Bitcoin (BTC) as soon as extra has its sights popularity on the $70,000 label after a instant correction that momentarily threatened to push the leading cryptocurrency decrease.

No topic trading beneath $70,000, prevailing market sentiment strongly means that the total sector stays in a bull stride, with the quit crypto poised for yet any other in all probability account high, specifically in gentle of the upcoming halving tournament.

As a consequence, crypto trading skilled TradingShot has instructed that Bitcoin, buoyed by the forthcoming halving, is primed for an unheard of surge, presumably signaling the onset of its most aggressive bull cycle to this point.

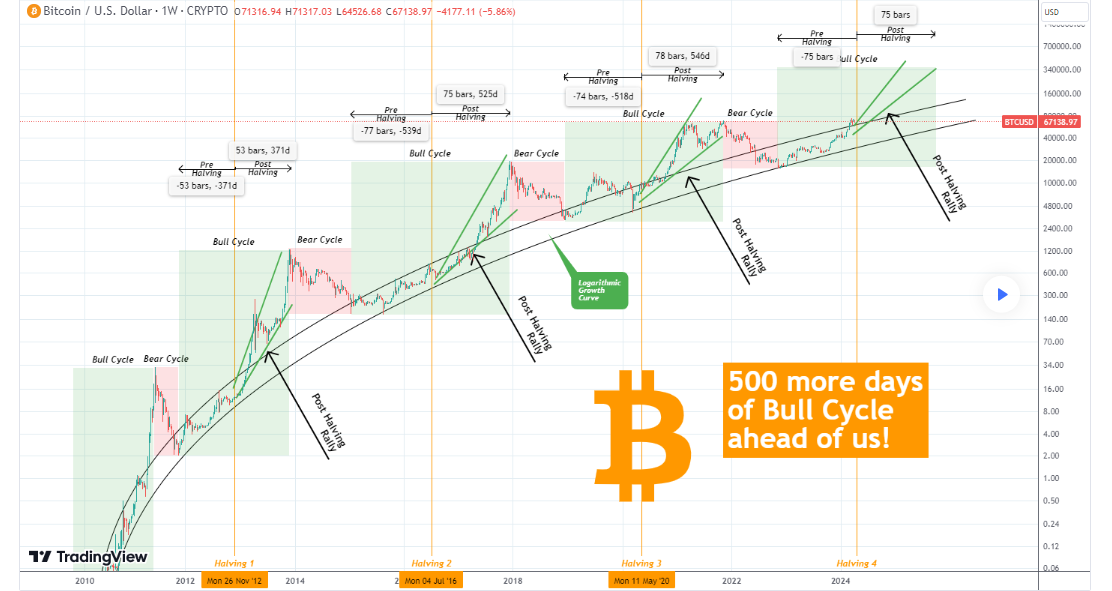

In a TradingView post on April 5, the market analyst essentially based fully the diagnosis on the juxtaposition of endure and bull cycles in opposition to Bitcoin’s logarithmic bellow curve (LGC), revealing a notable shift in momentum as the cryptocurrency lately broke free from the LGC.

Particularly, merchants invent potentially the most of the logarithmic bellow curve to discern long-length of time traits and price targets for Bitcoin. It offers insights into the magnitude and tempo of Bitcoin’s sign appreciation, assisting investors in making told investment choices.

This departure from the norm animated sooner than the halving tournament is perceived as a bullish signal, specifically when brooding about Bitcoin’s historical purchasing zone.

Accuracy of the golden ratio

A pivotal element of the diagnosis revolves across the halving’s golden ratio, a metric that has proven correct in previous cycles. As per the skilled, this ratio means that the length from the bottom of the previous endure cycle to the halving tournament is proportionally a lot like the length from the halving to the peak of the ensuing bull cycle.

In accordance with TradingShot, the golden ratio’s implications are profound, hinting that Bitcoin could perhaps per chance also very effectively be on the cusp of an prolonged bull cycle spanning a minimal of 500 days.

“It has [golden ratio] held beautifully on the 3 old Cycles and there could be never any reason no longer to expect it to unfold this time furthermore. This potential that that we now possess got a minimal of yet any other 500 days of Bull Cycle sooner than us and the finest fragment is that those will be within the fabricate of potentially the most aggressive fragment of the Cycle, the Put up-Halving Parabolic Rally (inexperienced Megaphone),” the analyst critical.

Particularly, the upcoming halving stays a pivotal tournament, specifically brooding about Bitcoin’s old efficiency leading up to such occurrences. Historically, Bitcoin has performed account highs after halving events, making this one worth monitoring.

No topic a instant correction, Bitcoin has considered minor positive components lately, fueled by a lot of in all probability bullish catalysts. One such catalyst is the solutions that BlackRock (NYSE: BLK), the sphere’s ideal asset manager, has incorporated main U.S. banks as participants in its impart Bitcoin exchange-traded fund (ETF). The filing shared on-line listed notable names like Goldman Sachs (NYSE: GS), Castle, UBS, and Citigroup (NYSE: C).

At the identical time, Bitcoin and the broader crypto market skilled positive components following indications from the Federal Reserve suggesting the likelihood of hobby rate cuts sooner than the discontinuance of 2024.

Bitcoin sign diagnosis

At the time of writing, Bitcoin was as soon as trading at $68,195, posting day-to-day positive components of approximately 0.5%.

Meanwhile, investor point of interest on Bitcoin stays mounted on important enhance ranges, critically $65,000, as they’re going to play a an valuable feature in shaping the asset’s subsequent trajectory.