Nubank, Latin The United States’s largest digital financial institution, is reportedly planning to combine dollar-pegged stablecoins and credit playing cards for payments.

The circulation used to be disclosed by the financial institution’s vice-chairman and feeble governor of Brazil’s central financial institution, Roberto Campos Neto. Speaking on the Meridian 2025 tournament on Wednesday, he highlighted the significance of blockchain skills in connecting digital belongings with the used banking system.

Per local media reports, Campos Neto acknowledged Nubank intends to originate attempting out stablecoin payments with its credit playing cards as share of a broader effort to link digital belongings with banking services and products.

“What the data reveals is that folks don’t seem like shopping for to transact, they’re shopping for as a store of designate, he reportedly acknowledged. “And we desire to take dangle of why here is going down. I mediate it be altering somewhat, but we desire to comprehend it.”

He additionally famend that the challenge for banks is finding a reach to accept deposits in tokenized kinds and utilize these belongings to challenge credit for customers.

Basically based in São Paulo in 2013, Nubank is a Brazilian digital financial institution serving extra than 100 million customers across Brazil, Mexico and Colombia. The financial institution first entered the digital asset home in 2022 by allocating 1% of its get dangle of belongings to Bitcoin and rolling out crypto buying and selling for its customers.

In March 2025, Nubank broadened its crypto lineup with the addition of 4 altcoins, giving customers get dangle of entry to to Cardano (ADA), Cosmos (ATOM), Shut to Protocol (NEAR), and Algorand (ALGO).

Linked: Nubank to start loyalty tokens on the Polygon blockchain

Stablecoin adoption surges in Latin The United States

Stablecoin adoption has been surging in Brazil. In February, the president of the Central Financial institution of Brazil instructed attendees at a Financial institution for World Settlements tournament that 90% of crypto activity in the nation used to be linked to stablecoins.

Greenback-pegged digital belongings believe additionally gained traction in Argentina, the put inflation has exceeded 100% nowadays.

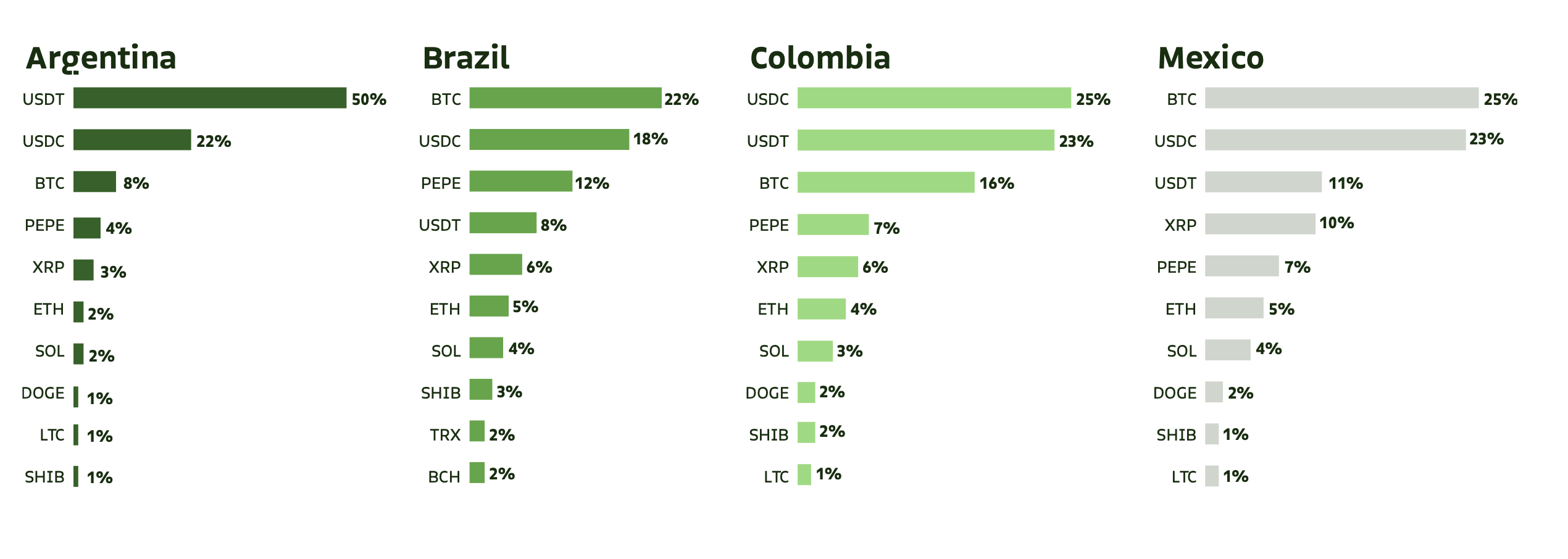

Per a March 2025 swear from Bitso, USDt (USDT) and USDC (USDC) accounted for 50% and 22% of all cryptocurrency purchases in the nation in 2024, respectively. The identical swear found that stablecoins made up 39% of all purchases on its platform across the put in 2024.

Stablecoin adoption has additionally been rising in assorted Latin American countries.

In July 2025, the Central Financial institution of Bolivia signed an settlement with El Salvador to advertise crypto as a “viable and reliable alternative” to fiat. Since lifting its crypto ban in June 2024, Bolivia has allowed banks to direction of Bitcoin and stablecoin transactions.

In Venezuela, the put inflation hit 229% in Might maybe, stablecoins admire USDt believe started to interchange the bolívar in daily commerce, from groceries to salaries. Chainalysis recordsdata reveals they made up 47% of all crypto transactions below $10,000 in 2024.

Magazine: Ethical Panel: Crypto major to overthrow banks, now it’s becoming them in stablecoin battle