Discover Asset Values (NAVs) in digital asset treasuries (DATs) contain collapsed, however right here’s now not as execrable because it sounds and also can be viewed as an opportunity for savvy merchants, in line with 10x Learn.

“The age of monetary magic is ending for Bitcoin treasury companies,” acknowledged 10x Learn analysts in a divulge shared with Cointelegraph on Friday.

“They conjured billions in paper wealth by issuing shares some distance above their real Bitcoin worth — until the semblance vanished,” they persisted.

On this “magic trick,” DATs basically transferred wealth from retail merchants who overpaid for shares into trusty Bitcoin (BTC) for the corporate. Shareholders lost billions whereas executives gathered real BTC, they talked about.

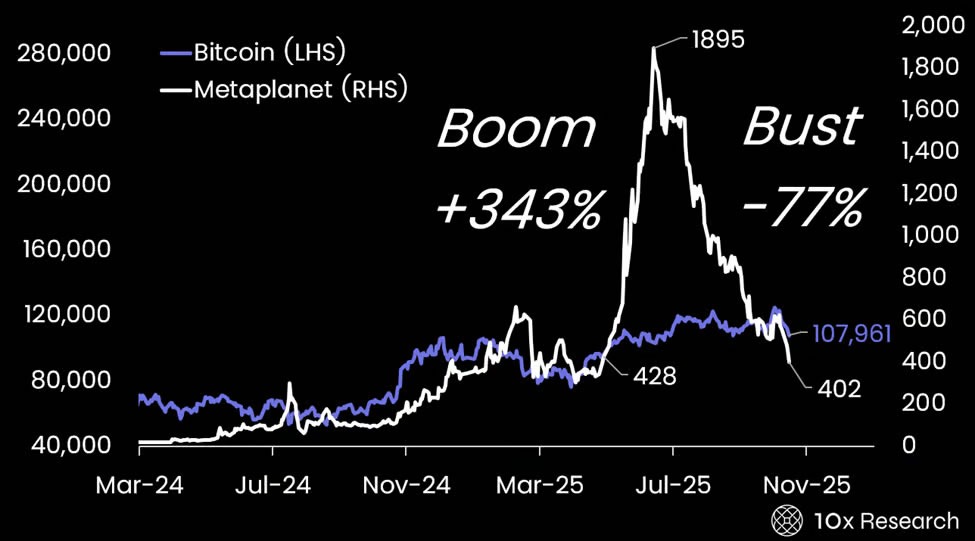

The researchers ragged Metaplanet, the fourth-largest Bitcoin treasury company, let’s divulge, because the corporate effectively remodeled a market capitalization of $8 billion, supported by merely $1 billion in Bitcoin holdings, into a $3.1 billion market cap backed by $3.3 billion in BTC.

Approach’s the same effort

Retail merchants paid two to seven times the trusty Bitcoin worth when procuring these shares one day of the hype. Now these premiums contain vanished, and heaps shareholders are underwater whereas companies converted that inflated capital into real Bitcoin.

Related: Bitcoin and DATs primed for explosive 2026: LONGITUDE

Michael Saylor’s Approach skilled a the same “sigh-and-bust cycle in its receive asset worth,” which has resulted in a slowdown in Bitcoin purchases, they neatly-known.

“With NAVs now having fully round-tripped, retail merchants contain lost billions—and heaps seemingly lack the conviction to retain adding to their positions.”

Fresh category of Bitcoin asset managers

The NAV normalization has created a rare entry point for dapper merchants. Companies now trading at or below NAV provide pure Bitcoin publicity with optionality on future alpha period and upside from any trading earnings.

The shakeout has also separated the true operators from marketing machines. The companies that dwell on this transition can be battle-tested, properly-capitalized, and equipped to generate consistent returns, making a brand new category of Bitcoin asset managers.

DATs that adapt now will “define the next bull market,” the researchers talked about earlier than concluding:

“Bitcoin itself will proceed to evolve, and Digital Asset Treasury companies with strong capital bases and trading-savvy management groups might maybe well aloof generate predominant alpha.”

Approach, Metaplanet stock sinks

Approach stock (MSTR) received 2% on Friday, ending the trading session at $289.87. However, it has fallen 39% since its all-time excessive closing designate of $473.83 in November 2024, in line with Google Finance.

Metaplanet shares (MTPLF) lost 6.5% on the Tokyo Stock Commerce the day long gone by in a drop to 402 yen ($2.67) and contain tanked Seventy nine% since their mid-June height of 1,895 yen ($12.58).

Magazine: Binance shakes up Korea, Morgan Stanley’s security tokens in Japan: Asia Particular