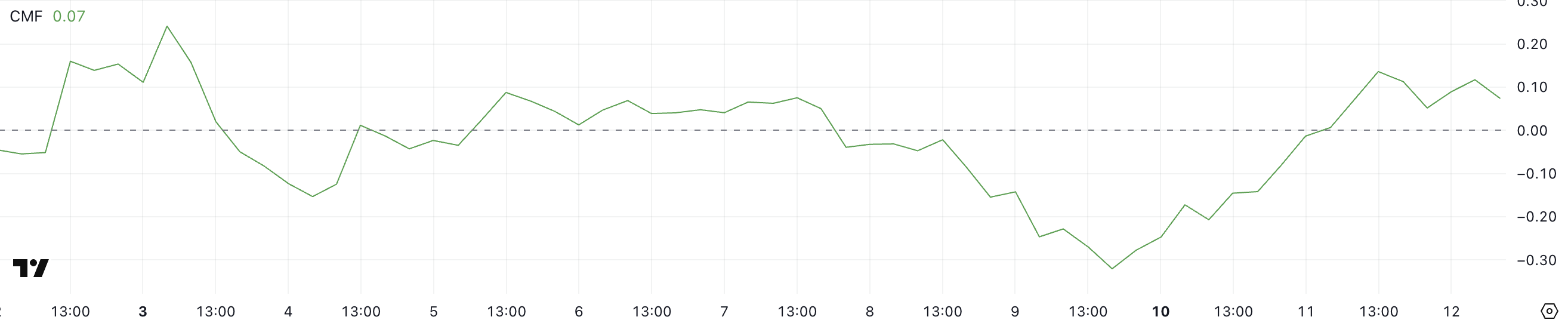

Ondo Finance CMF Surged In The Closing Three Days

ONDO’s Chaikin Money Traipse (CMF) is for the time being at 0.07, recuperating from a harmful low of -0.32 factual three days previously.

The CMF measures purchasing for and selling stress by examining both worth and quantity, with values above 0 indicating accumulation (purchasing for stress) and values under 0 signaling distribution (selling stress).

A CMF above 0.05 suggests rising bullish momentum, whereas prolonged harmful readings typically align with downtrends.

Ondo Finance CMF grew to alter into positive the outdated day after spending two consecutive days in harmful territory, signaling that purchasing for stress is rising.

With CMF now at 0.07, capital inflows are returning, which would possibly presumably enhance extra worth restoration. Nonetheless, for the reason that worth is quiet slightly low, sustained purchasing for quantity is most predominant to verify a stable uptrend.

If CMF continues rising, it would possibly presumably also point out stronger accumulation, doubtlessly leading to a breakout, organising ONDO amongst the cease Actual-World Resources cash available in the market.

Will ONDO Reclaim $1 Soon?

ONDO is for the time being recuperating after dipping under $0.seventy 9 for the critical time in months, following a broader correction across predominant RWA cash in the closing 30 days.

The most up-to-date bounce suggests patrons are stepping in, however the pattern stays unsure, with key resistance stages ahead.

If it breaks above $0.90, it would possibly presumably also continue rising toward $0.Ninety 9, and a extra breakout can also send it to $1.08 and even $1.20.

Nonetheless, if the uptrend fails and selling stress returns, ONDO worth can also tumble to $0.73, with the threat of falling under $0.70 for the critical time since November 2024.