NEO displayed bullish presence over the previous two weeks, when BTC sustained, and the crypto-verse grew to change into green. It continued its upward trajectory from a pre-marked, historically proven solid ask zone of $9.0. It is up 37% from the ask zone.

Meanwhile, this advise has placed NEO within the head 100 global crypto-checklist at Eighty fifth discipline by manner of market cap. Its market cap reached $821.95 Million by July fifth, 2024, from $605.74 Million.

As per Messari web shriek online, the market dominance of NEO stands at 0.03. Likewise, the 24-hour quantity has also grown by 56.99%, where the total quantity on all tradeable platforms amounted to $47.515 Million.

Additionally, the liquidity in NEO is broken-down; as of writing, the 24-hour quantity-to-market cap ratio stands at 5.63%.

Thus, with a low ratio, property appear much less liquid and in all likelihood recount much less precise markets. So, traders and traders must proceed with warning (DYOR).

Furthermore, per the coin cap web shriek online, the head 10 holders’ addresses preserve a total lot of the provision in circulation, 70.fifty three Million. At the same time, the capped total offer stands at 100 Million NEO.

As per the correctly off checklist, the total NEO holders are 135.35K, and the head 10 holders’ addresses preserve 88.77% of the circulation.

What Became the Most reasonable likely and Lowest NEO Ever Reached?

Per Tradingview, NEO used to be 2250% greater than its all-time low mark. The low used to be at $0.0739, registered on February 1st, 2017.

Likewise, the all-time excessive used to be registered on January 1st, 2018, when the mark peaked at $194.91. Comparatively, from the A-T-H level, the mark as of writing is sort of 94% down.

Digging Deeper On-Chain Diagnosis of NEO

The social quantity of NEO displayed a favorable trajectory, however there used to be also an uptick in vigorous customers on the social platforms. This reflected how unparalleled it is talked about, valued, and sought after by the communities.

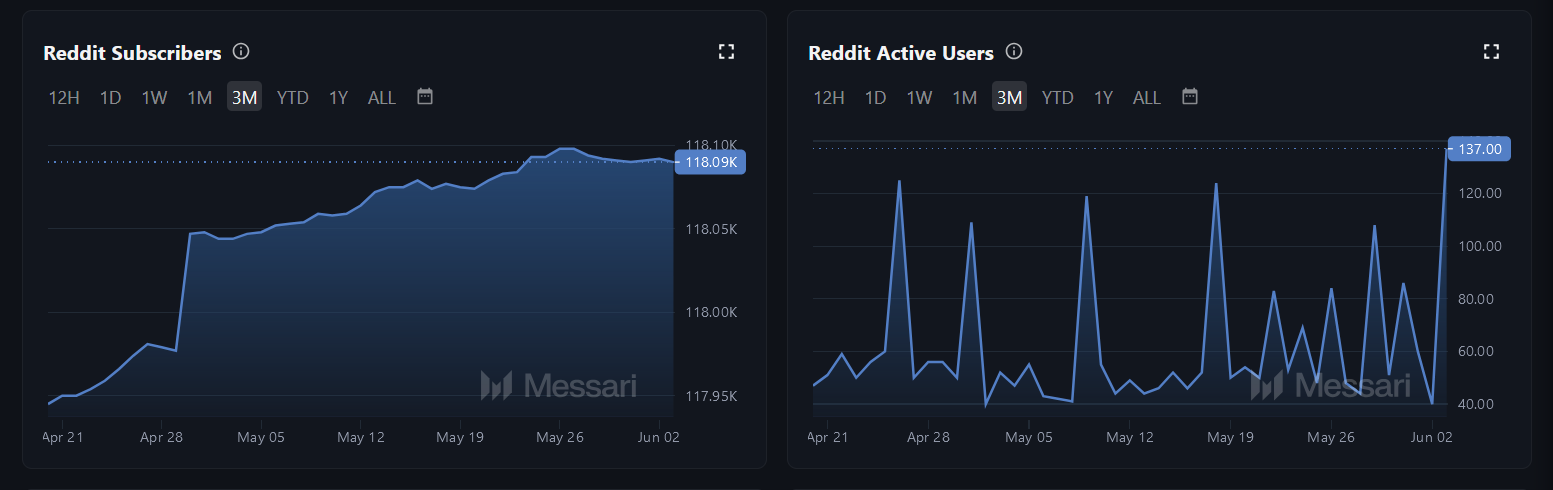

As per Messari, Reddit subscribers on the NEO asset hang drastically surged within the previous three months. The Reddit subscribers hang reached a amount of 118.09K. Meanwhile, the amount of Reddit vigorous customers for NEO shall be up (137).

Principally, a upward push in these social metrics highlights the increasing user participation that portrays ask for the crypto, and it leaves an optimistic affect on the mark.

Furthermore, the total charges paid to miners within the previous two weeks hang also elevated, whereas the vigorous addresses within the community had been at 60.

Per its community exercise, the transaction quantity peaked at $2.0 Million this week. The adjusted transaction quantity after lowering down noise peaked at $1.88 Million. The transaction quantity used to be $400K, and the adjusted transaction quantity used to be $333K.

Discovering What NEO Mark Structure May possibly well well Demonstrate Next?

NEO, over the month-to-month chart, formed a seamless structure from 2017 to 2024 (recount). It confirmed that the mark had peaked 2 times majorly. The main significant height used to be January 1st, 2018, when the mark gained 122K% to $194.91.

Thereon, the abrupt selling stress took the mark decrease. The cost consolidated for the next 792 days, shot up 800% to $136.98 (2nd height). The 2nd height also didn’t stabilize, and the mark went sideways over again, and it has already been 761 days as of writing.

In the broader image, a declining trendline resistance has been playing. If a rally breaks out over the month, the mark might presumably reach the $80 designate, registering a third height (almost 8x the newest mark).

The everyday chart shows that the mark might presumably upward push out of a falling wedge. Indicators had been bullish, and the nearest resistance are at $14 and $17. On the opposite hand, breaking $10 would birth up NEO’s path to $8.

NEO surged 37% over the previous two weeks. Its market cap reached $821.95 Million. Social quantity and community exercise are on the upward thrust. The cost might presumably reach $80 if it breaks out of month-to-month resistance.