As Bitcoin (BTC) continues to alternate below its all-time excessive of above $73,000, the maiden cryptocurrency has seen a enhance in the preference of millionaire holders in 2024.

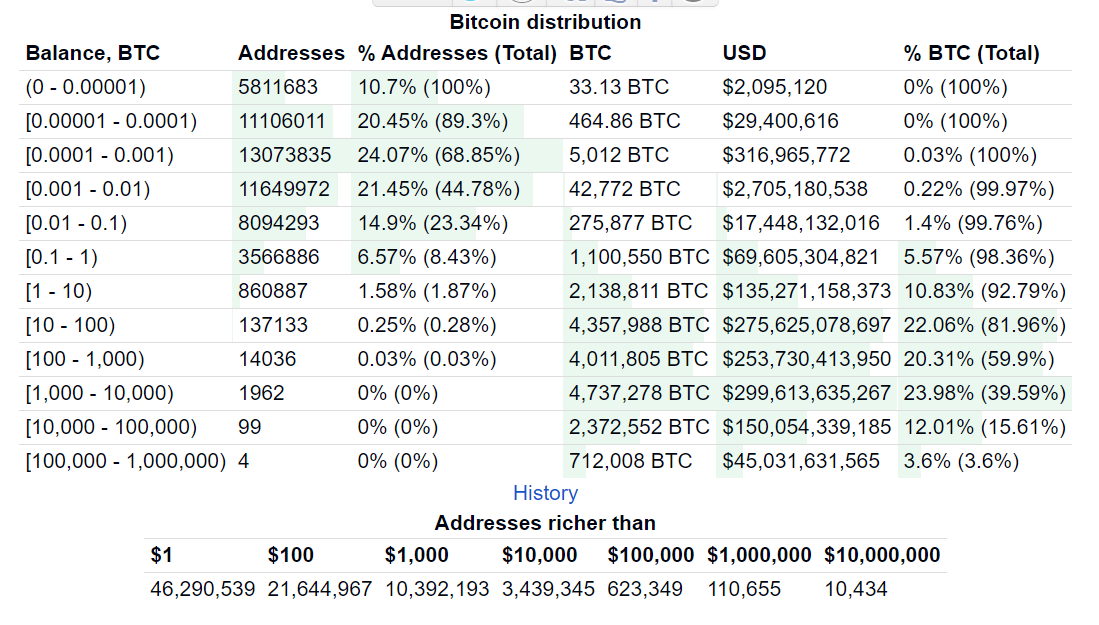

Currently, there are 121,089 Bitcoin addresses retaining now not now not as much as $1 million worth of BTC. Of these, 10,434 addresses comprise holdings exceeding $10 million, facts retrieved from BitInfoCharts on September 23 signifies.

To position this figure into viewpoint, facts retrieved from the platform on January 4, 2023, utilizing the Wayback Machine internet archive instrument, means that the preference of Bitcoin millionaire holders has surged by 25.21% in 2024 as per the tips calculated by Finbold.

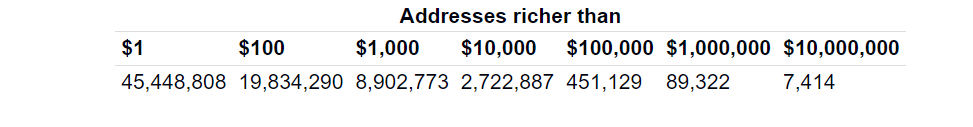

On the beginning of the one year, the total preference of holders stood at 96,736, with addresses retaining now not now not as much as $1 million, accounting for the splendid portion at 89,322. Subsequently, there are now 24,353 original millionaire Bitcoin addresses one year-to-date.

Meanwhile, it’s unprejudiced about very now not at risk of search out out the right kind preference of folk retaining over $1 million in Bitcoin. As a result of the blockchain’s nature, every handle’ balance is publicly on hand, but ownership particulars are undisclosed. In this regard, just a few addresses would possibly per chance per chance unprejudiced belong to the the same particular person.

Particularly, before all the things of the one year, Bitcoin became as soon as trading at $42,280, reflecting a 49% amplify one year-to-date. This implies that holders doubtlessly aloof indulge in the the same quantity of Bitcoin, which has won approximately $20,000 in worth

Implication of rising Bitcoin millionaire holders

This amplify in millionaire investors highlights Bitcoin’s resilience in present months. The cryptocurrency hit an all-time excessive earlier this one year, boosted by the rollout of the plan substitute-traded fund (ETF) in the US.

Though Bitcoin has corrected, the digital asset has mainly traded above the $60,000 trace, a place circulation that some market gamers think indicators the asset’s continued bullish momentum.

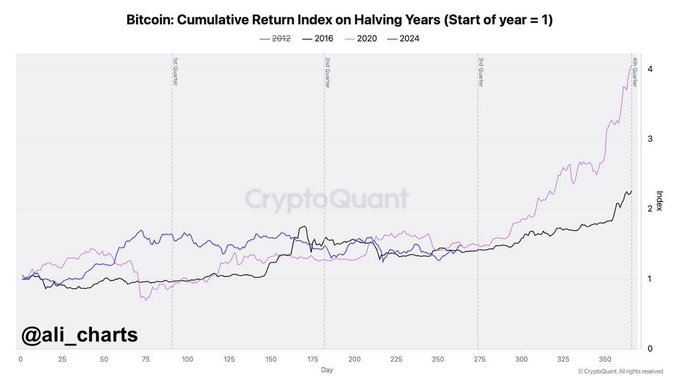

For the time being, investors are searching ahead to a conceivable Bitcoin place rally concentrating on a brand original file excessive above $70,000, a part at risk of pressure the preference of millionaire holders better. To this quit, crypto trading expert Ali Martinez observed in a put up on X on September 23 that Bitcoin has historically skilled critical place surges for the interval of its halving years, and 2024 appears to be following the trend.

The analyst’s outlook indicated that Bitcoin won 61% in Q4 of 2016 and 171% in 2020 for the interval of the the same interval. A comparative prognosis of the Cumulative Return Index for Bitcoin halving years—2012, 2016, 2020, and 2024—presentations that 2024’s place action mirrors the developments of both 2016 and 2020.

If this place action materializes, it would possibly possibly well per chance per chance align with the historical sample where Bitcoin rallies in October.

Certainly, the market is already signaling anticipation of a conceivable rally, with Tether (USDT) witnessing a critical capital inflow, pushing the market to a brand original file. This trend is important since USDT and stablecoins, in basic, are viewed as gateways to cryptocurrencies.

Bitcoin rally critics

Meanwhile, now not all market gamers think Bitcoin has extra upside attainable. Particularly, economist Peter Schiff argues that regardless of Bitcoin’s impressive rally in 2024, the cryptocurrency has no lengthy-term attainable to learn investors, urging holders to capitalize on transient place enhance to exit.

In his look, investors focusing on Bitcoin are missing out, noting that gold, which is trading at a file excessive, is a larger quite a lot of, he talked about in an X put up on September 23.

In summary, with Bitcoin witnessing place swings in 2024, it remains to be seen how the valuation dynamics will affect the preference of excessive-worth holders.