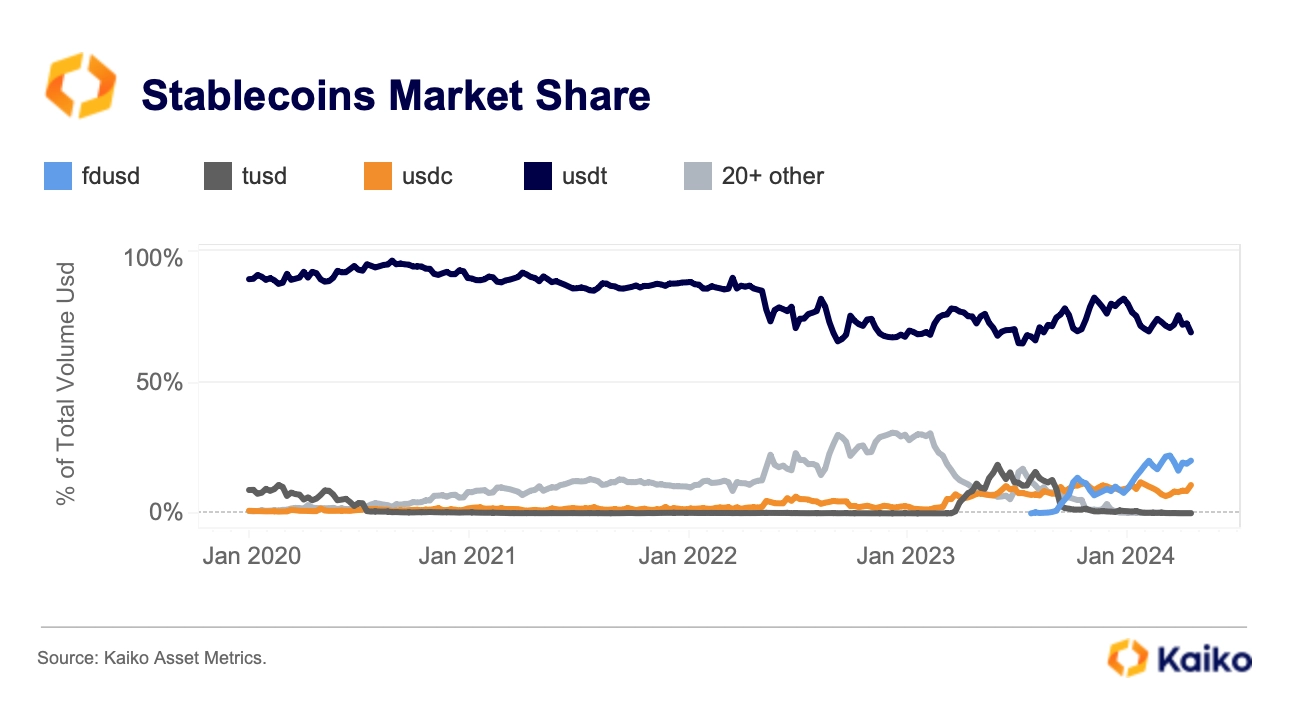

Market intelligence platform Kaiko Analytics reviews that novel competitors are chipping away at Tether’s (USDT) stablecoin dominance.

In a novel document titled “Tether Loses Market Share,” Kaiko Analytics says that the stablecoin issuer’s market fragment over centralized commerce platforms (CEXs) has dipped 13% twelve months-to-date (YTD) due to the expansion of rival buck-pegged digital resources, such as FDUSD and USDC.

“Regardless of its dominant market situation, USDT’s market fragment on CEXs has been trending downwards, declining from 82% to 69% YTD. This lower will be partly attributed to rising competition from stablecoins love FDUSD which earnings from Binance’s zero-fee promotions.

USDC has additionally experienced a upward push in its market fragment, signaling a rising favor for regulated choices. For the time being, stablecoins issued within the US contain up 10% of the total stablecoin commerce quantity.

Handiest one among the tip 5 stablecoins by market cap, Circle’s USDC, is regulated below assert US money transmitter frameworks. Nonetheless, its fragment has increased from no longer as a lot as 1% in 2020 to 11% on the present time.”

“One other motive within the back of Tether’s declining market fragment will be linked to the emergence of modern yield-bearing choices such as Ethena’s USDe. Since its birth in February, USDe’s quantity has grown considerably, despite the truth that it has retreated from April’s all-time high of larger than $800 million following Ethena’s ENA airdrop.”

In step with Tether’s 2024 Attestation Document, the agency posted a memoir-breaking $4.52 billion in earnings all the plot via the first quarter of the twelve months.