Pi Network (PI) has skyrocketed bigger than 70% in the final 24 hours, propelling its market capitalization to $16 billion and its quantity to bigger than $2.3 billion in the final 24 hours.

Despite reaching novel all-time highs shut to $3, this technical divergence suggests a unstable direction forward for PI. Merchants are staring at carefully as the token navigates between bullish momentum that might well perhaps power it toward $4 and warning indicators that might well perhaps predicament off a pullback to enhance phases as low as $1.7 and even $0.79.

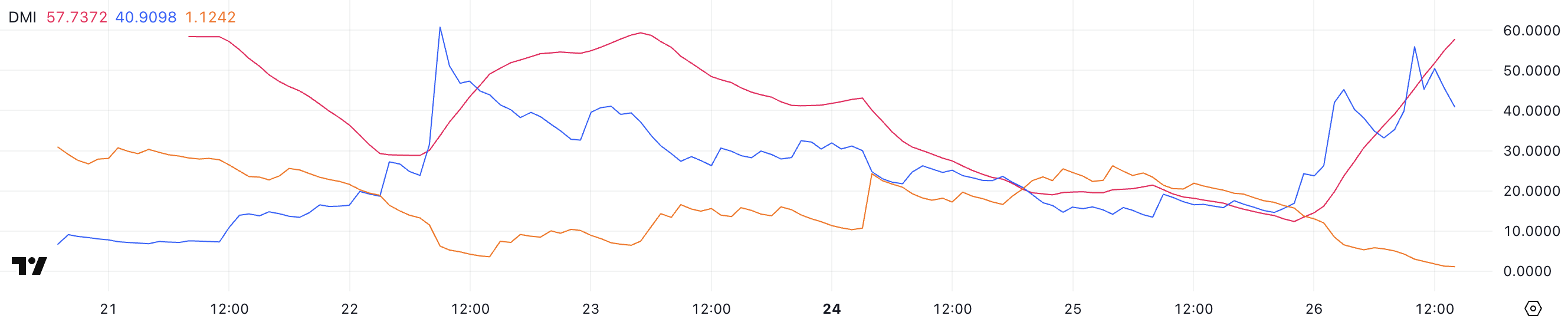

Pi Network DMI Shows the Uptrend Is Very Sturdy

The Pi Network’s Directional Movement Index (DMI) is exhibiting outstanding momentum, with its Average Directional Index (ADX) surging to 57.7 from perfect 12.3 a day previously.

The ADX is a key technical indicator that measures the energy of a pattern no matter its direction. Readings below 20 assuredly enlighten a historic pattern, 20-40 point out a moderate pattern, and values above 40 signal an outstanding pattern.

This dramatic broaden in Pi’s ADX from historic to very sturdy territory indicates a valuable intensification in the underlying pattern’s energy.

Complementing this ADX surge, Pi’s Positive Directional Indicator (+DI) climbed sharply to 40.9 from 14.6 two days previously, whereas its Detrimental Directional Indicator (-DI) plummeted to 1.1 from 19.4 in the identical interval.

When +DI is enormously higher than -DI, as is for the time being the case with Pi, it confirms an outstanding bullish pattern. The combination of a excessive ADX tag with a huge spread between +DI and -DI suggests Pi Network is experiencing an especially highly effective uptrend with minimal promoting stress.

If these technical indicators preserve their fresh configuration, they might well enlighten persevered upward tag motion for Pi in the shut to term, as the market appears to be below sturdy buying retain an eye on with minimal resistance.

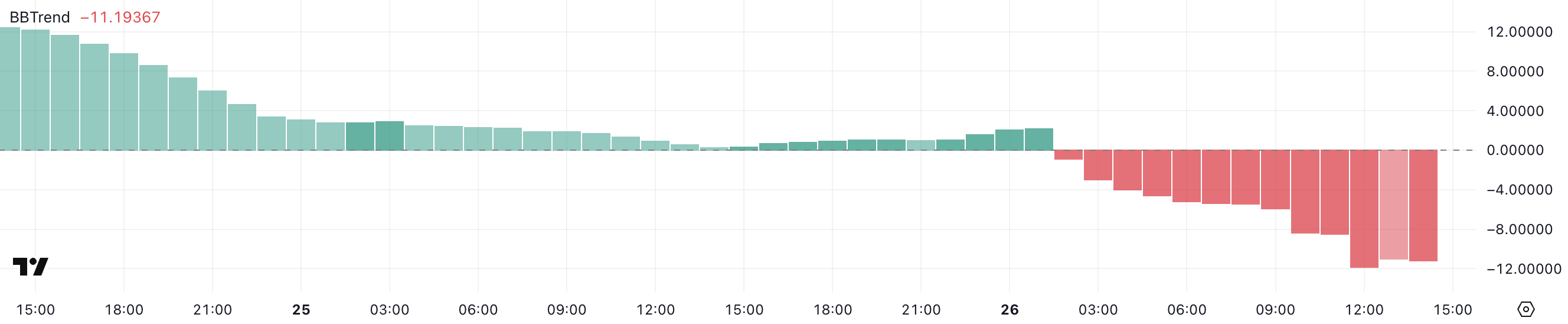

PI BBTrend Is Detrimental Despite the Impress Surge

Despite the ongoing tag surge, Pi’s Bollinger Bands Pattern indicator (BBTrend) has plummeted to -11, marking a dramatic decline from its studying of 51.2 perfect three days previously, after hovering between 1 and 3 the day earlier than at the moment time.

The BBTrend indicator is a if reality be told knowledgeable technical instrument that measures tag motion relative to Bollinger Bands. It truly quantifies how tag is trending internal these volatility-essentially essentially based mostly channels.

Positive readings enlighten upward tag motion relative to the bands, whereas antagonistic values point out downward motion or reversion toward the center band.

This difficult decline to -11 in Pi’s BBTrend might well signal that the novel uptrend is changing into enormously overextended and doubtlessly weak to a correction or consolidation portion.

When BBTrend turns particularly antagonistic after a tag surge, it customarily indicates that the asset has moved too some distance too instant and is now trading at phases that might well be unsustainable in the instant term.

This technical warning signal means that Pi might well perhaps trip a pullback toward its center Bollinger Band, a interval of sideways consolidation, or at minimal, a deceleration in its upward momentum.

Can Pi Network Attain $4 In March?

Pi Network tag reached novel all-time highs perfect hours previously as its tag approached the $3 heed for the first time.

With this sturdy upward momentum, Pi might well doubtlessly proceed its ascent, breaking by the $3 psychological barrier and sorting out higher resistance phases at $3.5 and even $4 in the shut to term.

This impressive rally demonstrates increasing market passion and buying stress that might well perhaps support extra upside if the optimistic sentiment persists.

However, as indicated by the antagonistic BBTrend studying, this rally might well be overextended and in risk of reversal. Would perchance fair clean the downward technical signal materialize into tag motion, Pi might well trip a if reality be told huge correction, first and indispensable falling to take a look at enhance at $1.7.

If this stage fails to preserve, extra declines to $1.42 change into seemingly as promoting stress intensifies.

In a scenario the set up an outstanding downtrend takes preserve, Pi’s tag might well perhaps trip an some distance more dramatic pullback to $0.79, which can well perhaps signify its lowest stage in 5 days and a valuable retracement from fresh highs.