The NFT (non-fungible token) auction market has cooled down greatly from its 2021 frenzy, characterized by fewer auctions and more cost effective designate ranges, but specialists are likening the phase to a wholesome consolidation that can bring in more sustainable improve over the years.

In accordance with Artprice’s 2024 As a lot as date Artwork Market document, over the past yr, NFT auction sales fetched finest $9.3 million.

This became as soon as a far shout from the height of speculation in 2021, when digital artist Beeple offered an NFT for an unbelievable $69 million at Christie’s, propelling him into the international spotlight.

As the tournament sent shockwaves thru each the tech and art work worlds, marking NFTs as a innovative new asset class, that yr, the NFT market raised an spectacular $110.5 million thru regulated auctions, with pieces by rising artists admire Fewocious and collections admire CryptoPunks commanding hundreds of hundreds.

2023 noticed the market transferring far flung from dizzying designate tags, with fewer auctions and more moderate designate ranges becoming the new norm.

The document says,

What became as soon as as soon as a chaotic and speculative bubble has now calmed into a more exact market, permitting house for collectors and investors to assess the accurate impact of this digital art work revolution.

Fewer headline-grabbing sales, but NFT collections ogle sustained interest

For the explanation that peak of the NFT pronounce, the market’s main artists bear viewed their costs tumble to more cheap levels.

Fewocious, a teenage sensation in 2021 who offered a chunk for $2.8 million at Sotheby’s, hasn’t had any work offered at auction this yr.

Equally, Larva Labs’ CryptoPunks, as soon as a darling of the NFT house, now not attract the wild bids they as soon as did.

Even Beeple, whose work ignited the NFT explosion, noticed a grand more modest sale of $177,800 in 2023.

No topic this market correction, purchaser interest remains exact, in particular for established NFT collections, the document says.

Yuga Labs, the creator of the Bored Ape Yacht Club (BAYC), has persisted to ogle solid request. At a recent Sotheby’s on-line sale, 100% of Yuga Labs’ NFTs had been offered, with doubtlessly the most important lot fetching $264,000.

This capacity that that whereas the broader NFT market has cooled, there is serene foremost enthusiasm for excessive-quality collections.

Cooling in NFT auctions in line with the broader cooling of the art work market

The autumn in NFT auction values mustn’t be checked out in isolation.

In accordance with Artnet’s mid-yr assessment of 2024, the first half of 2024 noticed a total of $5.05 billion being spent on art work at auctions, a decline of 29.5% since the identical interval closing yr.

Artprice’s document provides that the international marketplace for contemporary art work has also now not produced any primary auction recordsdata closing yr, even supposing the amount of transactions on cheap works increased.

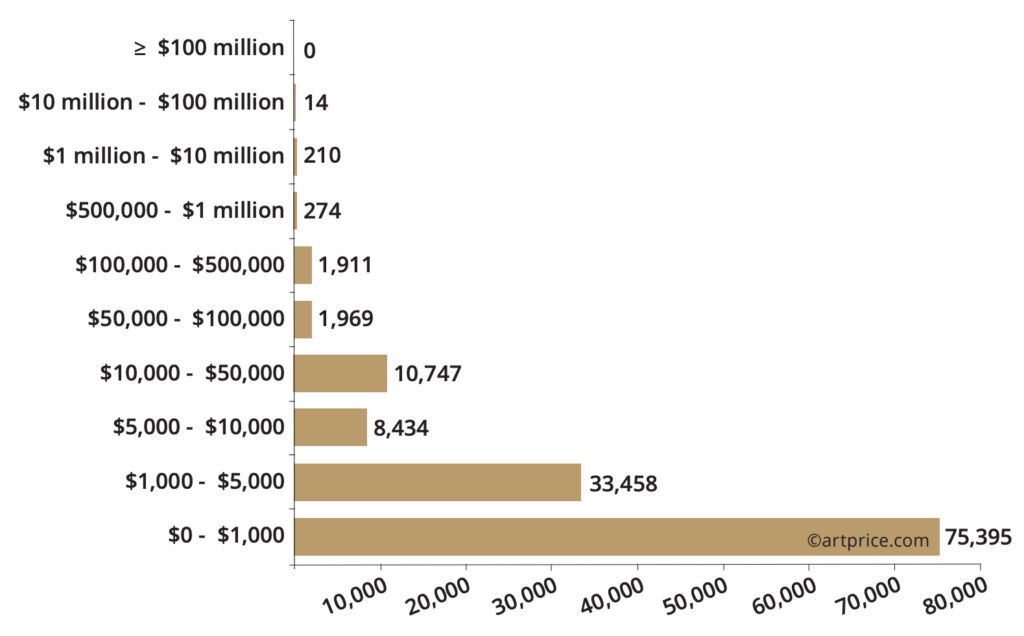

As a lot as date art work auction results by designate fluctuate 2023-24, Provide: Artprice

In accordance with the document, the 2023-24 financial yr noticed a important contraction in contemporary art work auctions with nearly a billion bucks less as compared with the ancient peak two years ago.

Nonetheless, with a total of $1.888 billion, it says the market has returned to pre-pandemic levels whereas surpassing the well-liked of the five years preceding the wisely being crisis by 200 million.

The international context, with its continual geo-political and financial tensions, has slowed down the marketplace for prestige works. Convincing sellers

to construct their most important possessions up for auction is understandably a horrifying job in risky cases. In the period in-between, enormous patrons are clearly in a cautious temper, scrutinizing the prolonged-time interval outlook.

What next for NFT auction marketplace?

Specialists ogle a silver lining in the plod.

Artprice says collectors can now bear works from main digital artists for far less than the sky-excessive costs of 2021.

Wisely-known artists similar to Refik Anadol, who these days exhibited on the Museum of Contemporary Artwork (MoMA), and Dmitri Cherniak, a pioneer in generative art work, bear viewed their NFTs on hand at auctions for between $15,000 and $20,000.

Additionally, for less than $10,000, patrons can receive nearly 200 NFTs by artists admire Moxarra Gonzalez, Matt Deslauriers, and Hideo, all chosen by primary auction properties over the closing yr.

As NFTs enter their 2d decade of existence, but finest their third yr on the regulated auction market, the speculative wave and the FOMO phenomenon bear each subsided and the hype has subsided. We’re basically a golden change to originate a exact and sustainable market, removed from the fun of the fun.

This shift signals that the NFT market is maturing, transferring far flung from a speculative frenzy to a more sustainable model.

The market is now interested by constructing a exact basis rather than chasing viral moments.

While the spectacular designate surges of the past can also impartial now not dominate headlines, the digital art work world is carving out a measured, more resilient future.

With this newfound balance, there’s a golden change for collectors and artists alike to foster a sustainable marketplace for years to return.

The put up NFT auction market cools greatly: is there a silver lining for investors? looked first on Invezz