Fabian Dori, the chief funding officer at digital asset bank Sygnum, says that banks offering crypto-backed loans desire crypto collateral in the make of onchain sources moderately than replace-traded funds (ETFs), and the usage of onchain collateral can relieve borrowers.

Dori talked about that onchain sources are more liquid, permitting lenders to quit margin requires crypto-backed loans on ask and provide bigger loan-to-cost (LTV) ratios to borrowers for the reason that lender can liquidate the collateral in true-time. Dori urged Cointelegraph:

“Or no longer it’s genuinely preferable to indulge in the declare tokens as collateral, because then you might doubtless well doubtless doubtless additionally attain it 24/7. If it be crucial to quit a margin name on an ETF on Friday at heart of the evening, when the market is closed, then it be more hard. So, declare token conserving is de facto preferable from that point of stare.”

Mortgage-to-cost ratios in crypto consult with the total amount of a loan versus the collateral backing the loan, be pleased Bitcoin (BTC), Ethereum (ETH), or any other tokens accredited by the lender.

A bigger LTV ratio strategy the borrower is ready to catch admission to more credit ranking in terms of their posted crypto collateral, while a decrease LTV strategy they’ll catch a smaller loan for the same amount of collateral.

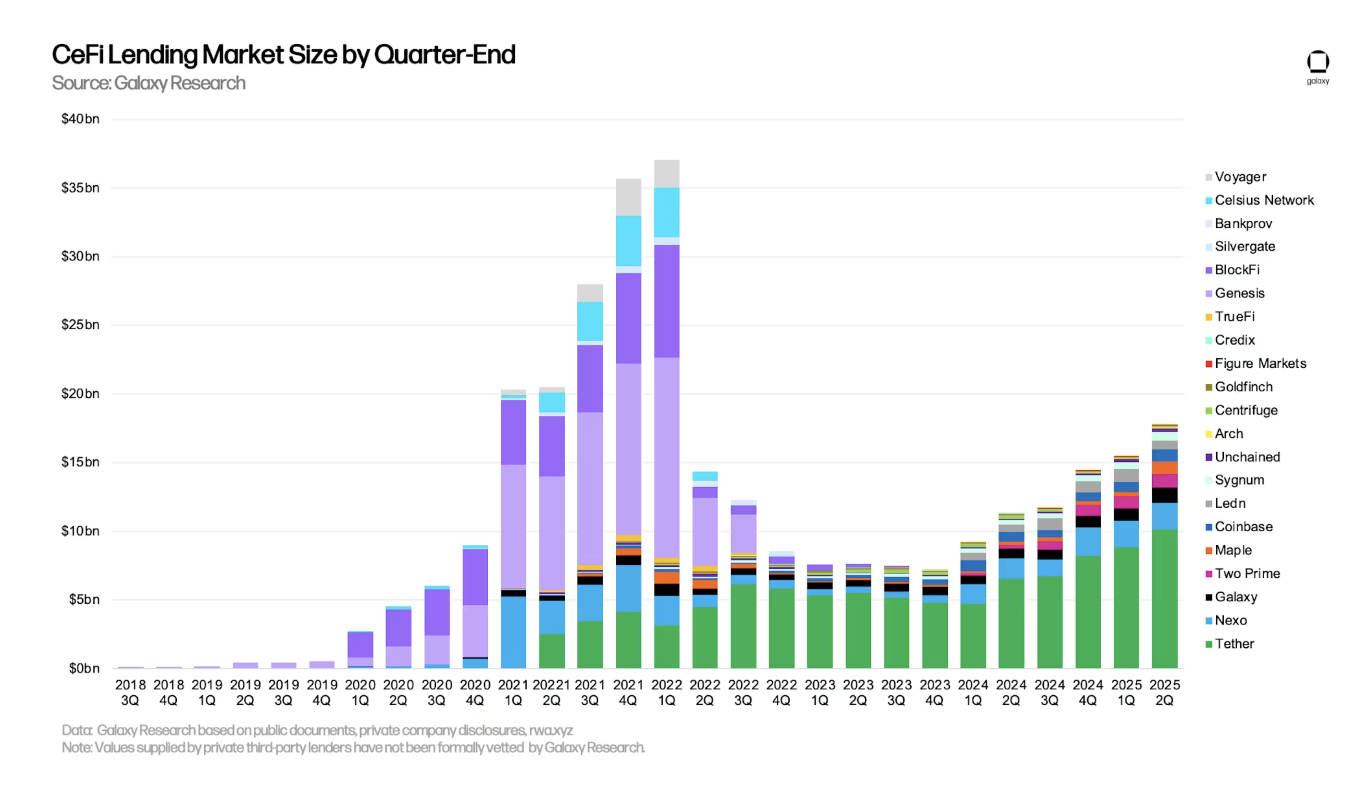

Crypto-backed loans are serene of their infancy, Dori talked about, but he became assured that the field would continue to develop as crypto gains frequent adoption.

Monetary institutions are gradually embracing loans secured by crypto as crypto lenders scoot public on US inventory exchanges, and feeble monetary (TradFi) firms warmth up to the premise of accepting crypto as loan collateral.

Linked: South Korea caps crypto lending rates at 20%, bans leveraged loans

Crypto lending debuts on Wall Side road as TradFi warms up to crypto-backed lending

Figure Expertise, a crypto-backed lending firm, made its debut on the Nasdaq replace, a tech-targeted US inventory replace, on Thursday.

Shares of the firm surged by over 24% at some stage in intraday procuring and selling on the principle day, and the firm currently has a market capitalization of over $6.8 billion, consistent with Yahoo Finance.

Monetary providers and products firm JP Morgan is additionally pondering offering crypto-backed loans to purchasers, a pattern that will happen someday in 2026 if the legacy monetary big moves forward with the premise.

Journal: Home loans the usage of crypto as collateral: Do the hazards outweigh the reward?