By examining the records from the REKT database, a newest look by the firm “Orderly Making a wager Manual” has found that within the previous year, crypto scams within the gaming and metaverse sectors own reached a file amount of 43.7 million dollars.

The alarm is raised for users of cryptographic spaces, who ought to extra and extra face rip-off makes an strive much like phishing, spurious smooth contracts, exploits, and a ways extra.

Alternatively, despite the phenomenon appearing to be on the rise, in 2023 the total sequence of hacks took faraway from the crypto market a decrease worth of sources when when put next with 2022.

This info marks a actually mighty vogue reversal, other than the category of unsuitable-chain bridges that broaden the technical vulnerabilities of some operations that happen on blockchains.

The total crucial aspects beneath.

Summary

Gaming and metaverse: thefts and crypto scams worth 43.7 million dollars in 2023

The firm “Orderly Bettin Manual” in a newest look, performed by examining the records demonstrate on the REKT database, highlighted alarming numbers concerning crypto scams working within the gaming and metaverse sectors.

In 2023, cybercriminals own stolen various decentralized protocols belonging to these market niches for a complete worth of roughly 43.7 million dollars.

The pick itself represents valid 2.5% of the total money lost by users within the crypto world within the previous year attributable to hacks and exploits of a mode of kinds, amounting to 1.64 billion dollars, however it completely highlights the advancement of additional and extra delicate unsuitable practices by malicious actors.

Gaming and metaverse portray the sixth most focused category in 2023, after unsuitable-chain bridges, CeFi platforms, lending protocols on Polygon, Binance’s decentralized community, and DEX on Ethereum.

Especially within the self-discipline of cryptographic games and virtual worlds, traps for much less skilled users are changing into extra and extra artful, most often accompanied by AI abilities, making it advanced to distinguish them from what is undoubtedly legit.

Once in some time scammers are trying to build a relationship with the victim, with the map of constructing a “spurious friendship” and decreasing defensive boundaries. Once the goal is reached, scammers utilize various capability to extract functional records and money from users’ pockets.

Going into specifics, the vulnerabilities reported by REKT on this context differ from theft makes an strive thru phishing, to spurious virtual exchanges contained within the metaverse, NFT scams, up to the utilize of malicious smooth contracts.

Companies like GameStop, Microsoft, and Excellent Aquire are furious by the extra and extra frequent theft of digital sources within gaming platforms attributable to they primarily supply the chance to pay for games in cryptocurrencies and could well well perchance be the following goal of hackers.

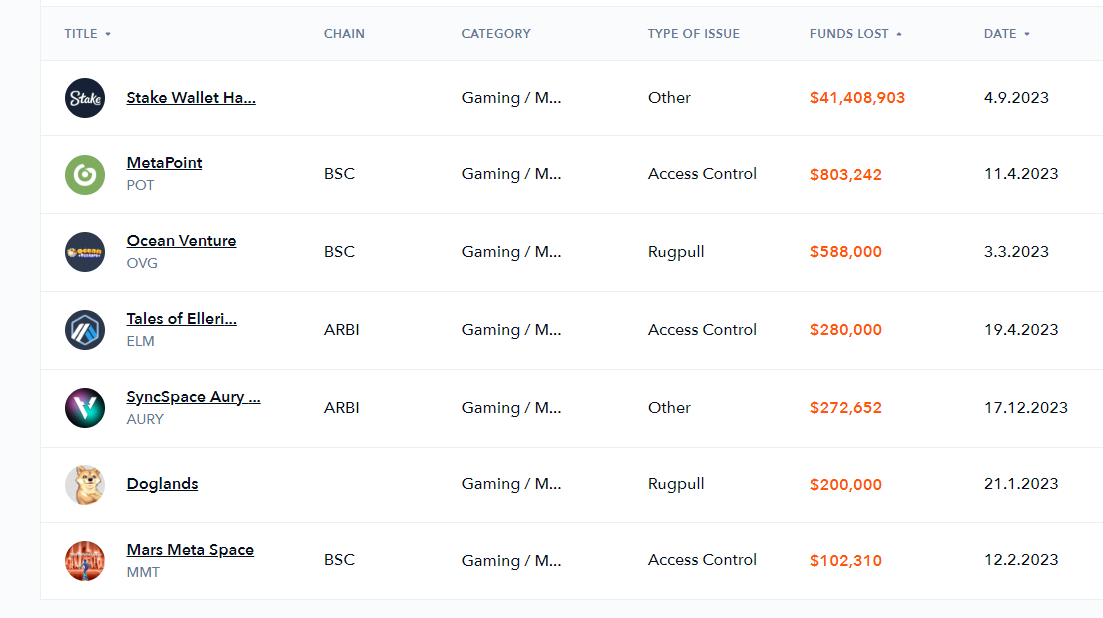

The gaming/metaverse projects most affected in 2023 per REKT records are Stake Wallet, MetaPoint, Ocean Challenge, Tales of Elleria, Syncspace Aury, Doglands, and Mars Meta Put of dwelling.

Pc security consultants imply preserving a discontinuance witness for the duration of this time of year, which historically proves to be undoubtedly one of primarily the most lucrative for hackers within the crypto world.

Total, the chance of being hit by a cryptographic rip-off is larger within the first half of of the year than within the 2nd half of, other than December.

Continuously check the muse and authenticity of the hyperlinks we score on the bag, continuously double talk to the verified channels of the mission in build a query to, utilize reporting instruments for malicious smooth contracts like WalletGuard and on no myth belief someone when money ethics are keen.

These small precautions could well well perchance put your pockets.

Right here’s what igmas Pekarskas, CEO of Orderly Making a wager Manual, reported concerning the proliferation of crypto scams in gaming and metaverse contexts:

“Some platforms, including these within the metaverse and gaming sphere, are extra inclined to cybercrime than others. When making transactions on undoubtedly this form of platforms, construct particular to fabricate your analysis and due diligence. Be wary of costs that appear ‘too correct to be accurate’ or of unverified items within the marketplace, especially even as you happen to are procuring a highly little or sought-after gaming merchandise, as scammers will are trying to reap the advantages of your hobby.”

Hacks and exploits decrease general in 2023 however incidents on bridges carry

Beyond the upsetting numbers within the gaming/metaverse category, in 2023 the vogue of crypto scams and hacks in web3 in similar outdated has slowed down when when put next with 2022 when there used to be a valid bloodbath for cryptographic protocols.

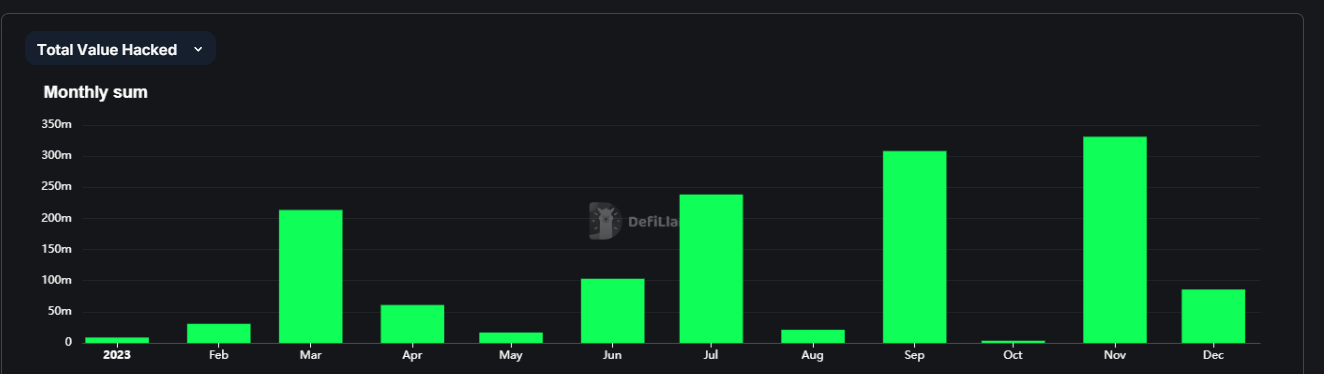

In accordance with records from DeFiLlama, within the previous year full exploits keen sources worth over 1.4 billion dollars, with a tall fragment within the months of March, July, September, and November.

Essentially the most attacked projects had been Euler Finance, Mixing Community, Poloniex, and Atomic Wallet.

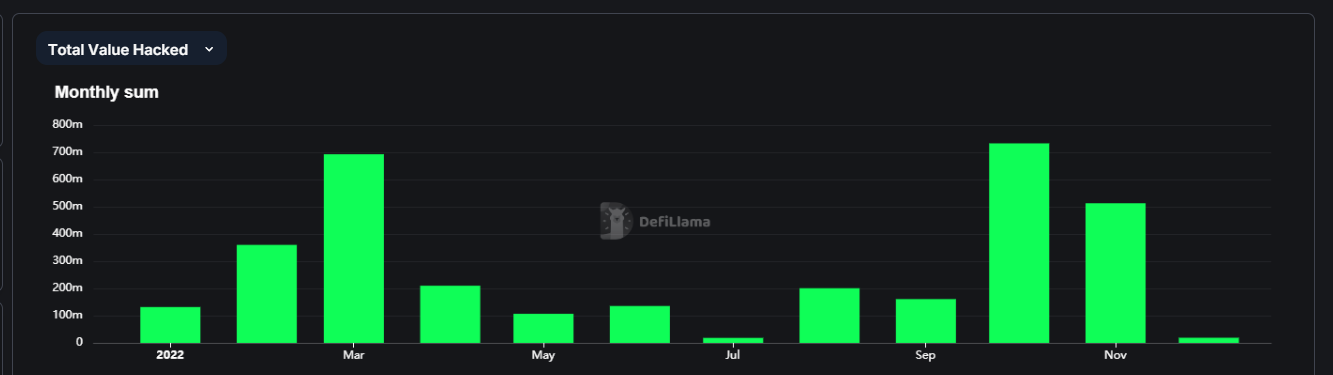

In 2022, the total amount of crypto stolen by hackers reached the staggering pick of 3.2 billion dollars, which is 41.6% of all thefts on blockchain ever recorded.

March, October, and November had been file months for cybercriminals, concentrated on infrastructures such because the Ronin community, Binance Bridge, and the FTX substitute.

Anyway in 2023 there used to be a category that stood out along with gaming platforms and metaverse for the tall amount of scams and thefts.

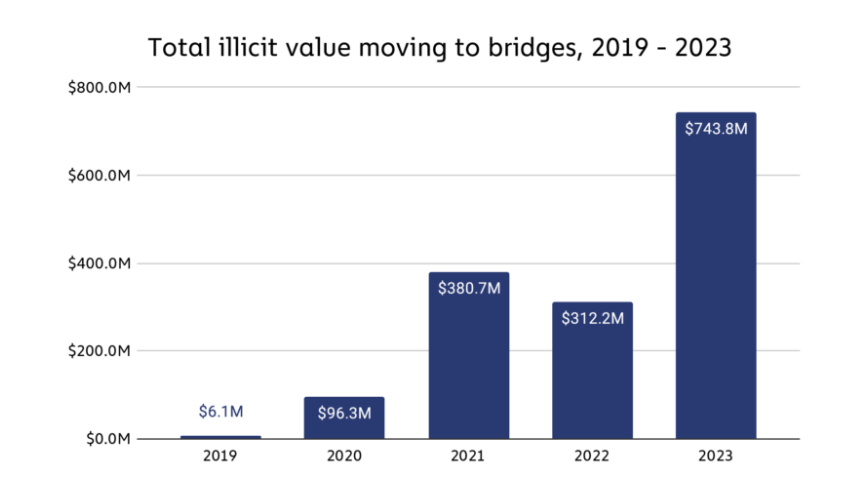

We are talking about unsuitable-chain bridges, completely the fave goal of hackers who exploit the light immature interoperability abilities to originate tall illicit positive aspects.

Since their inception, bridges own lost about 2.83 billion dollars with cases like Ronin, BSC TokenHub, Wormhole, Multichain, Nomad, Horizon, Heco, and Orbit among primarily the most winning hits.

The increasing need for decentralized finance to circulation sources swiftly and economically across loads of blockchains is pushing extra and extra bridges to ogle solutions that are light untested by the neighborhood, with a excessive agonize of technical vulnerabilities within the code.

As highlighted by a newest look by Chainalysis, within the final two years these protocols had been of tall relief to North Korean hackers who own laundered over 1 billion dollars from other illicit transactions performed on the community.

The wish for the field at this 2nd is that the new emerging interoperability solutions like LayerZero and Chainlink CCIP can bridge this gap, making it easy, however at the similar time also real to transfer sources in multichain mode without the agonize of encountering crypto scams.