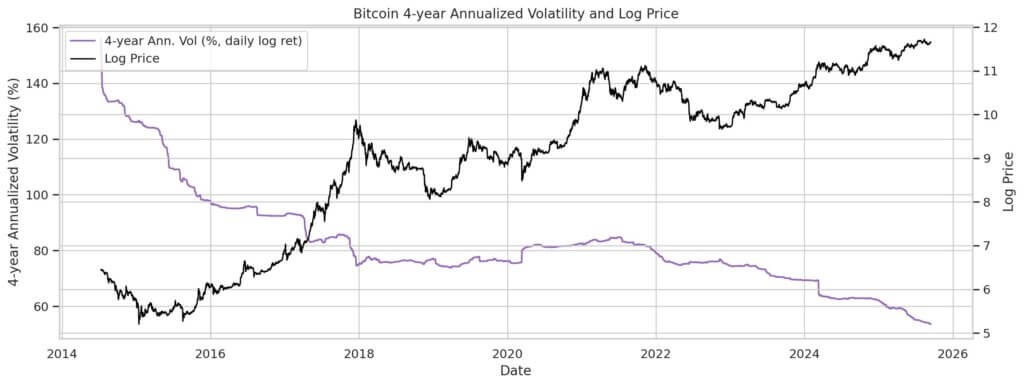

Bitcoin volatility has stayed beneath 50% on 60-day measures since early 2023, extending through 2025.

In step with Kaiko, the drawdown in realized volatility has persevered even as liquidity cases and market participation changed, placing the asset in its longest low-vol regime on document.

Trace appreciation has came about alongside that compression

Bitcoin model delivered a steep prolong in 2023 whereas realized volatility fell roughly 20%, a pattern that extended through 2024 into Q1 2025 as market cap grew.

That combination of higher market cost and decrease measured volatility is drawing closer comparisons to astronomical, liquid risk property, despite the truth that the absolute level of Bitcoin’s swings stays elevated.

The outlet between venerable property continues to slender. Remaining year, iShares set up Bitcoin’s annualized volatility at round 54%, when put next with roughly 15.1% for gold and 10.5% for global equities. In step with iShares, the multi-year downtrend is unbroken, despite the truth that situation markets composed circulation bigger than shares and bullion on a like-for-like basis.

| Asset | Annualized volatility | Offer |

|---|---|---|

| Bitcoin | ~54% | iShares |

| Gold | ~15.1% | iShares |

| Global equities | ~10.5% | iShares |

Shorter-time duration gauges back the image. BitBo’s volatility dashboard shows 30- and 60-day readings tracking at or come cycle lows, whereas historic bull-market peaks veritably topped 150% annualized. The trade shows deeper derivatives liquidity, more systematic trading, and the growth of volatility-selling systems that dampen realized strikes.

Low volatility did now not take away drawdown risk

The September 2025 risk-off episode erased about $162 billion from the total crypto market cost in days, yet Bitcoin’s percentage decline changed into smaller than that of many astronomical altcoins, a pattern that has repeated at some stage in most modern corrections.

Broader review of inferior-market swings finds altcoin and DeFi tokens veritably dash at bigger than triple Bitcoin’s volatility, which can feed back into BTC through liquidity shocks. Dispersion stays a defining feature of the asset class.

Forward-taking a watch metrics focal level attention on two tracks, structural positioning and match risk. Constancy’s work aspects to alternate choices markets that priced a higher volatility time duration structure into slack 2024 and early 2025 round ETF flows and macro catalysts, even as realized prints stayed muted. Per Constancy, that hole between implied and realized can finish all of sudden if flows urge up, namely round astronomical expiries and funding spikes.

At the micro level, miner economics possess acted as a toggle for volatility bursts. The Puell Plenty of, a earnings-to-issuance ratio, has tended to align with miner distribution and accumulation phases.

In step with Amberdata, readings above roughly 1.2 can accompany miner selling, including to procedure back force, whereas sub-0.9 ranges veritably emerge all over quieter accumulation windows. Halving-cycle dynamics and energy cost strikes feed at as soon as into that vary.

Trace-course units that lean on a community results structure where a low-volatility advance could spin. Energy-law frameworks in step with Metcalfe-style scaling, cited by market study, plot intervening time waypoints round $130,000 and $163,000 with a slack-2025 target come $200,000.

These trajectories search the most fresh regime as a transition that would possibly perhaps well precede forceful pattern extensions when liquidity thickens and marginal investors return. Such units are sensitive to inputs, so the be aware will rely on realized community disclose, capital flows, and macro coverage outcomes.

The macro overlay that issues most to volatility stays easy

Dollar strength, global charge paths, and regulatory readability proceed to form participation, with institutional adoption drawing on increasing market infrastructure. In step with Kaiko, derivatives depth and on-trade liquidity possess grown, and that depth helps support realized swings muted unless a shock forces repricing.

From here, two astronomical scenarios body expectations.

If regulatory outcomes, institutional allocation, and regular liquidity persist, annualized prints beneath 50 percent could accompany new highs, a profile closer to mid-cap know-how shares. If macro tightens again or real uncertainty returns, realized volatility could reset toward prior cycle ranges, including 80 percent or higher on absorbing downtrends with pressured deleveraging.

These ranges are per case reviews summarized by Constancy and match-driven drawdowns.

For now, the guidelines shows a maturing volatility profile. Realized measures sit down come cycle lows whereas alternate choices returns possess room to improve if catalysts come.

Market participants are staring at miner profitability bands, ETF-driven flows and the coverage calendar for the next fracture in the regime.