Neiro, an Ethereum-primarily primarily based meme coin, recorded a convincing bullish momentum over the past day no matter the market-broad turbulence.

Neiro (NEIRO) has surged 15% in the last 24 hours no matter the market witnessing a duration of lackluster performance. This uptrend follows a extensive 36% safe on Oct. 6, which overshadowed the 9.23% loss NEIRO encountered the day earlier than this day.

The bullish momentum persevered with a 24.51% rally on Oct. 7. A further 2.42% elevate this morning helped push NEIRO into the pause sing on the gainers record.

NEIRO is up by 15.3% in the past 24 hours and is procuring and selling at $0.001678 at the time of writing. Its market cap reached $714 million with a on a typical basis procuring and selling quantity of $1.17 billion.

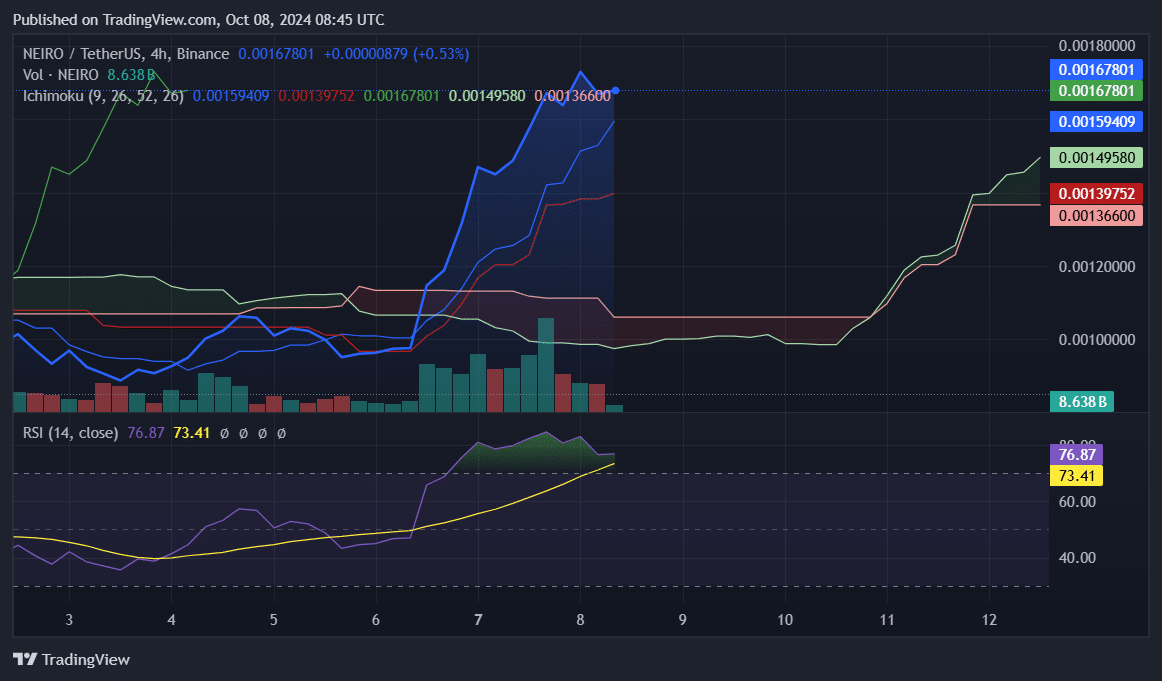

On the four-hour chart, NEIRO has damaged above the Ichimoku Cloud, signaling a possible continuation of its bullish jog. Particularly, the Ichimoku Cloud indicators display camouflage mighty toughen stages amid the upsurge.

The Fallacious Line, currently at $0.001397, is a ways under NEIRO’s unique tag, suggesting that the asset has solidified a nearer floor.

Meanwhile, Main Span A at $0.001495 highlights the cloud’s toughen stage. This confirms the aptitude for added upward inch if the toughen holds. If the value consolidates around these stages without falling lend a hand into the cloud, the token might maybe fair ogle even greater gains.

The RSI, now at 77.55, indicates that NEIRO is in overbought territory. Additional, procuring stress remains high, as advised by the Signal Line at 73.46. While this is bullish, it furthermore indicators that a correction might maybe spring up because the token turns into overextended.

Investors must protect an understand out for a possible retracement, critically given the overbought indicators on the RSI. A pullback toward the Fallacious Line around $0.001397 might maybe display camouflage a risk for merchants looking out for to re-enter the market.