Welcome to the US Crypto Records Morning Briefing—your valuable rundown of the finest trends in crypto for the day ahead.

Take dangle of a espresso as markets brace for one other pivotal moment. From Washington’s shutdown to deep-pocketed crypto whales pushing leverage, forces are converging that also can propel Bitcoin (BTC) into uncharted territory. Analysts win themselves split on whether this strength is strong or fragile.

Crypto Records of the Day: Geoff Kendrick Sees Bitcoin Willing for $135,000 as Shutdown Looms

Bitcoin can also be making ready to a fresh all-time excessive, in step with Typical Chartered’s Head of Digital Resources Research, Geoff Kendrick.

In a normal email to BeInCrypto, Kendrick talked about he expects Bitcoin to “print a fresh all-time-excessive subsequent week” and push toward his long-held Q3 intention of $135,000, reported in a most up-to-date US Crypto Records newsletter.

The catalyst, he argues, lies within the dynamics of the US authorities shutdown.

“The shutdown issues this time round. At some level of the previous Trump shutdown (December 22, 2018, to January 25, 2019), Bitcoin was in a assorted space than it’s miles now, so it did cramped. Alternatively, this 12 months, Bitcoin traded with US authorities dangers, as simplest shown by its relationship to US treasury term top rate,” Kendrick outlined.

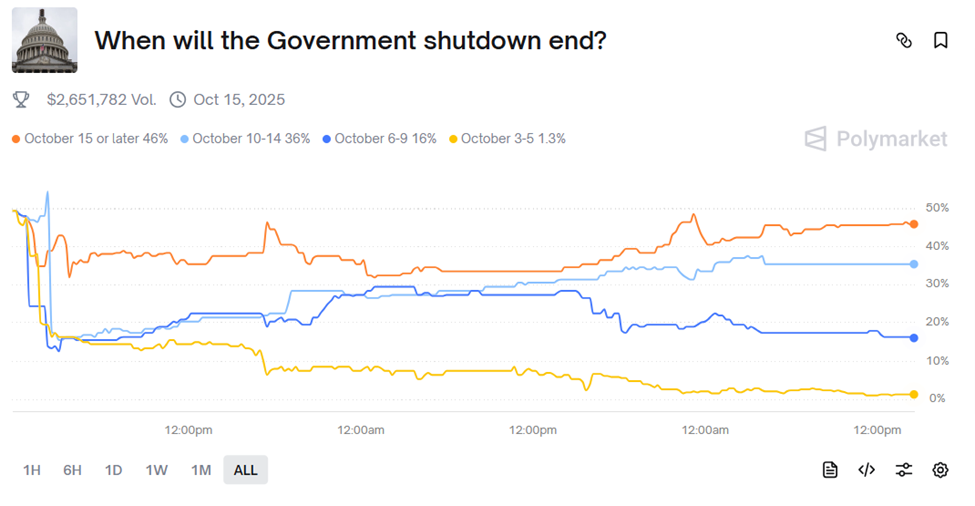

On Polymarket, traders are pricing a 60% likelihood that the shutdown lasts between 10 and 29 days, suggesting no like a flash resolution.

For Kendrick, this creates a long setting in which Bitcoin can outperform as a hedge against fiscal gridlock and US credit ranking stress.

The assorted key driver lies in ETF flows. Gold has been outperforming Bitcoin ETFs in most up-to-date weeks, nonetheless Kendrick expects that construction to reverse.

“Safe Bitcoin ETF inflows are now at USD58bn, of which USD23bn has been in 2025. I’d search recordsdata from on the least one other $20 billion by 12 months-quit, a quantity which would win my $200,000 12 months-quit forecast imaginable,” he talked about.

With Uptober underway and liquidity dynamics handing over Bitcoin’s desire, Kendrick believes the market is determined to reward holders with a brand unusual height within the arriving days.

Perp Whales Power Aggressive Longs, Raising Both Hopes and Risks

While macro tailwinds dominate headlines, on-chain and derivatives recordsdata list rising momentum for Bitcoin’s subsequent breakout. Analysts at CryptoQuant and diverse firms spotlight a surge in perpetual futures assignment led by perp whales.

“Bitcoin perp whales went long closely on OKX, Bybit, HTX. The taker buy ratio on OKX is the splendid since January 2023,” wrote Ki Younger Ju, founder and CEO of CryptoQuant.

Per Ki, the most up-to-date setup marks the fourth try to interrupt Bitcoin’s ATH, most efficient this time, perp whales are on the frontline.

4th try to interrupt Bitcoin ATH, nonetheless this time with perp whales.

— Ki Younger Ju (@ki_young_ju) October 3, 2025

Supporting this, analyst Maartunn seen that for the reason that monthly delivery, taker buy volume has exceeded sell volume by roughly $1.8 billion.

“Futures investors are stepping up…certain signal of aggressive long positioning,” Maartunn talked about.

This assignment has fueled speculation that a leveraged rally can also be within the works. In a most up-to-date prognosis, Maartunn outlined that rallies powered basically by borrowed capital other than long-term field accumulation are inherently fragile.

“It must also test spectacular for a transient time, nonetheless it’s incredibly unstable and accurate ready for a cause to fall over,” he warned.

The threat is that heavy long positioning can also trigger cascading liquidations if momentum falters, suppressing field demand even as costs upward push.

This makes most up-to-date valuations more speculative than sustainable. Collected, with whale positioning aligned with macro catalysts like the authorities shutdown and ETF flows, the prerequisites seem ripe for Bitcoin to at closing certain its all-time excessive barrier.

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to take a look at nowadays:

- ETF inflows return: Bitcoin and Ethereum account $900 million in inflows in a single day.

- Original Bitcoin demand emerges as mark claims $120,000; up subsequent – unusual ATH.

- Privacy money quietly outperform Bitcoin and Ethereum with 71.6% beneficial properties in 2025.

- Bitcoin alternatives traders expose cautious optimism after $120,000 breakout.

- Solana holders are unconvinced of a 20% mark upward push; Main selling begins.

- Why Ripple’s RLUSD increase highlights Ethereum, no longer XRPL, as the precise winner.

- Analyst says Hyperliquid restful ‘most investible,’ no matter losing portion to Aster.

- Circle reports $2.4 trillion stablecoin assignment in Asia-Pacific.

Crypto Equities Pre-Market Overview

| Company | On the Shut of October 2 | Pre-Market Overview |

| Strategy (MSTR) | $353.33 | $352.00 (-0.026%) |

| Coinbase (COIN) | $372.07 | $373.50 (+0.38%) |

| Galaxy Digital Holdings (GLXY) | $36.52 | $36.89 (+1.01%) |

| MARA Holdings (MARA) | $18.79 | $18.98 (+1.01%) |

| Insurrection Platforms (RIOT) | $19.25 | $19.36 (+0.57%) |

| Core Scientific (CORZ) | $18.10 | $18.13 (+0.17%) |

The submit A New Bitcoin All-Time Excessive May well per chance additionally Come As Early As Next Week | US Crypto Records seemed first on BeInCrypto.